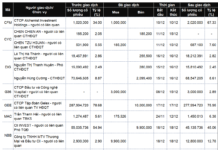

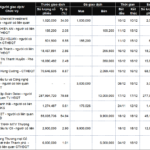

When it comes to the most competitive home loan rates in the market, TPBank stands out with its special offer for young individuals under 35, featuring a fixed rate of just 3.6% for the first three months. Additionally, borrowers can enjoy a principal grace period of up to 60 months from TPBank.

Following closely is Eximbank with its “Y-Rise Eximbank” home loan package, offering a preferential rate of 3.68% per annum for up to 36 months for customers aged 22-35. The loan term can extend up to 40 years, significantly reducing monthly repayment pressure. Borrowers also benefit from a principal repayment grace period of up to 7 years.

MSB Bank introduces a tailored home loan package for young buyers with rates starting at 4.5% per annum, fixed for the first six months. The loan tenure can stretch up to 35 years, with flexible principal repayment options that align with the borrower’s financial capabilities. The loan limit is generous, covering up to 80% of the property value or 95% of the total loan plan. Notably, customers can enjoy a principal grace period of up to 24 months and a waiver of early repayment fees up to 100 million VND per month.

ABBank also caters to young individuals aged 19 to 40 with an attractive home loan package. This package offers an annual interest rate starting at 5%, financing up to 100% of the required capital, and flexible loan terms of up to 35 years.

Home loan interest rates adjusted upward at several banks. (Illustrative image)

SeABank launches the “Chắp cánh giấc mơ an cư” (Winged Dream of Settling Down) loan package, designed to help young Vietnamese realize their dream of owning their first home. This package offers rates starting at 5.8% per annum, loan terms up to 55 years, and a principal grace period of 5 years.

VIB Bank is actively promoting home loan packages for apartments with flexible fixed interest rates during the initial period, catering to diverse financial needs.

Specifically, VIB offers four options: 5.9% per annum fixed for 6 months, 6.9% for 12 months, 7.9% for 24 months, and 8.9% for the first 36 months. Borrowers should note the actual interest rate after the promotional period. For instance, with the 6.9% package fixed for 12 months, from the 13th month, the rate will be calculated based on the real estate loan interest rate formula (currently around 8.5%) plus a margin of about 2.8%, resulting in an effective rate of approximately 11.3% per annum. This is a critical factor for borrowers to consider to ensure financial stability throughout the loan term.

Sacombank introduces two new financial solutions, “Z Home” and “Prime Home,” targeting young customers aged 18-40 looking to purchase their first home. Sacombank offers loan limits up to 10 billion VND (maximum 85% of the collateral value) with preferential fixed rates of 6.5%, 7%, and 7.5% per annum for 12, 24, and 36 months, respectively.

Additionally, Sacombank designs the “Prime Home” package for customers purchasing real estate for investment, offering fixed rates of 8%, 8.5%, and 9% per annum for 1, 2, and 3 years, respectively. Borrowers can enjoy a principal grace period of up to 5 years and only need to prepare a minimum of 15% of the property value, with Sacombank financing the remaining 85%, without limiting the total loan amount per customer.

Among the BIG 4 banks, Agribank has adjusted its home loan policy for young customers under 35. The bank has discontinued fixed-rate packages of 24 months or more for new contracts. Instead, a fixed rate of 6.3% per annum is offered for the first 18 months, provided the loan term is at least 36 months.

Previously, customers enjoyed a rate of just 5.5% per annum fixed for the first 36 months, which was significantly more favorable than the current terms. However, other conditions remain unchanged: borrowers can receive up to 75% of the required capital if the property itself is collateral, and up to 100% with additional collateral. The maximum loan term remains 40 years, with a principal grace period of up to 5 years.

BIDV has officially ended its home loan program for customers under 35, replacing it with a general home loan package applicable to all borrowers. Customers can choose between two flexible interest rate packages: 6.5% per annum for 12 months (for loans with a minimum term of 36 months) or 7.0% for 18 months (for loans with a minimum term of 60 months). After the promotional period, the rate will float based on the formula: 12-month individual savings deposit rate plus a margin of 4.0-4.5%, ensuring competitiveness while reflecting market fluctuations.

