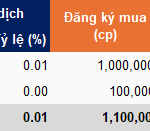

Recently, Vietnam Asset Management Joint Stock Company (VCAM) submitted a report detailing its stock transactions in Vietcap Securities Joint Stock Company (Stock Code: VCI, HoSE). According to the report, VCAM successfully acquired 580,000 VCI shares out of the 1 million shares registered for purchase during the trading period from December 2, 2025, to December 18, 2025. The incomplete transaction was attributed to market prices not aligning with investment objectives.

Following the transaction, VCAM’s ownership of VCI shares increased from 68,300 to 648,300 shares, raising its stake from 0.01% to 0.09% of Vietcap Securities’ capital.

Illustrative image

During the same period, the Ban Viet Discovery Fund, managed by VCAM, successfully purchased 100,000 registered VCI shares, increasing its ownership from 0% to 0.01% of Vietcap Securities’ charter capital.

In addition to acquiring VCI shares, VCAM recently registered to purchase 2 million BVB shares of Ban Viet Commercial Joint Stock Bank (BVBank) from December 23, 2025, to January 20, 2026, for long-term investment purposes. Prior to this, VCAM held no BVB shares.

Notably, Ms. Nguyen Thanh Phuong serves as the Chairwoman of the Board of Directors for both Vietcap Securities and VCAM, and also holds the position of Vice Chairwoman of the Board of Directors at BVBank.

Established in 2006, Vietnam Asset Management Joint Stock Company (VCAM) specializes in fund management, including the establishment and management of securities investment funds and portfolio management. Its headquarters are located on the 5th floor of HM Town Building, 412 Nguyen Thi Minh Khai Street, Ban Co Ward, Ho Chi Minh City.

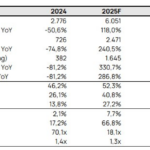

In terms of business performance, VCAM reported a net revenue of nearly VND 3.1 billion in the first nine months of 2025, a 50% decrease compared to the same period in 2024. Financial activities generated over VND 34.8 billion in revenue, a 74.9% increase.

After deducting taxes and fees, VCAM’s net profit reached nearly VND 8 billion, nearly four times the net profit of the first nine months of 2024.

As of September 30, 2025, VCAM’s total assets increased by 12.6% from the beginning of the year to nearly VND 251 billion, while total liabilities decreased by 18.9% to over VND 13.3 billion.

VCI Continually “Bottom-Fishing”: Two Ecosystem Members Register to Buy 1.1 Million Shares

On November 26th, Vietnam Asset Management Joint Stock Company (VCAM) and its affiliated fund, Vietnam Discovery Investment Fund (VCAMDF), registered to purchase a combined maximum of 1.1 million shares of Vietcap Securities Joint Stock Company (VCI).

Industry Leader Projected to Hit Record Profits by 2026, Dividends Could Reach 17,000 VND per Share

Regarding dividend policy, the company has consistently maintained a 100% cash payout ratio of its earnings from 2019 to 2024. Vietcap forecasts that this ratio will remain robust, ranging between 98% and 100%, throughout the 2025–2029 period.