Mr. Giang Văn Hiển, Deputy Director of Ho Chi Minh City Tax Department

Recently, the Ho Chi Minh City Tax Department and the Ho Chi Minh City Trade and Investment Promotion Center hosted the 269th Business-Government Dialogue Conference. The event focused on addressing challenges in tax settlement and providing updates on tax policies.

During the conference, a representative from a technology company raised concerns about managing “ghost businesses.” They stated: “Many businesses purchase goods without knowing if the seller is still operational. In some cases, a small transaction can inadvertently involve a ‘ghost business,’ leading to severe penalties years later. Despite thorough checks by the buyer, such risks persist. What measures can tax authorities or government agencies implement to curb ‘ghost businesses’ and reduce risks for legitimate enterprises?

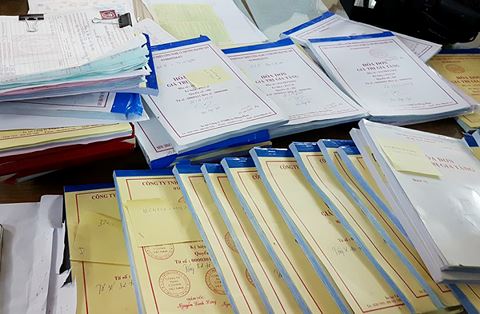

Addressing this issue, Mr. Giang Văn Hiển, Deputy Director of Ho Chi Minh City Tax Department, highlighted that recent government policies have streamlined processes, allowing businesses to self-declare, self-pay, and self-assume responsibility. However, some individuals and organizations have exploited these policies by establishing businesses solely for illegal invoice trading.

The tax department has identified these violations and continuously innovates management methods, including risk factor assessments and enhanced IT applications. Mr. Hiển noted that verifying paper invoices was previously challenging, but the department now offers multiple online platforms for businesses to verify their trading partners’ operational status.

He emphasized that combating invoice fraud is a shared responsibility between tax authorities and the business community. Legitimate operations are easily verifiable. Businesses should establish internal regulations and educate employees on partner verification, including legal status and physical addresses.

“In some cases, businesses dine at restaurants but receive invoices from unrelated entities without questioning or verifying. Businesses are directly responsible for ensuring their trading partners are legitimate. Tax authorities typically detect issues during tax settlement periods, by which time violators may have already disappeared. With advanced IT systems, tax authorities can now scrutinize hundreds of transactions to collaborate with relevant agencies for enforcement,” Mr. Hiển explained.

The Deputy Director also stressed that legal penalties for illegal invoice trading are severe for both buyers and sellers. He urged businesses to collaborate with authorities and implement safeguards to protect their operations, reputation, and market position. Risks often arise from inadequate internal controls.

“Businesses can now proactively verify their partners’ status through the tax department’s online portals. Combating invoice fraud is not solely the tax authority’s duty but a collective effort by the business community. Businesses must strengthen internal controls, thoroughly vet partners, and ensure transparency in legal, operational, and historical data. The goal is to foster a fair, transparent, and healthy business environment where legitimate operations are protected by authorities,” the Ho Chi Minh City Tax Department leadership concluded.

Urgent Notice from Ho Chi Minh City Tax Department: Residents, Please Take Note!

The Ho Chi Minh City Tax Department has issued an urgent notice regarding the temporary suspension of in-person services and direct document submissions from taxpayers at their office located at 63 Vu Tong Phan Street, Binh Trung Ward, Thu Duc City, on Saturday, December 13, 2025.