2 Sessions

3 Sessions

4 Sessions

5 Sessions

High Volume Trades

– 06:58 December 22, 2025

Vietstock Daily 23/12/2025: Re-testing Critical Resistance Levels

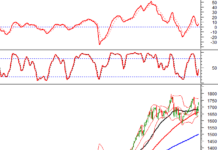

The VN-Index continues its impressive growth, now testing the previous October 2025 peak (1,740-1,795 points). Strong foreign buying and sustained trading volumes above the 20-day average signal a high likelihood of breaking through this resistance level.

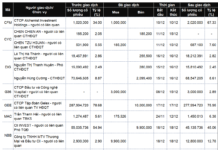

Top Stocks to Watch at the Opening Session on December 17th

Discover the most volatile stocks in recent trading sessions with Vietstock’s comprehensive list of top gainers and losers. Stay ahead of the market trends by exploring the stocks that have experienced significant price movements, providing valuable insights for informed investment decisions.

Vietstock Daily 19/12/2025: Accumulation Amid Low Liquidity?

The VN-Index rebounded into positive territory by the end’t of the session, forming a Hammer candlestick pattern. The index is currently consolidating above the 100-day SMA, while trading volume remains subdued below the 20-session average, reflecting cautious investor sentiment. The MACD indicator continues to weaken, hovering near the zero line, which heightens short-term risk should it cross below this threshold in upcoming sessions.