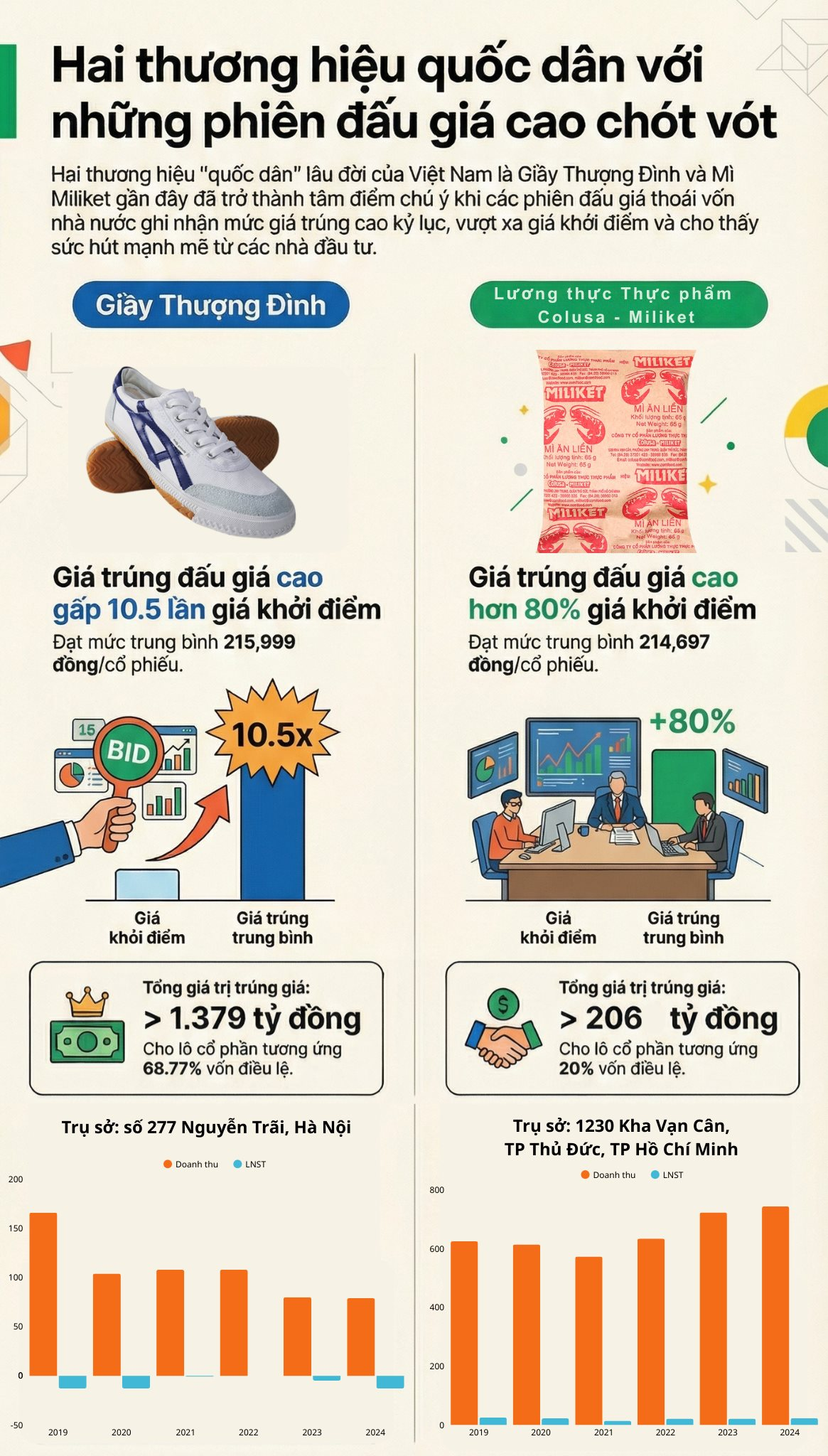

Upper Dinh Shoe Joint Stock Company (UPCoM: GTD) and Colusa – Miliket Food Joint Stock Company (UPCoM: CMN) are two notable cases where the auction prices of state-owned shares significantly surpassed their market values on UPCoM. This occurred even as the stocks were experiencing a heated rally and setting consecutive record highs in recent trading sessions.

