I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts experienced mixed movements during the December 24, 2025 trading session. Specifically, 41I1G1000 (I1G1000) rose by 0.35%, reaching 2,022 points; 41I1G2000 (I1G2000) increased by 0.08%, hitting 2,015.3 points; 41I1G3000 (I1G3000) gained 0.05%, closing at 2,003 points; while 41I1G6000 (I1G6000) dipped by 0.04%, settling at 1,999.2 points. The underlying index, VN30-Index, ended the session at 2,023.13 points.

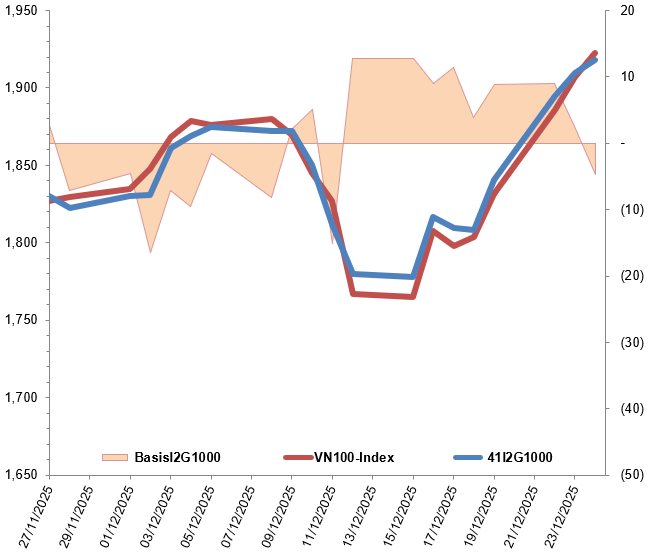

Additionally, VN100 futures contracts also saw mixed movements on December 24, 2025. Notably, 41I2G1000 (I2G1000) climbed by 0.43%, reaching 1,918.1 points; 41I2G2000 (I2G2000) rose by 0.5%, closing at 1,897.2 points; 41I2G3000 (I2G3000) declined by 0.27%, ending at 1,897.2 points; and 41I2G6000 (I2G6000) fell by 0.25%, settling at 1,892.1 points. The underlying index, VN100-Index, concluded the session at 1,922.80 points.

During the December 24, 2025 trading session, 41I1G1000 opened with selling pressure dominating, causing a sharp decline. However, Long positions quickly intervened, helping the contract recover to its reference level and maintain a prolonged sideways movement until the end of the morning session. In the afternoon, the sideways trend continued, but buyers retained control, keeping the contract in positive territory until the close, with a final gain of 7 points.

Intraday Chart of 41I1G1000

Source: https://stockchart.vietstock.vn

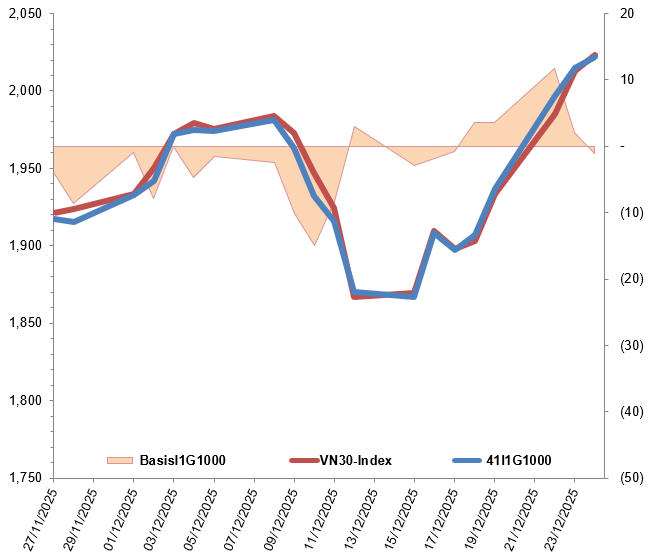

At the close, the basis of the G1000 contract reversed from the previous session, reaching -1.13 points. This indicates a return of bearish sentiment among investors.

Movements of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

Meanwhile, the basis of the I2G1000 contract also reversed, reaching -4.7 points, reflecting renewed bearish sentiment among investors.

