As of this afternoon’s survey, the global spot gold price hit a record high of $4,400 per ounce. This surge has bolstered domestic gold markets, driving prices upward in today’s trading session.

Reports indicate that domestic gold prices across various brands and products have risen by approximately 500,000 to 1 million VND per tael compared to earlier this morning.

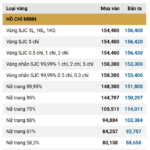

In the ring segment, selling prices at major retailers have been adjusted upward. Bao Tin Minh Chau lists prices at 153–156 million VND per tael; PNJ trades around 151.8–154.8 million VND per tael; DOJI is at 151.5–154.5 million VND per tael. Bao Tin Manh Hai has also increased ring prices to 152.6–155.6 million VND per tael, while SJC lists them at 150.8–153.8 million VND per tael.

Ring prices listed at Bao Tin Manh Hai as of this afternoon’s survey.

For gold bars, prices at major retailers now hover around 155.5–157.5 million VND per tael, marking a significant increase from the session’s start.

–

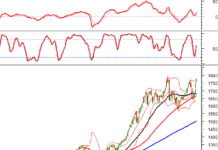

By midday on December 22 (Vietnam time), the global spot gold price was trading at approximately $4,392 per ounce, up $54 per ounce from the previous session.

Global gold prices at the time of survey. (Source: Kitco)

Mirroring international trends, domestic gold prices have been adjusted upward. SJC lists gold bars at 155.5–157.5 million VND per tael, a 900,000 VND increase from this morning.

For gold rings, SJC has raised prices to 150.8–153.8 million VND per tael, a 300,000 VND increase.

At other retailers like Bao Tin Minh Chau, PNJ, and DOJI, gold bars are trading around 155.1–157.1 million VND per tael. Ring prices at Bao Tin Minh Chau are 152–155 million VND per tael, while PNJ and DOJI list them at 151.5–154.5 million VND per tael.

—

At Mi Hong, this morning’s opening session saw ring and bar prices rise by 100,000 VND per tael for buying, while selling prices remained unchanged from last week’s close. Currently, Mi Hong lists rings and bars at 155.4–156.6 million VND per tael (buy–sell).

Meanwhile, other major gold retailers have not yet adjusted their prices. Ring prices at Bao Tin Minh Chau are 152–155 million VND per tael; PNJ and DOJI list them at 151–154 million VND per tael. SJC lists rings at 150.5–153.5 million VND per tael. For bars, these retailers maintain prices around 150.5–153.5 million VND per tael.

Globally, spot gold was trading at approximately $4,369 per ounce at the time of survey, up $32 per ounce from the previous session. Gold’s upward momentum is supported by cooling U.S. inflation data, increasing expectations that the Federal Reserve may ease monetary policy sooner.

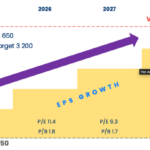

Heter Grant, Vice President and Senior Strategist at Zaner Metals, remains optimistic about gold’s outlook. He predicts prices could break out of current trends, targeting $4,515 per ounce and potentially $5,000 per ounce.

Heraeus, a precious metals group, forecasts gold prices between $3,750 and $5,000 per ounce in 2026, citing risks in the U.S. economy. Goldman Sachs predicts a 14% rise to $4,900 per ounce by December 2026, driven by central bank demand and Fed rate cuts.

Conversely, gold faces short-term pressure from a stronger U.S. dollar and year-end position adjustments. The dollar recently hit a one-week high, making gold more expensive for non-dollar holders.

Zain Vawda of MarketPulse by OANDA notes that current pressure stems from year-end adjustments and holiday caution. However, weaker-than-expected U.S. economic data strengthens the case for Fed rate cuts in 2026.

November’s U.S. CPI rose 2.7% year-over-year, below the 3.1% forecast. Austan Goolsbee, President of the Chicago Federal Reserve, suggests sustained lower inflation could lead to more rate cuts. Futures markets now indicate a slight increase in odds for a Fed cut in January 2026.

In physical markets, Indian gold discounts hit a one-month high as record prices dampened wedding-season demand. Chinese discounts are the strongest since late August 2020, reflecting sluggish physical demand.

Why Silver Emerges as the Driving Force Behind Market Momentum

Silver prices surged to a record high over the weekend, bolstered by robust investment demand and tightening supply conditions. Meanwhile, gold also posted a weekly gain as markets increasingly wagered on an imminent rate cut by the U.S. Federal Reserve.

December 16: SJC Gold and Plain Gold Ring Prices Reverse, Continuously Declining

After a morning drop of 1 million VND per tael, domestic gold prices continued their downward trend in the afternoon of December 16th, falling an additional 600,000 to 800,000 VND per tael.