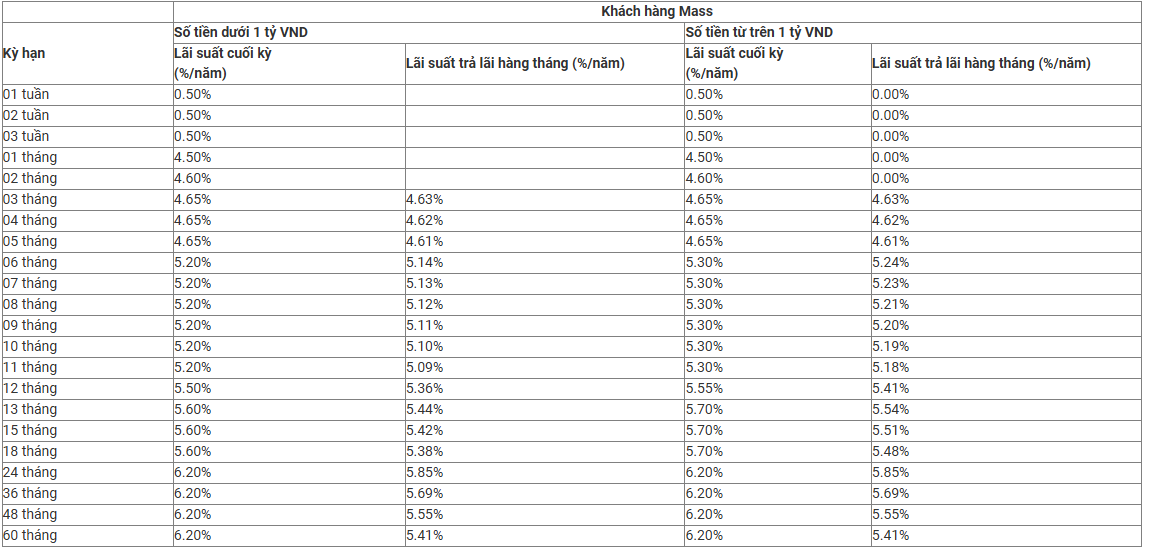

Specifically, for the online deposit interest rate table for the Mass customer group, MB maintains the deposit interest rates for short terms ranging from 1 week to 11 months. Accordingly, the savings interest rate for the 1-month term remains at 4.5%/year, the 2-month term at 4.6%/year, while terms from 3 to 5 months are listed at 4.65%/year. The deposit interest rate for terms from 6 to 11 months continues to hover around 5.2%/year.

From the 12-month term onwards, MB begins to increase interest rates. Specifically, the online deposit interest rate for the 12-month term is raised to 5.5%/year for amounts under 1 billion VND and 5.55%/year for amounts from 1 billion VND and above. Terms from 13 to 18 months are also adjusted upwards, reaching 5.6 – 5.7%/year depending on the deposit size.

Notably, online deposit interest rates for long terms from 24 to 60 months are uniformly listed by MB at 6.2%/year for both deposit groups under and over 1 billion VND. This is currently the highest interest rate applied to Mass customers according to MB’s new interest rate table.

For Priority customers, the online savings interest rate with end-of-term payment is applied at a higher rate. According to the listed table, the 1-month term interest rate is 4.5%/year, the 2-month term is 4.6%/year, and the 3- to 5-month terms are 4.75%/year. Terms from 6 to 11 months are listed at 5.3%/year; the 12-month term rises to 5.75%/year; and the 13- to 18-month terms reach 5.8%/year. For long terms from 24 to 60 months, MB applies an interest rate of up to 6.4%/year for Priority customers.

Meanwhile, Private customers continue to enjoy the highest interest rate levels within the MB system. Specifically, online deposit interest rates with end-of-term payment for 1- to 2-month terms are 4.6 – 4.7%/year, respectively; 3- to 5-month terms are 4.75%/year. Interest rates for 6- to 11-month terms are listed at 5.4%/year; the 12-month term is 5.8%/year; and the 13- to 15-month terms are 5.9%/year. For long terms from 24 to 60 months, Private customers enjoy the highest interest rate of up to 6.4%/year.

Even counter deposit interest rates are pushed by MB to the highest level of 6.4%/year if customers deposit from 1 billion VND and reside in the Central and Southern regions.

Specifically, for counter deposit products, MB is currently applying two different interest rate tables between the regular area and the Central – Southern region, with interest rates in the Central and Southern regions being higher than the general level.

In the regular area, for deposits under 1 billion VND, the counter deposit interest rate with end-of-term payment for the 1-month term is listed by MB at 3.5%/year, the 2-month term at 3.6%/year. Terms from 3 to 5 months are uniformly applied at 3.9%/year. The deposit interest rate for terms from 6 to 11 months hovers around 4.5%/year. For longer terms, the counter deposit interest rate for 12- to 18-month terms is 5.4%/year; the 24-month term is 6.2%/year, and terms from 36 to 60 months are uniformly at 6.2%/year.

For deposits from 1 billion VND and above, MB applies a higher interest rate. Specifically, the 1-month term is listed at 3.7%/year, the 2-month term at 3.8%/year; terms from 3 to 5 months are 4.1%/year. The deposit interest rate for terms from 6 to 11 months increases to 4.7%/year. For medium and long terms, MB lists 5.5%/year for 12- to 18-month terms and 6.3%/year for terms from 24 to 60 months.

In branches within the Central and Southern regions, MB applies a higher interest rate level compared to the regular area.

Specifically, for deposits under 1 billion VND, the counter deposit interest rate for the 1-month term is raised to 3.6%/year, the 2-month term to 3.7%/year. Terms from 3 to 5 months are uniformly applied at 4.0%/year. The deposit interest rate for terms from 6 to 11 months is maintained at 4.6%/year. For long terms, MB lists 5.5%/year for 12- to 18-month terms; 6.3%/year for the 24-month term, and continues to maintain 6.3%/year for terms from 36 to 60 months.

For deposits from 1 billion VND and above, counter interest rates are additionally margined. Accordingly, the 1-month term interest rate is 3.8%/year, the 2-month term is 3.9%/year. Terms from 3 to 5 months are listed at 4.2%/year. The deposit interest rate for terms from 6 to 11 months increases to 4.8%/year. For medium and long terms, MB applies 5.6%/year for 12- to 18-month terms and 6.4%/year for terms from 24 to 60 months.

Banks Ramp Up Efforts to Mobilize Deposits

Deposit growth is lagging behind lending, forcing many banks to raise deposit interest rates to compete for funds from the public during the year-end peak season.

Why Are the Big 4 Banks Suddenly Hiking Deposit Interest Rates?

In the final month of the year, competitive deposit interest rates have spread beyond joint-stock commercial banks, with state-owned banks now joining the fray. Experts suggest that these elevated rates primarily reflect short-term liquidity pressures in the market rather than signaling a shift in monetary policy. However, concerns about potential risks remain.