Movements of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

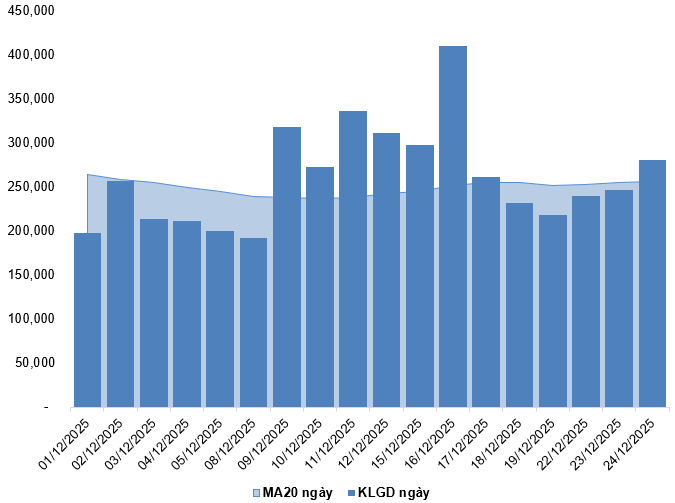

Trading volume and value in the derivatives market increased by 14.11% and 14.22%, respectively, compared to the December 23, 2025 session. Specifically, G1000 trading volume rose by 14.26%, with 280,524 contracts matched. I2G1000 trading volume dropped by 24.44%, with only 34 contracts traded.

Foreign investors continued to sell, with a net selling volume of 513 contracts during the December 24, 2025 session.

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

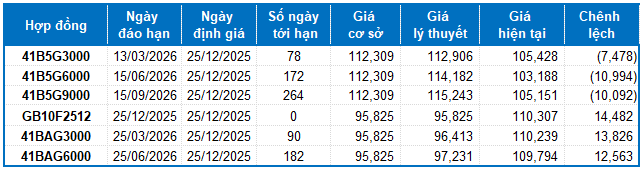

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of December 25, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments appropriate for each futures contract.

I.3. Technical Analysis of VN30-Index

During the December 24, 2025 session, VN30-Index rose for the fifth consecutive session, forming a Dragonfly Doji candlestick pattern accompanied by above-average volume (20 sessions), indicating persistent investor optimism.

Currently, the index is retesting the October 2025 high (around 2,015-2,055 points), while the MACD indicator continues to rise after giving a buy signal above the zero line, further supporting the short-term uptrend.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of December 25, 2025, the reasonable price range for actively traded government bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments appropriate for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, and 41B5G9000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they present a compelling value in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 24/12/2025

Derivatives Market Update: Bullish Signals Dominate on December 23, 2025

On December 22, 2025, both the VN30 and VN100 futures contracts surged during the trading session. The VN30-Index marked its third consecutive day of gains, forming a bullish Three White Soldiers candlestick pattern. This uptrend was accompanied by consistently rising trading volumes, surpassing the 20-session average, indicating strong investor optimism.

Vietstock Weekly 22-26/12/2025: Can the Market Sustain Its Momentum?

The VN-Index rebounded with a prominent Big White Candle pattern, as the Bollinger Bands’ Middle Line continues to provide robust support for the medium-term trend. However, the index is likely to face continued volatility and challenges in reclaiming its October 2025 highs, given that trading volume has remained below the 20-week average for nine consecutive weeks.

Derivatives Market Outlook for Week 22-26/12/2025: Short-Term Prospects Show Signs of Improvement

On December 19, 2025, both the VN30 and VN100 futures contracts surged during the trading session. The VN30-Index continued its upward trajectory, forming a long-bodied candlestick pattern accompanied by trading volume surpassing the 20-session average, indicating a notably optimistic sentiment among investors.

Derivatives Market Update: Volatile Trading on December 19, 2025

On December 18, 2025, both the VN30 and VN100 futures contracts saw a collective rise in points during the trading session. The VN30-Index exhibited a tug-of-war pattern, characterized by small-bodied candlestick formations and erratic trading volumes in recent sessions, indicating investor sentiment remains unsettled.