During the morning trading session on December 20, spot silver prices surged by 2.6%, reaching $67.14 per ounce. This capped off a week of remarkable gains, with an 8.4% increase after hitting a historic high of $67.45 during the session.

Spot gold prices rose by 0.4%, reaching $4,347.07 per ounce, while also recording a 1.1% weekly gain. U.S. gold futures closed 0.5% higher at $4,387.3 per ounce.

Michael Matousek, Head of Trading at U.S. Global Investors, noted that gold and silver share a strong correlation, but in recent months, silver has taken the lead in driving market momentum. “When the gap between the two metals widens, investors tend to buy gold to narrow the short-term disparity,” he explained.

Silver prices soared to record highs in the final trading session of the week, while gold also posted weekly gains amid heightened market activity.

Since the beginning of the year, silver prices have skyrocketed by 132%, significantly outpacing gold’s 65% increase. Experts attribute this trend to robust inflows into silver ETFs, speculative activity from retail investors, and constrained supply. Image: NewsBytes

Expectations of Federal Reserve rate cuts gained traction following data showing U.S. inflation rose just 2.7% year-over-year in November, falling short of the 3.1% forecast. Additionally, the U.S. Labor Department reported a rise in the unemployment rate to 4.6%, the highest since September 2021, signaling a softening labor market.

“Lower inflation and a weakening labor market are bolstering expectations that the Fed will maintain its policy easing trajectory,” commented Phillip Streible, Chief Strategist at Blue Line Futures. According to LSEG data, traders now anticipate at least two 25-basis-point rate cuts from the Fed in the coming year.

Among other precious metals, platinum climbed 3.1% to $1,975.51 per ounce, reaching its highest level in over 17 years, while palladium rose 0.8% to $1,709.75 per ounce, also posting weekly gains.

Silver Price Today, December 20: Silver Market Continues to Surge

Silver prices soared to a new peak in the international market today, propelling domestic silver bullion prices to an unprecedented high of 2.6 million VND per tael.

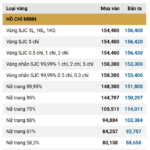

Today’s SJC Gold Price & Smooth Gold Ring Rates – December 19th

On the evening of December 18th, global gold prices experienced significant volatility, surging to $4,370 per ounce before sharply reversing and plummeting to the $4,310 per ounce range.