The fast-paced lifestyle, shrinking time availability, and evolving financial habits have led Vietnamese consumers to embrace a new consumption model: cashless, wait-free, and app-minimal. What they seek is a solution simple enough to handle most daily tasks with a single tap.

Thu Hằng (33, Hanoi) shares that every month, she juggles multiple apps to pay utility bills, school fees, or book flights. “My biggest concern isn’t the process itself, but the risk of using the wrong app or account and missing payments,” she says. For her, a platform consolidating all financial and utility services in one place would reduce stress and enhance spending transparency.

Similarly, Quang Minh (29, Ho Chi Minh City) reveals his investment journey was once disrupted by overly complex app-switching. “Opening an investment account here, transferring funds there, and managing insurance elsewhere—it all drained my motivation,” he shares. For young users like Minh, an integrated model not only saves time but also minimizes errors and streamlines financial management.

Addressing these real-world needs, Digimi emerges as the ideal solution, enabling users to manage nearly all daily transactions with a single tap.

One Tap: A Consolidated Financial & Utility Ecosystem

BVBank’s digital bank, Digimi, allows users to open investment accounts, purchase health insurance, pay bills, book flights, or hail taxis—all within one system. Fully online and compliant with Decree 52 on cashless payments, it ensures safety and transparency in line with financial market standards.

The standout feature isn’t the number of services, but how seamlessly they’re connected. Users no longer juggle disjointed processes: no in-person consultations or paperwork for insurance, no time-bound bill payments, and no app-switching for flights or taxis. One interface, multiple tasks, one unified workflow.

Previously time-consuming activities are now streamlined. Home insurance, once requiring assessments and contract approvals, is completed in minutes. Utility payments are made anytime. Travel needs—flight bookings or taxi rides—are handled instantly within the app.

Three Pillars: Investment – Insurance – Payments

For financial services, Digimi enables in-app investment account openings with Vietcap. Post-eKYC, users enjoy 0.05% fees and 9.5% margin interest for the first two months. Additional offerings include online savings and deposit certificates—ideal for those diversifying assets while prioritizing simplicity.

For insurance, Digimi focuses on high-demand private home insurance, offering coverage up to 50 billion VND for homes and 800 million VND for interiors. Digital certificates are issued instantly, and contracts are stored online for easy access—far more convenient than physical management.

In payments and mobility, Digimi integrates high-frequency services: utility bill payments, QR scans, flight bookings, and VNPAY Taxi calls. Most daily expenses are consolidated on one platform, simplifying cash flow management and reducing app-switching errors.

Seamless Experience: The Decisive Factor in Digital Finance Competition

In a diversifying fintech market, competitive advantage lies not in feature quantity, but in reducing user processing time. Digimi differentiates itself through a frictionless experience, minimizing redundant verifications and automating transactions.

As the “cashless living” trend grows, users favor platforms that simplify interactions. Digimi aims to be a “digital living tool,” enabling users to manage most personal financial needs in a unified, secure workflow.

By integrating investments, insurance, payments, and mobility into one platform, Digimi offers not just convenience, but standardized safety. This is why many young users are shifting to integrated models over multiple standalone apps.

Platforms like Digimi reflect a shift in personal finance toward minimalism and efficiency. Today’s users value not feature count, but how much they can accomplish in how little time.

With Digimi, needs from bill payments to investments, insurance, and mobility are consolidated in one place. This isn’t just a cashless evolution, but a new approach to digital finance—more flexible, scientific, and time-efficient.

In celebration of BVBank’s anniversary, the bank is launching multiple promotions for individual customers. Credit cardholders can earn rewards ranging from 330,000 to 3,300,000 points based on transaction volume and frequency, with priority for early activations or high activity.

Additionally, savings account holders depositing 50 million VND or more for 6–18 months receive an extra 0.5% annual interest on standard, online, and optimized savings products.

Digimi app users spending 500,000 VND or more also earn 33,000 reward points, awarded to those with the highest transaction volumes (excluding partner channels). These promotions run from December 17, 2025, to January 17, 2026, with limited availability.

Vietnam Officially Establishes International Financial Centers in Ho Chi Minh City and Da Nang

On December 18th, the Vietnamese government issued Decree No. 323/2025/NĐ-CP, establishing the International Financial Center in Vietnam. This decree, comprising 7 chapters and 23 articles, concretizes National Assembly Resolution No. 222/2025/QH15. It provides detailed regulations on the organization, operation, development roadmap, and management mechanisms for the International Financial Center.

BVBank Unveils Massive Year-End Deals and 0% Installment Offers on Credit Cards for Peak Shopping Season

With 2026 just around the corner, schedules are packed and expenses are soaring. Amidst the year’s most festive season, a smart financial tool can help you stay on top of your budget while fully embracing every celebration. BVBank Card is emerging as the go-to choice for maintaining peace of mind during this peak season.

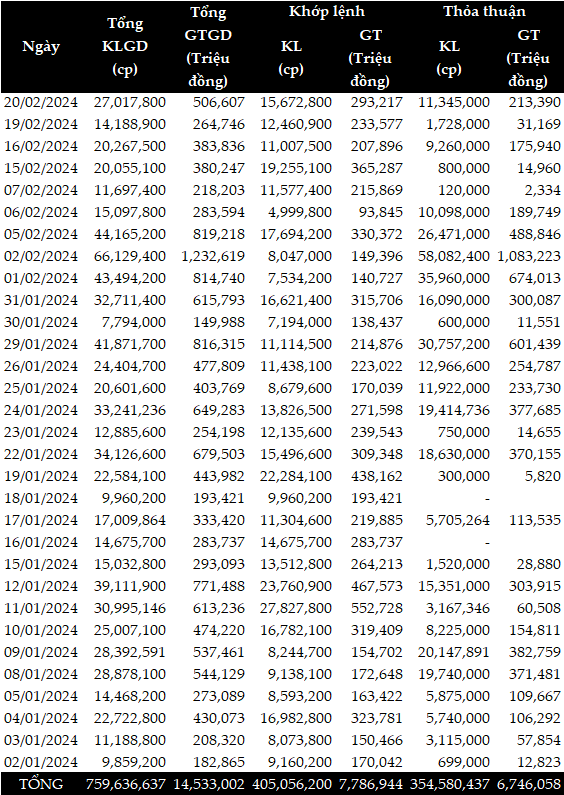

International Market Favors SSI: Over $300 Million in Margin Capital Emerging

SSI has secured an unprecedented unsecured syndicated loan of up to $300 million, marking the largest transaction of its kind in Vietnam’s securities industry. This milestone not only underscores the international financial institutions’ confidence in Vietnamese enterprises but also highlights SSI’s exceptional credit profile and robust risk management capabilities. As a fully unsecured facility, the loan serves as a direct testament to SSI’s financial strength and strategic acumen.

Double Profits, Double Impact: The Financial Trend Revolutionizing Personal Money Management in Vietnam

Have you ever wondered, “Can idle or spent money generate returns?” The answer is a resounding yes, and this philosophy is driving a revolution in how modern individuals manage their personal finances. A prime example of this trend is VIB’s Profit Duo—a financial solution that forward-thinking users are leveraging to achieve dual profitability.