UOB Bank’s Global Economics & Market Research team in Singapore has released its economic outlook report for Vietnam in Q1 2026.

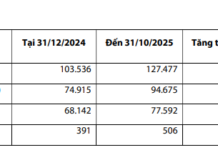

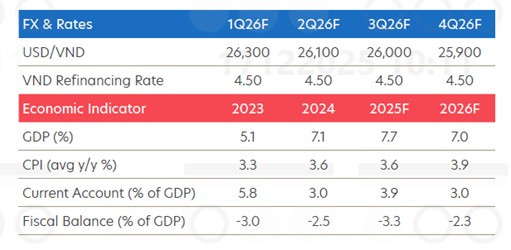

For Q4 of this year, UOB forecasts Vietnam’s economic growth at 7.2%, bringing the annual growth rate to 7.7%. In 2026, growth is expected to moderate to around 7% due to the high base effect from 2025 and the slowdown in export order front-loading.

UOB projects Vietnam’s annual growth to reach 7.7%.

The positive growth outlook for 2026, coupled with inflationary pressures on the Vietnamese Dong (VND), will limit the State Bank of Vietnam’s room for policy easing. As a result, UOB anticipates the central bank to maintain the refinancing rate at 4.5%.

In 2026, UOB maintains a cautious stance on the VND, forecasting the USD/VND exchange rate at 26,300 in Q1, 26,100 in Q2, 26,000 in Q3, and 25,900 in Q4.

UOB expects the US Dollar (USD) to weaken in the coming year, primarily driven by the Federal Reserve’s anticipated continuation of monetary policy easing. Political risks could resurface, further pressuring the USD downward in the upcoming months.

“As Jerome Powell’s term as FOMC Chair ends in May 2026, markets may start pricing in the possibility of a successor more aligned with the Trump administration’s preference for lower interest rates. This scenario would reinforce expectations of a lower terminal rate, leading to a prolonged USD weakening trend,” a UOB expert commented.

According to UOB, the positive factors driving gold’s recent surge remain intact. Gold’s role as a safe-haven asset continues to strengthen portfolio diversification. Consequently, gold accumulation on major global exchanges like COMEX and SHFE remains robust. Similarly, inflows into gold ETFs are consistently positive.

UOB maintains its view of a weaker USD in the coming year, primarily due to expectations of continued Fed monetary policy easing.

At the national level, global central banks’ gold reserve accumulation shows no signs of slowing. Expectations of further Fed rate cuts at the December FOMC meeting also provide short-term support.

Overall, barring any changes to these supportive factors, gold prices are likely to maintain their current upward trajectory. Therefore, UOB remains bullish on gold, revising its price forecast to $4,300/oz in Q1 2026, $4,400/oz in Q2, $4,500/oz in Q3, and $4,600/oz in Q4.

USD Free Market Plunges Below 27,000 VND Mark on December 19th Afternoon

The free-market USD exchange rate has been steadily cooling in recent days, dropping below the 27,000 VND mark and narrowing the gap with bank rates.