VietinBank has also discontinued its home loan package for young customers under 35, introducing a new package. For loans with a minimum term of 24 months, the promotional rate is 6.5% for 12 months. For loans with a minimum term of 36 months, the rate is 7.0% for 18 months. For loans with a minimum term of 48 months, the rate is 7.5% for 24 months. For loans with a minimum term of 60 months, the rate is 8.5% for 36 months.

Starting November 2025, Vietcombank will cease its special loan package for young customers. Instead, customers can choose between two options: a 12-month fixed package at 7.0% per annum or an 18-month fixed package with 6.5% for the first 6 months and 7.5% for the next 12 months. After the promotional period, the rate will adjust to market conditions, currently fluctuating around 9.0% per annum.

Market Impact Remains Limited

Assessing the impact of rising home loan interest rates on the real estate market, Mr. Nguyễn Quốc Anh, Deputy General Director of PropertyGuru Vietnam, noted that the recent rate increases are primarily “technical adjustments.” This is partly due to a decline in deposits within the banking system, prompting banks to raise rates to attract capital, especially for medium and long-term deposits.

Interest rate hikes have yet to significantly impact the real estate market. (Photo: Minh Đức)

Mr. Quốc Anh believes the current rate increases are not substantial enough to shock the real estate market. The primary effect is making buyers and investors more cautious about leveraging debt and more selective about investment timing and products.

From a market perspective, capital continues to flow into real estate and other investment channels, as deposit interest rates, though rising, remain low compared to previous periods. This helps maintain price stability in the market, avoiding a sharp decline.

In the short term, the real estate market may enter a probing phase as interest rates rise and capital costs increase. However, the likelihood of a repeat of the 2022 tension scenario is low, given the more stable macroeconomic foundation and significant market structure adjustments post-shock.

Economist Cấn Văn Lực also noted that interest rates are a necessary but insufficient condition. According to Mr. Lực, interest rates alone cannot determine the health of the real estate market; other critical factors include project legality, new supply, administrative procedure reforms, and market confidence. Low interest rates are only effective when accompanied by a transparent ecosystem and supply that meets real demand.

Dr. Lê Xuân Nghĩa, a member of the National Financial and Monetary Policy Advisory Council, echoed this sentiment, stating that rising interest rates are a necessary but insufficient factor in determining real estate market dynamics.

“Post-shock, the market now operates more cautiously, focusing on legality and real demand rather than speculation. Low interest rates maximize their effect when paired with a transparent ecosystem and supply that meets genuine needs. Interest rates alone cannot dictate market health; project legality, administrative reforms, and market confidence are key to sustainable recovery,” he analyzed.

Exclusive Real Estate Experience: Premier Project Showcase Event Unveiled

Recently, Gold Coast Vũng Tàu emerged as a sensation by hosting a series of sales training events (Mega Training) in a unique cinema-style “premiere” format, right at the movie theater.

Proposed New Land Price Regulations to Take Effect in 2026

The draft Decree detailing and guiding certain provisions of the National Assembly’s Resolution on mechanisms and policies to address challenges in the implementation of the Land Law is currently under public consultation. Notably, it introduces new regulations on the construction and adjustment of land price tables. The Decree is expected to take effect from January 1, 2026.

Affordable Housing at Diamond Boulevard: The Ideal Choice for Young Buyers at Just $1,500/m²

In a rapidly evolving real estate market where housing prices outpace income growth, young individuals face increasing challenges in securing affordable and suitable living spaces. The availability of reasonably priced apartments in Ho Chi Minh City has significantly dwindled, intensifying the struggle for homeownership. Amidst this landscape, projects like Diamond Boulevard emerge as a viable solution, offering competitive pricing, transparent legal frameworks, and prime connectivity—making it an ideal choice for those seeking practical and reliable housing options.