Riding the wave of the broader market’s surge, Sacombank’s STB shares turned a vibrant purple from the opening of the December 23rd session, with nearly 5 million buy orders at the ceiling price. STB’s price climbed to VND 56,000 per share, marking its second consecutive ceiling session.

In just over a week of trading, STB has soared nearly 22%, propelling Sacombank’s market capitalization to VND 105.6 trillion. This rebound brings much-needed relief to shareholders after a steep correction from mid-October highs.

While most shareholders are savoring the fruits of this rally, a prominent foreign investor missed out on the initial surge.

Finland’s Pyn Elite Fund reduced its stake in Sacombank just before the stock’s upward trajectory began. The fund sold 4 million STB shares on December 9th, lowering its holdings from 95.7 million shares (5.07%) to 91.6 million shares (4.86%).

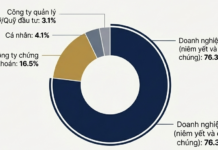

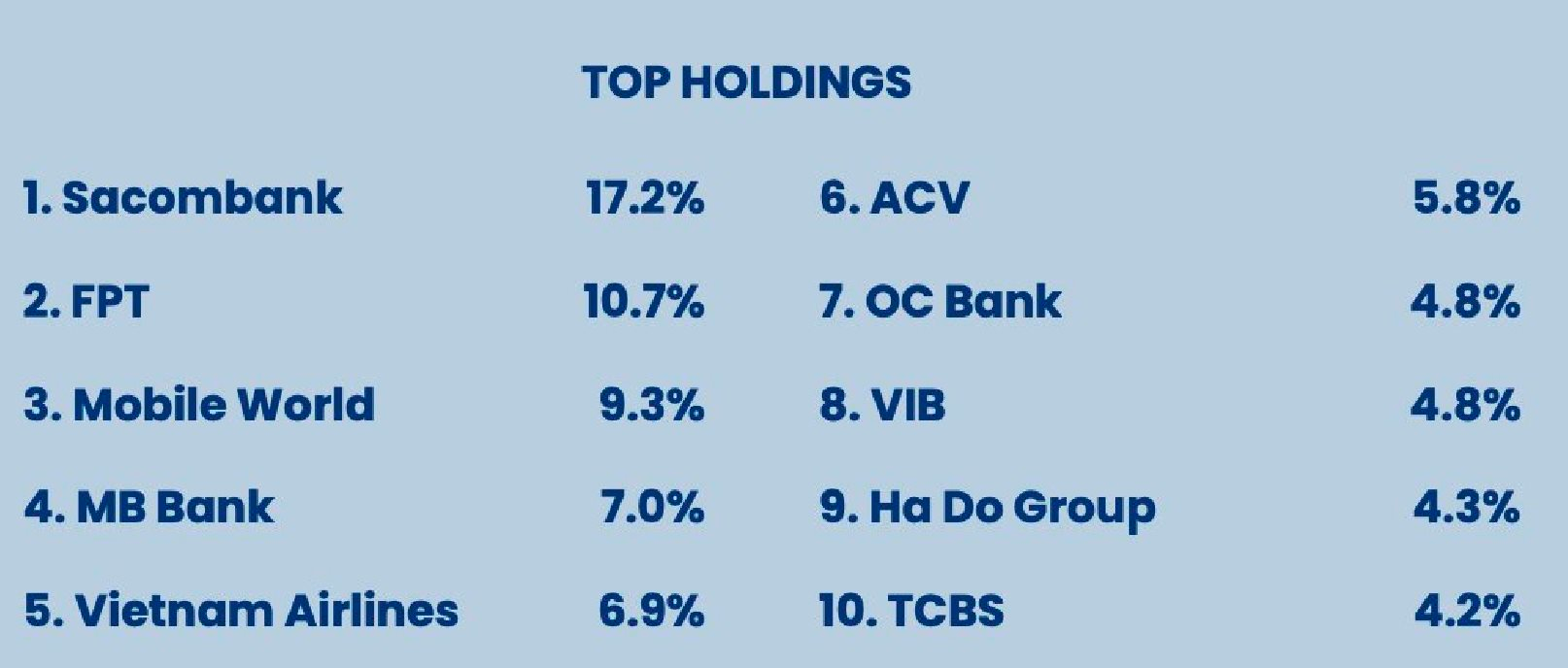

Despite the reduction, STB remains Pyn Elite Fund’s top holding. As of November, the fund managed over €890 million (approximately USD 1 billion), with STB accounting for 17.2% of its portfolio, equivalent to roughly VND 4.6 trillion.

