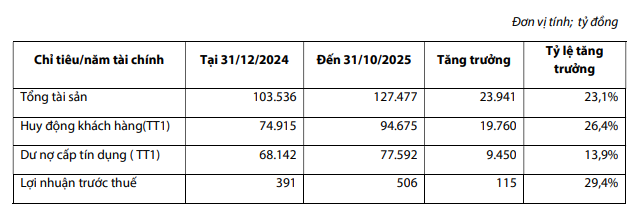

According to the report, BVBank announced that its pre-tax profit for the first 10 months of 2025 reached VND 506 billion, achieving 92% of the annual target of VND 550 billion. As of October 31, 2025, the bank’s total assets stood at VND 127,477 billion, a 23% increase from the beginning of the year. Customer deposits reached VND 94,675 billion (+26%), and outstanding loans amounted to VND 77,592 billion (+14%).

BVBank has set its business goals for the 2025-2030 term, aiming for total assets of VND 154,000 – 296,000 billion, an 18% increase; outstanding loans of VND 92,000 – 179,000 billion, also an 18% increase; and chartered capital of VND 9,500 – 14,000 billion. The bank targets an average ROE of 10% and aims to keep the non-performing loan ratio below 3%.

Proposed Increase in Chartered Capital by VND 3,504 Billion

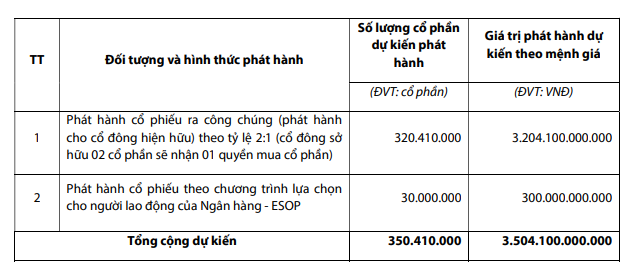

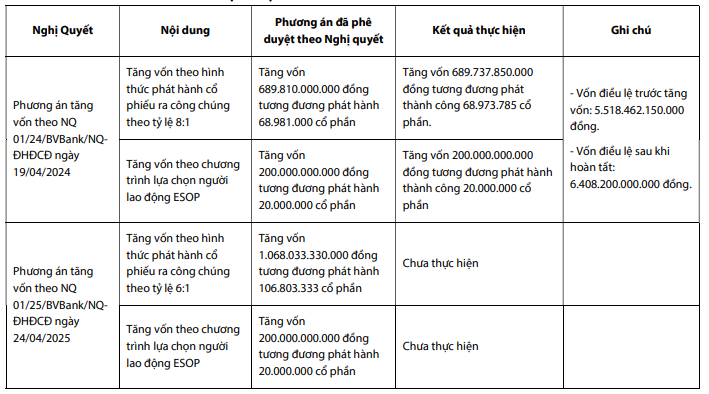

At the recent General Meeting, BVBank proposed two plans to increase its chartered capital by a maximum of VND 3,504 billion in 2026.

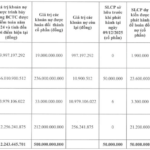

First, BVBank plans to issue 320.41 million shares to existing shareholders at a ratio of 2:1 (shareholders holding 2 shares will receive 1 right, and 2 rights will allow the purchase of 1 new share). Shareholders cannot transfer these rights. The newly issued shares will not be subject to transfer restrictions. The offering price will not be lower than VND 10,000 per share.

The bank intends to use the expected VND 3,204 billion from this offering to supplement its lending capital. The issuance is planned for 2026.

Second, BVBank plans to issue 30 million shares under the Employee Stock Ownership Plan (ESOP). The offering targets the bank’s employees and those of its subsidiaries, as approved by the Board of Directors. The expected VND 300 billion from this issuance will also be used to supplement lending capital.

If both issuances are completed, BVBank’s chartered capital is expected to increase from VND 6,408 billion to VND 9,912 billion.

Additionally, BVBank has not yet completed two capital increase plans approved at the 2025 Annual General Meeting in April 2025: a public offering of 106.8 million shares and an ESOP issuance of 20 million shares.

Amendments to Legal Representative Regulations and Election of Board Members for the 2025-2030 Term

At the Extraordinary General Meeting, BVBank proposed amendments to its charter. The current clause states, “The CEO is the legal representative of the bank.” The proposed amendment reads, “The legal representative is the CEO or the Chairman of the Board of Directors in cases where the bank has not yet formally appointed a CEO.”

The Board of Directors also proposed the election of board members for the 2025-2030 term. The board will consist of 7 members, including 1 executive member, 4 non-executive members, and 2 independent members. The Audit Committee will comprise 5 members.

– 13:18 23/12/2025

Bank Reports 10-Month Profits Surpassing Entire 2024 Target by 30%, Prepares for Shareholder Meeting to Elect New Board and Double Capital

Ban Viet Joint Stock Commercial Bank (BVBank – Stock Code: BVB) has recently released materials for its Extraordinary General Meeting of Shareholders (EGM) in 2025. The meeting is scheduled to take place on December 26, 2025, at the T78 Guest House located at 145 Ly Chinh Thang, Xuan Hoa Ward, Ho Chi Minh City.