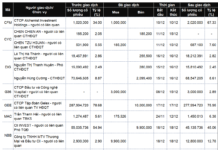

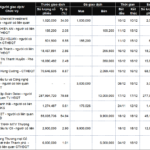

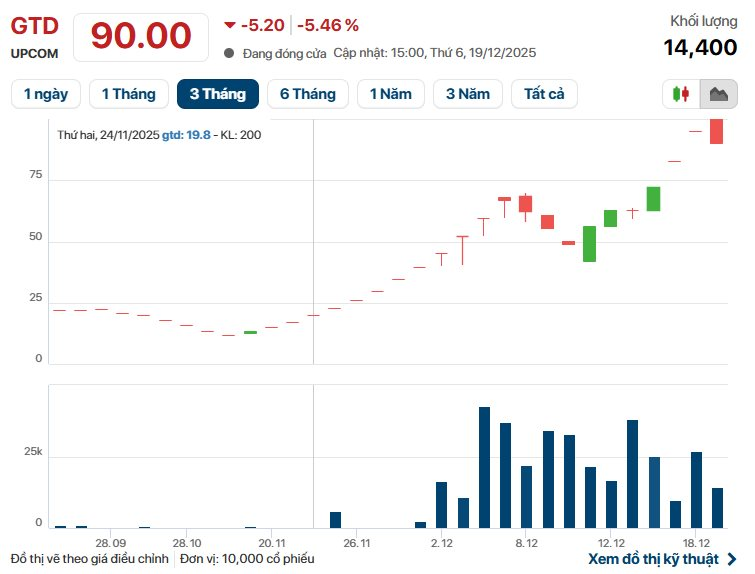

The Hanoi Stock Exchange (HNX) recently announced the auction results for nearly 6.4 million GTD shares, representing 68.77% of Upper Dinh Shoe’s charter capital, held by the Hanoi People’s Committee. The auction, held on December 16, 2025, attracted significant interest from 15 domestic individual investors, with total registered bids reaching nearly 39.3 million shares—over six times the offered amount.

Two investors successfully bid for the entire lot at an average price of VND 215,999 per share, more than 10.5 times the starting price of VND 20,500 per share. At this price, the total value of the shares exceeded VND 1,379 billion.

This divestment was a key focus for 2025, approved by the Annual General Meeting of Shareholders, amid leadership warnings of potential capital loss if the divestment process were further delayed.

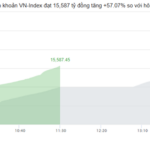

On UPCoM, GTD shares surged dramatically, with 12 consecutive ceiling sessions from November 19 to December 4. The three sessions preceding December 19 closed at the ceiling price, and by the end of December 19, the stock was trading at VND 90,000 per share.

At the time of the auction, the shares won by the two investors were trading at a temporary discount of over 50% compared to the UPCoM market price.

Amid the sharp price increase, Upper Dinh Shoe issued multiple clarifications, attributing the stock’s volatility to market supply and demand dynamics. The company confirmed no unusual operational factors and maintained stable financial health.

One of Upper Dinh Shoe’s notable assets is its 36,105 m² land plot at 277 Nguyen Trai, Hanoi. This prime location, with extensive frontage on Nguyen Trai Street, is earmarked for relocation from the city center under Hanoi’s urban planning policy.

According to the 2024 consolidated financial report, Upper Dinh Shoe recorded net revenue of nearly VND 79 billion, a 2% decline from 2023. Rising costs led to a post-tax loss of nearly VND 13 billion.

Similarly, Colusa – Miliket, the producer of the iconic “Two Shrimp” instant noodles, faced a comparable scenario during its state divestment process.

On December 18, Vietnam National Tobacco Corporation (Vinataba) auctioned 960,000 shares, representing 20% of Colusa – Miliket’s charter capital. The auction attracted four domestic institutional investors, with total bids quadrupling the offered amount.

A domestic institution won the entire lot at a total value of over VND 206.1 billion, equivalent to an average price of VND 214,697 per share—approximately 80% above the starting price of VND 119,500 per share.

On UPCoM, CMN closed at VND 85,800 per share on December 19. However, this market price was 60% lower than the auction price, resulting in a significant temporary loss for the winning institution compared to market value.

Following the auction announcement, CMN shares surged, with three consecutive ceiling sessions starting November 20. By December 19, the stock had risen over 60% in just one month.

Colusa – Miliket’s headquarters are located in Thu Duc City, Ho Chi Minh City. The company is renowned for its “Two Shrimp” instant noodles and produces various other convenience foods.

Majority Stake in Origato Fresh Bakery Brand Acquired by Investor from Vinataba

A savvy individual investor has spent over VND 177 billion to acquire the entire stake in Hải Hà – Kotobuki, the company behind the beloved Origato fresh bakery brand, from Vinataba.

Two Iconic Brands and Auctions Doubling Stock Peaks

Thượng Đình Footwear Corporation (UPCoM: GTD) and Colusa – Miliket Food Corporation (UPCoM: CMN) have both achieved remarkable success in their recent stock auctions, with average winning bid prices surpassing 200,000 VND per share. These impressive results significantly outpace the current market prices on UPCoM, even as both stocks consistently hit upper limits and reach historic highs.

Hanoi Successfully Auctions Thuong Dinh Shoe Company Shares, Raising Over VND 1.379 Trillion

The Hanoi People’s Committee has successfully concluded the auction of nearly 6.4 million shares of Giầy Thượng Đình, achieving an average price of 215,999 VND per share. This transaction is estimated to generate over 1,379 billion VND in revenue.