Recent market observations reveal that several banks have adjusted their preferential home loan programs tailored for young individuals under 35. Initially, these packages offered attractive interest rates of 5.5%-6.3% per annum, fixed for the first three years, but recent modifications have left borrowers concerned about potential repayment pressures post-promotion period.

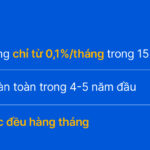

However, according to a survey by Banking Times, not all preferential housing loan packages have been revised as of mid-December 2025. Several commercial banks, including VPBank, Shinhan Bank, and SHB, continue to offer long-term incentives. For instance, VPBank and Shinhan Bank provide housing loans at 5.9-7.2% per annum for eligible projects. SHB maintains a competitive offer with interest rates starting at 3.99% per annum, a 5-year grace period on principal repayment, and financing up to 90% of the collateral value.

In Ho Chi Minh City and Dong Nai, many banks are sustaining low-interest rates for home loans. HDBank, MSB, ACB, and OCB offer rates between 6.5-8% per annum for the first year. VIB provides rates of 6.9-8.9% per annum for the initial 1-3 years, while BVBank offers a fixed rate of 8.5% for 12 months, and ACB ranges from 8-9.5% depending on the term.

In the first quarters of 2025, loans for purchasing, leasing, constructing, and renovating homes accounted for approximately 61.2% of total consumer credit debt in Ho Chi Minh City and Dong Nai, equivalent to around 906 trillion VND by September 2025. This indicates a significant increase in homebuyers accessing affordable financing due to the low-interest rate environment.

Low-interest rates enhance homeownership opportunities for young urban dwellers following administrative boundary mergers.

On the housing supply side, the Ministry of Construction reports that 26 provinces have listed 121 social housing projects under preferential loan programs as of October 2025. Commercial banks have committed approximately 13.2 trillion VND for these projects, with 950 billion VND allocated for homebuyers. Additionally, developers and banks are collaborating to offer discounts and reduced interest rates. For example, VPBank and HouseNow in Ho Chi Minh City offer loans at 6% per annum during promotions, financing up to 80% of the property value over 35 years. MSB and Gamuda Land Vietnam provide loans at a maximum of 7% per annum for the first 24 months, with a 60-month grace period and a 36-month repayment plan.

Real estate developers are also introducing financial incentives. Khai Hoan Land offers a 1% monthly payment plan, 0% interest for the first 24 months, and no prepayment penalties for its Khai Hoan Prime – Hiep Phuoc project. Phu Dong Group’s Phu Dong SkyOne project allows buyers to pay 4.5 million VND monthly for 24 months, with a fixed 5% interest rate for the first five years.

While some promotional programs and banks have slightly adjusted consumer credit rates, overall housing loan rates remain at multi-year lows. This trend bodes well for consumer credit growth in early 2026 and provides affordable housing opportunities for low-income workers in the coming months.

Which Bank Offers the Best Home Loan Interest Rates in December 2025?

In December 2025, deposit interest rates at numerous banks continued to rise, leading to a corresponding upward trend in mortgage lending rates.

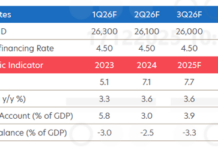

Skyrocketing Credit Growth Forecast Sparks Inflation Concerns: 15-Year High Predicted

As of the end of September, the economy’s credit growth has reached 13.37% compared to the beginning of the year. It is estimated that credit growth for this year could hit 19-20%, the highest level in 15 years. The State Bank of Vietnam emphasizes ongoing monitoring to ensure both economic growth and inflation control.

The Year-End Credit Sprint: Optimistic Expectations, Quality Assurance Needed

As we move into the final quarter of 2025, a surge in credit is expected, potentially surpassing the annual target set by the State Bank of Vietnam. This presents both opportunities and challenges for the financial and banking system. Experts emphasize the critical need to direct credit to the right sectors, primarily production and business, while effectively managing risks to ensure sustainable development.

No More Home Loan Stress – Tailored Packages to Suit Your Needs

Purchasing a home is a significant milestone and a dream for many, but the daunting prospect of a 20 to 30-year mortgage and the worry of losing control of one’s finances have deterred many from taking the leap. However, acquiring a home loan need not be a risky endeavor if the loan is structured with flexibility, allowing borrowers to take control of their financial journey.

“Van Phu Reports 56% Profit Growth in First Half of 2025”

With a boost from positive macroeconomic factors, the real estate market’s recovery has significantly impacted Van Phu – Invest Development Joint Stock Company (HOSE: VPI). The company has reported impressive financial results for the first half of 2025, with a 56% year-over-year increase in after-tax profit, totaling VND 148.8 billion.