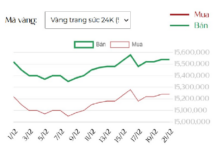

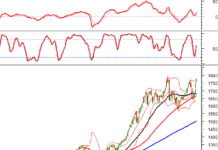

As 2025 draws to a close, Vietnam’s financial markets have experienced significant volatility. Following a buoyant first half, the VN-Index has been undergoing a notable correction since September. Simultaneously, domestic gold prices have reversed after a period of rapid growth, with widening buy-sell spreads deterring short-term investors. With both stocks and gold proving unstable, capital is shifting towards safer avenues, particularly savings accounts, which offer both asset preservation and steady returns.

In this context, the concept of “smart money management” goes beyond simply holding funds in a bank account. It involves strategically choosing the right timing, channels, and methods to safeguard and grow wealth. Investors who once chased market trends now recognize that preserving capital is not a defensive move but a strategic step toward future opportunities. As financial priorities shift, Vietnamese consumers are increasingly focused on optimizing their savings, balancing risk awareness with long-term financial goals.

Savings strategies are no longer passive but proactive responses to market fluctuations. Ensuring capital safety is essential for seizing larger opportunities. With competitive interest rates and diverse bank incentives, savings accounts not only preserve wealth but also generate stable profits. Many young individuals are adopting a “portfolio diversification” approach, combining investments for growth with fixed savings to protect capital. In turbulent times, preserving wealth is a significant achievement.

Online Certificates of Deposit at 7.8% p.a., starting from just VND 10 million

Amid the search for secure yet profitable options, some banks are introducing more proactive savings products. BVBank, for instance, has launched online Certificates of Deposit with rates up to 7.8% p.a. Customers, especially younger ones, can purchase these certificates via the Digimi digital bank with a minimum investment of VND 10 million, eliminating the need for branch visits.

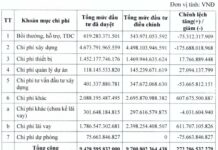

These certificates are available in 6, 9, 12, and 15-month terms, with options for interest payments at maturity or monthly. Current rates range from 6.5% to 7.8% p.a., with specific rates of 6.5% (6-9 months), 6.8% (12 months), and 7.8% (15 months) for end-of-term payouts.

The total issuance limit is VND 1 trillion, available from December 22, 2025, to March 31, 2026, or until fully subscribed. Beyond returns, these certificates can serve as financial verification for overseas travel, study, or work, and are transferable as needed.

|

Term |

BVBank Certificate Rates (% p.a.) |

|

|

End-of-Term |

Monthly |

|

|

6 months |

6.50 |

6.40 |

|

9 months |

6.50 |

6.35 |

|

12 months |

6.80 |

6.60 |

|

15 months |

7.80 |

7.50 |

Bonus Rates for Various Terms, Starting from VND 50 Million

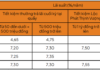

For traditional savings accounts, BVBank is offering new incentives as part of its 33rd-anniversary celebration.

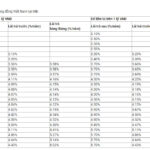

Customers depositing VND 50 million or more for 6–18 months will receive an additional 0.5% p.a. on listed rates. This bonus applies to regular, online, and optimized savings accounts.

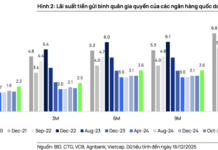

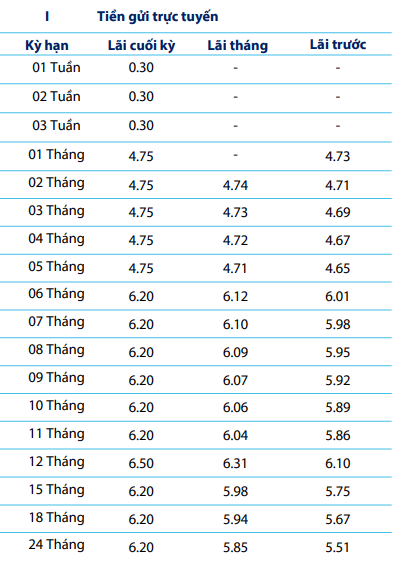

Since December 17, BVBank has introduced new deposit rates for individual customers, highly competitive in the market. For 1–5 month terms, the maximum rate is 4.75% p.a. Terms of 6–11 months and 15–24 months offer 6.2% p.a., while 36–60 month terms yield 6.4% p.a. Notably, the 12-month term is listed at 6.5% p.a.

With the 0.5% bonus, BVBank savers can earn up to 7% p.a.

(BVBank’s New Deposit Rates as of December 17, 2025)

In a volatile financial landscape, choosing the right savings option is both prudent and responsible. Savings offer more than just interest—they provide peace of mind, knowing your wealth is growing steadily without market risks. Savings also foster disciplined financial management, a cornerstone of effective money management. Savers typically control spending better, maintain stable emergency funds, and make less emotionally driven investment decisions.

Explore BVBank’s New Deposit Rates HERE

Banks Go All-In: High-Interest Rates Lure Depositors

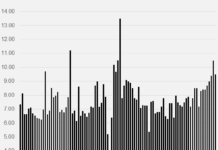

Banks are relentlessly hiking deposit interest rates as the year draws to a close. The fierce competition to offer the highest rates intensifies as banks scramble to meet soaring capital demands, with staff aggressively pursuing customers to secure top-tier returns.

The Ultimate Guide to MB Bank’s Interest Rates: Maximizing Your Returns with the 24-Month Term Deposit

As of August 2025, Military Bank (MB) offers a competitive interest rate of up to 5.8% p.a. for personal savings accounts with a tenure of 24 months or more in the Central and Southern regions of the country. Customers in other regions can also enjoy attractive interest rates, with the highest rate being 5.7% p.a.