Vietnam’s 2026 Growth Slows but Remains Among the Region’s Highest

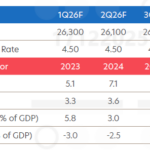

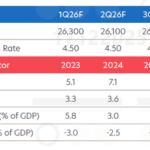

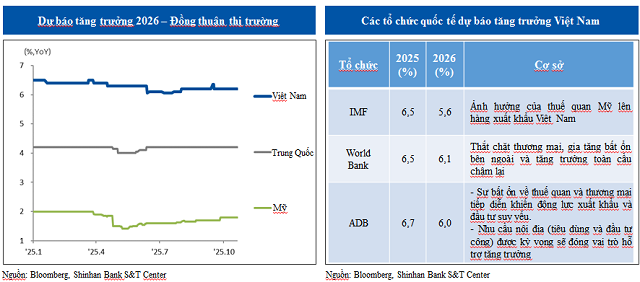

In the report “Vietnam Economic and Forex Market Outlook – First Half of 2026” published by Shinhan Bank Vietnam’s Global Trading Center, major international organizations forecast that Vietnam’s economic growth in 2026 may slow compared to 2025, yet it will remain significantly higher than many regional economies.

According to Shinhan Bank, the primary growth pressures stem from external factors such as rising tariffs, trade restrictions, and a global economic slowdown. Amid these challenges, domestic private consumption and public investment are expected to remain key pillars, sustaining the economy’s growth momentum.

Among international organizations, the International Monetary Fund (IMF) offers a more cautious forecast, reflecting concerns over U.S.-China trade tensions and increasingly stringent U.S. tariff policies.

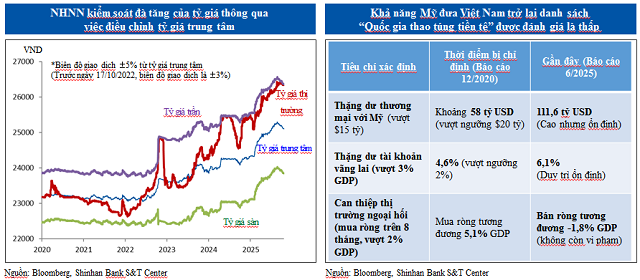

State Bank of Vietnam Prioritizes Exchange Rate Stability and Inflation Control

Assessing the 2026 outlook, Shinhan Bank anticipates that the State Bank of Vietnam (SBV) will continue to limit sharp exchange rate fluctuations, prioritizing macroeconomic stability and inflation control.

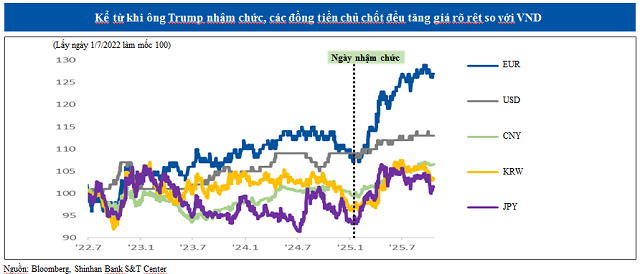

Since President Donald Trump’s second term, the SBV has maintained a cautious stance, vigilant against the risk of significant VND devaluation, amid concerns that Vietnam could be re-listed by the U.S. as a currency manipulator.

Previously, during Trump’s first term in December 2020, Vietnam was labeled a currency manipulator due to its large trade surplus with the U.S. and forex market interventions.

Following President Trump’s announcement of a 46% tariff on Vietnamese imports on “Liberation Day,” both sides negotiated, reducing the tariff to 20% by July.

Shinhan Bank highlights that the U.S.’s protectionist policies and national interest priorities significantly disadvantage the VND, given Vietnam’s highly open economy and export reliance, particularly on the U.S. market.

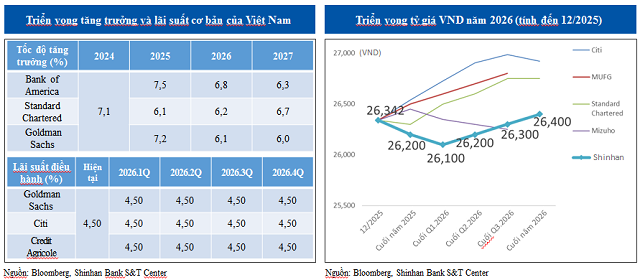

Narrowing Monetary Policy Room, Fiscal Policy Expected to Lead

While VND weakness is a rational response to external shocks, Shinhan Bank notes the rapid depreciation increases the likelihood of adjustments and recovery as external factors stabilize toward year-end.

With interest rates nearing historic lows, monetary policy room is limited. Vietnam is likely to enhance fiscal policy, particularly public investment, to support 2026 economic growth.

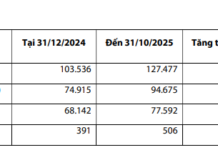

The report underscores that the banking system’s non-performing loan (NPL) ratio, at around 5%, necessitates urgent bad debt resolution, capital increases, and financial safety consolidation.

Long-term, Shinhan Bank expects Vietnam to sustain reform momentum, including institutional improvements, private sector empowerment, and high-tech sector development in digital economy, AI, and semiconductors. These factors are crucial for managing VND depreciation and maintaining macroeconomic stability.

– 4:16 PM, December 23, 2025

Central Bank Mandates Enhanced Inspection and Oversight of Payment Acceptance Entities

The State Bank of Vietnam (SBV) has issued Official Dispatch No. 11241/NHNN-TT dated December 19, 2025, urging all banks, foreign bank branches, payment intermediary service providers, and SBV-affiliated units to implement synchronized measures. These measures aim to ensure secure, seamless, and compliant payment operations, effectively meeting the heightened payment demands during the 2025 year-end settlement period and the 2026 Lunar New Year celebrations.

UOB Forecasts SBV to Maintain Policy Rates Unchanged Throughout 2026

UOB Bank (Singapore) has released its latest report on Vietnam’s economic outlook for 2025 and 2026.

SHB Honored by State Bank of Vietnam and ADB for Outstanding Support to Women-Led Businesses

The State Bank of Vietnam (SBV) and the Asian Development Bank (ADB) jointly hosted an event to honor leading banks, including SHB, for their exceptional contributions to supporting women-led businesses. This initiative plays a pivotal role in fostering sustainable economic growth and empowering women in Vietnam’s business landscape.

Interest Rates on Deposits Rise Within Permitted Range

Banking system liquidity is under strain as the year-end approaches, driven by rapid credit growth and rising interbank interest rates. This has compelled banks to raise deposit interest rates after a prolonged period of stability. However, the increase remains within the permissible range.