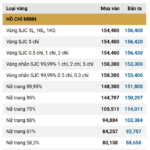

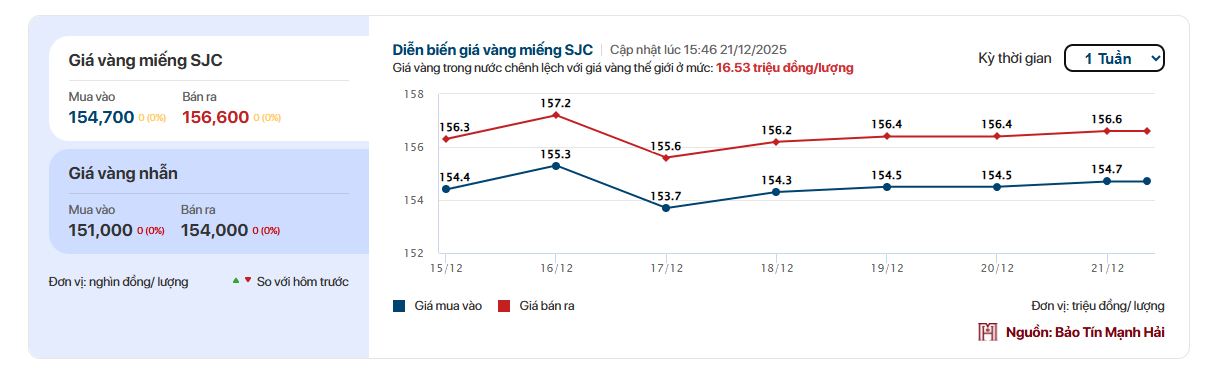

This past weekend (December 21), the price of SJC gold bars in the market remained stable at 154.7 – 156.6 million VND per tael, unchanged from the previous day.

Currently, the price of gold rings ranges from 150.0 – 151.0 million VND per tael for buying and 153.5 – 154.5 million VND per tael for selling.

Over the past week, gold prices experienced significant fluctuations during the early trading sessions, surging on Monday (December 15, 2025) before reversing and stabilizing towards the end of the week.

For instance, at Bao Tin Minh Hai, the price of SJC gold increased by 900 thousand VND per tael on December 15, 2025, only to plummet by 1.6 million VND per tael the following day. By the end of the week, the gold bar price was listed at 154.7 – 156.6 million VND per tael.

Gold ring prices followed a similar pattern, rising by 500 thousand VND per tael on December 15 to 155.8 million VND per tael before dropping to around 155 million VND per tael (selling price). As of December 21, Bao Tin Minh Hai’s gold ring prices stood at 152.2 – 155.2 million VND per tael.

Compared to the previous week, gold prices increased slightly by 100-200 thousand VND per tael. Since the beginning of the year, domestic gold prices have surged by approximately 90%.

In the international market, spot gold closed the week at $4,337 per ounce. The precious metal traded within a narrow range over the past week. Compared to the start of the year, global gold prices have risen by approximately 66%.

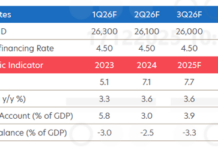

According to Kitco News, in its 2026 commodities outlook report, TD Securities predicts that lower interest rates, currency devaluation trends, supply-side factors, and diversification demand will push gold prices to a new high of $4,400 per ounce in the first half of 2026.

Commodity analysts believe there’s no reason to expect a sharp decline in gold prices next year. “The consequences of reduced holding costs led by the Fed, expectations of a steepening yield curve, and lingering concerns about the Fed’s independence lead us to believe that gold will set new quarterly records at $4,400 per ounce in the first half of 2026,” experts stated.

“Growing concerns that the future Fed may not aggressively pursue its 2% inflation target, coupled with speculation that the White House might exert significant pressure to lower rates amid record-high and rising U.S. public debt, are critical reasons why we expect gold’s upward trend to resume strongly,” TD Securities’ report noted.

TD Securities believes gold’s new long-term price range will be between $3,500 and $4,400 per ounce. “For prices to remain below the lower end of this range, investor attention would need to shift back to U.S. risk assets, or there would need to be a change in the view that the U.S. labor market will not weaken and the Fed will not continue cutting rates,” the analysts commented.

The absence of narratives about USD weakening, de-dollarization, and debt monetization could also cool gold prices. However, forecasts of a weakening job market, potential struggles for risk assets to rise next year, and the Fed’s expected additional 100 basis points in rate cuts—with some market expectations reaching 150 basis points—come amid persistent inflation above the 2% target.

Today’s SJC Gold Price & Smooth Gold Ring Rates – December 19th

On the evening of December 18th, global gold prices experienced significant volatility, surging to $4,370 per ounce before sharply reversing and plummeting to the $4,310 per ounce range.