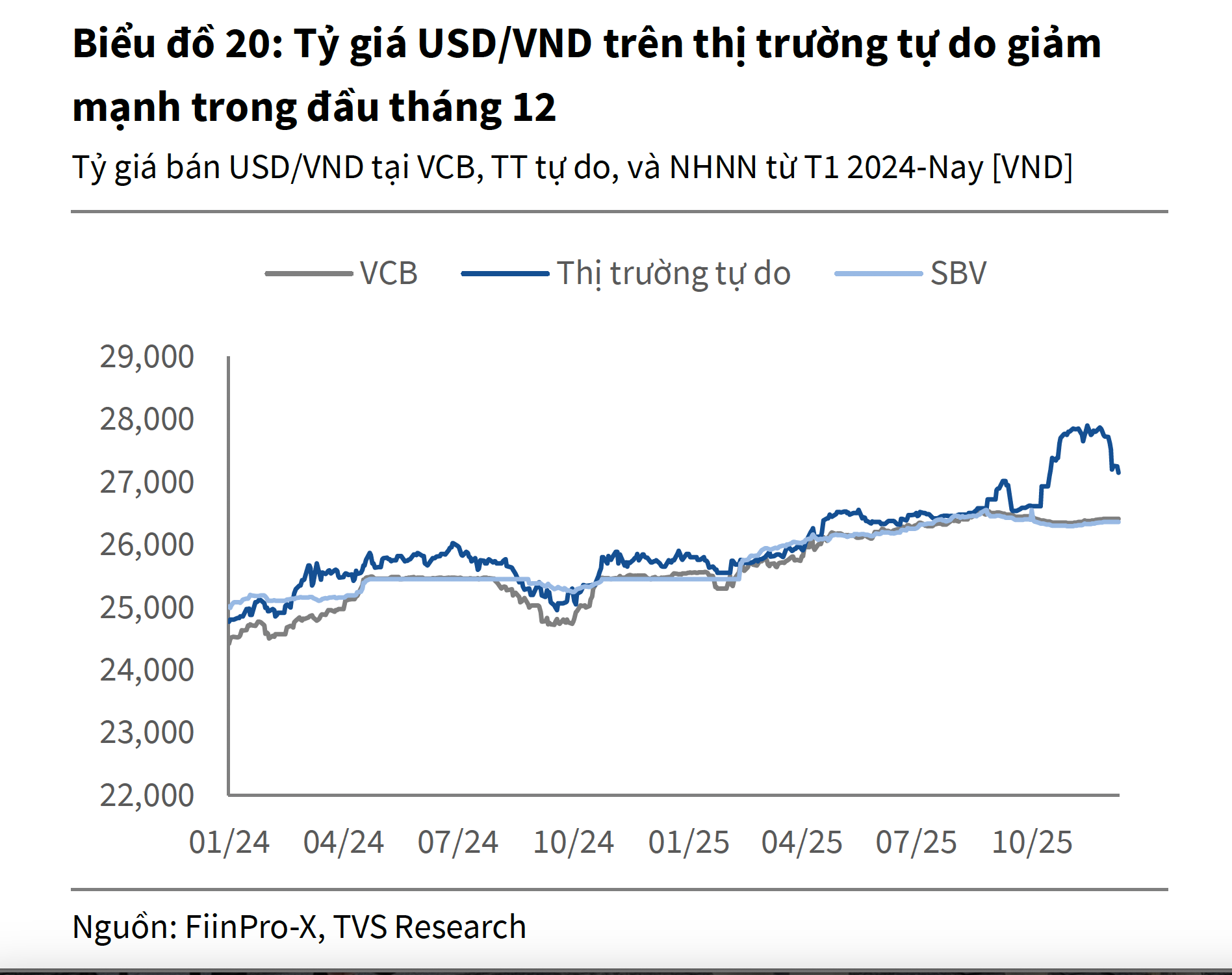

On December 19th, the State Bank of Vietnam set the central exchange rate at 25,148 VND/USD, a 2 VND/USD decrease from the previous day.

Commercial banks like Vietcombank, BIDV, and ACB maintained stable USD rates at 26,140 VND/USD for buying and 26,405 VND/USD for selling.

In the free market, the USD continued its downward trend, breaching the 27,000 VND/USD mark. Some currency exchange points quoted rates at 26,850 VND/USD for buying and 26,980 VND/USD for selling, a significant drop of 120 VND/USD compared to the previous day.

Since the beginning of the week, the USD has lost approximately 450 VND in the free market. From its peak near 28,000 VND in mid-November, the USD/VND exchange rate has fallen by over 1,000 VND at various trading points.

Free Market USD Rate Drops Below 27,000 VND

Analysts attribute the cooling of the free market USD rate to the currency’s low international value over the past two months. The US Dollar Index (DXY) currently trades at 98.4 points.

In its latest currency market update, Thien Viet Securities (TVS) suggests that the Federal Reserve’s third interest rate cut of the year, by 0.25%, will ease pressure on the USD/VND exchange rate. TVS forecasts a 3.5% average increase in the USD/VND rate for 2025.

The easing of the USD/VND rate towards the year-end reduces pressure on monetary policy, providing the State Bank of Vietnam with more room to stabilize interest rates and support economic growth.

Central Bank Credit Department Head: SBV to Intensify Credit Solutions for Double-Digit Economic Growth

According to Ms. Ha Thu Giang, Director of the Credit Department, key solutions include continuing to review, amend, supplement, and refine the legal framework, mechanisms, and policies governing bank credit activities. Additionally, actively implementing major Party resolutions and policies on agricultural development, science and technology, digital transformation, private economy, healthcare, education, and energy remains a priority.

Upcoming Government Review: Green Project Proposal with 2% Annual Interest Rate Funding

Mrs. Pham Thi Thanh Tung, Deputy Director of the Credit Department for Economic Sectors at the State Bank of Vietnam, announced that this week, the State Bank will submit to the Government a draft Decree guiding the implementation of a 2% annual interest rate subsidy for loans supporting green, circular projects that adhere to ESG standards.