In its November report, Pyn Elite Fund cited the delayed VAMC auction until 2026 and increased loan loss provisions as factors dampening STB’s performance. While these provisions strengthen Sacombank’s balance sheet, they weigh on short-term profitability.

SSI Securities estimates Sacombank’s Q4 2025 pre-tax profit at VND 1.9 trillion, a 58.7% decline year-over-year. Full-year provisions are projected to surge 108% to VND 4.1 trillion, offsetting the Phong Phu deal’s impact. 2025 profit is forecast at VND 12.9 trillion, a modest 1.4% increase.

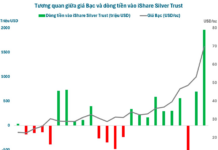

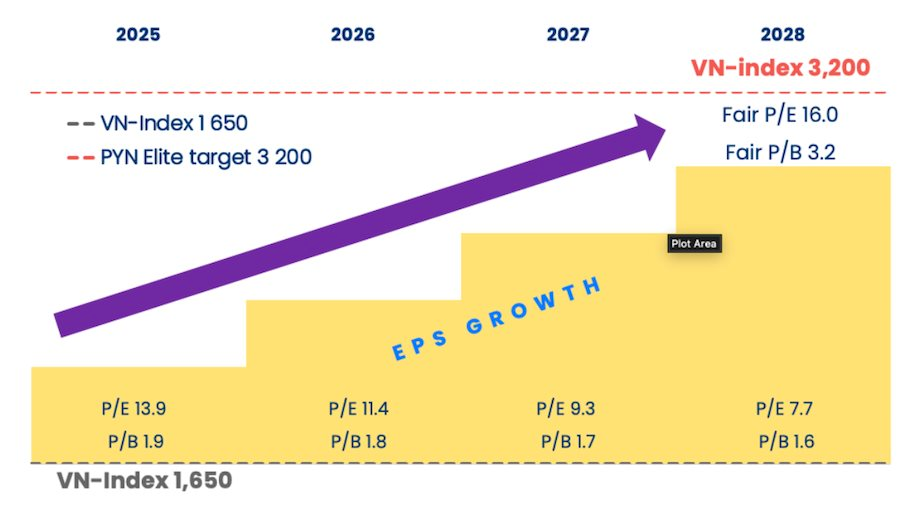

Pyn Elite Fund remains bullish on Vietnam’s market. In a recent investor letter, Petri Deryng, the fund’s head, raised the VN-Index target to 3,200 by 2028.

This target assumes 18-20% annual earnings growth for listed companies, achievable based on historical trends. This growth would result in a reasonable P/E ratio of 16.0 by 2028, up from current undervalued levels.

The fund attributes Vietnam’s market potential to its robust macroeconomic fundamentals. The government’s ambitious 10%+ GDP growth target for the next decade could significantly elevate the economy and living standards. This vision is backed by concrete administrative reforms, unleashing vast economic potential.

VIN-Index Propels VN-Index to New Heights

“Fund managers, with a hint of humor, quip that this year’s VN-Index should be rebranded as the VIN-Index, given the overwhelming dominance of this corporate group in driving the index’s performance,” shared the head of Pyn Elite Fund.

Sacombank’s Green Finance Package Ranked Among Top 10 Green & Sustainable Products/Services of 2025

Sacombank’s Green Finance Package has been honored among the Top 10 Green & Sustainable Products and Services of 2025, as part of the Vietnam Trusted Brand Program 2025 organized by VnEconomy (Vietnam Economic Times).