Services

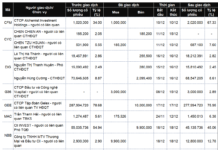

Vietnam Container Joint Stock Company (Viconship, HOSE: VSC) has recently registered to purchase an additional 14 million shares of HAH from Hai An Transport and Loading Joint Stock Company (HOSE: HAH). This move aims to increase Viconship’s ownership stake. The transaction is expected to be executed via order matching and/or negotiated trading between December 25, 2025, and January 23, 2026.

If successful, Viconship’s holdings in HAH will rise from 21.86 million shares (12.95%) to 35.86 million shares (21.24%).

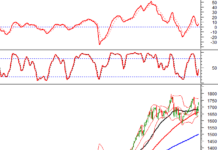

On the stock market, HAH shares are currently trading at VND 59,800 per share, marking a 60% increase since the beginning of the year but still 11% below the mid-November peak. The company’s market capitalization stands at approximately VND 10,000 billion. Based on HAH’s current market price, Viconship may need to invest over VND 800 billion for this transaction.

| 2025 Trading Performance of HAH Shares |

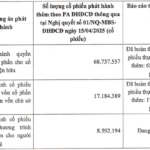

In other developments, HAH plans to issue an additional 2.5 million ESOP shares, representing 1.48% of the total outstanding shares, at a price of VND 10,000 per share. These shares will be subject to a 3-year transfer restriction from the completion of the offering.

If employees do not fully subscribe to the offering, the company will distribute the remaining shares to other eligible parties at a price no lower than VND 10,000 per share. The issuance is scheduled for Q1/2026, pending approval from the State Securities Commission.

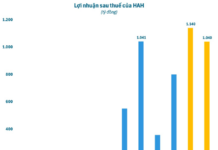

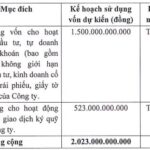

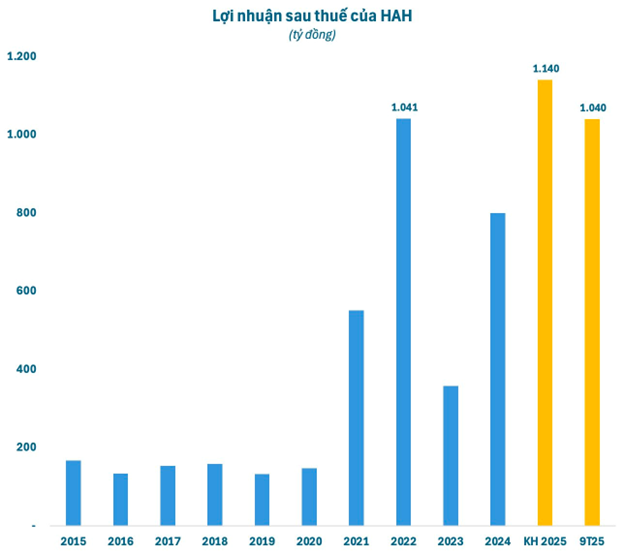

Notably, HAH has approved an updated business plan for the 2025 fiscal year, targeting a total volume of 1,466,000 TEU, a 0.8% increase from the initial plan. The revised plan also projects total revenue of VND 5,057 billion (up 11%) and post-tax profit of VND 1,140 billion (up 31.8%).

For the first nine months of 2025, HAH reported revenue exceeding VND 3,790 billion, a 36% year-on-year increase. Post-tax profit reached over VND 1,040 billion, 2.3 times higher than the same period last year. These results significantly surpass the initial profit target and achieve 79% of the adjusted plan.

– 17:58 22/12/2025

MBS to Utilize Nearly VND 86 Billion from ESOP Issuance for Margin Trading Capital

On December 19th, the Board of Directors of MB Securities Corporation (HNX: MBS) passed a resolution to implement an employee stock ownership plan (ESOP). This plan involves issuing nearly 8.6 million shares to employees, scheduled for execution in 2025. The proceeds from this issuance will be allocated to margin lending activities.

F88 Aims to Boost Chartered Capital Beyond 1.1 Trillion VND via Bonus Share Issuance

F88 is set to issue over 101.65 million shares to shareholders at a 1:12 rights ratio, with its chartered capital expected to rise to nearly VND 1,101.3 billion. The implementation is scheduled for 2025 and the first quarter of 2026.

An Binh Securities Aims to Triple Capital to Over 3,000 Billion VND

An Binh Securities JSC (HOSE: ABW) is seeking shareholder approval for a capital increase plan. The proposal involves issuing new shares to existing shareholders and an Employee Stock Ownership Plan (ESOP). If successful, the company aims to raise up to VND 2,073 billion, bringing its total chartered capital to VND 3,084.5 billion.