|

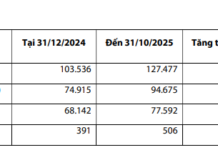

OMO Net Injection Operations from the Beginning of 2025 to December 22. Unit: Billion VND

Source: VietstockFinance

|

Specifically, despite the State Bank of Vietnam (SBV) injecting a new 80.327 trillion VND through term purchases at a 4.5% annual interest rate, the maturing capital amounting to 87.558 trillion VND returned to the SBV, resulting in a net withdrawal of 7.231 trillion VND. As of December 22, the outstanding volume on the term purchase channel decreased to 404.287 trillion VND.

|

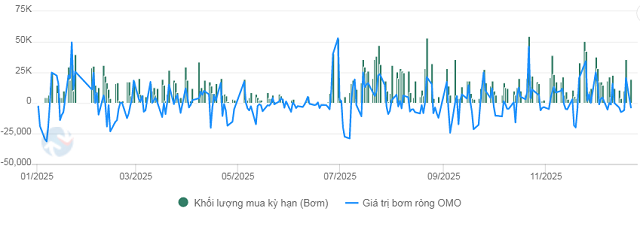

Interbank Overnight Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

This development occurred against the backdrop of a sharp decline in interbank interest rates, particularly for short-term tenors. The overnight rate saw the most significant drop, falling from 7.08% at the end of the previous week to 4.48% on December 17 (a decrease of approximately 260 basis points), before closing the week at 5.67%. The one-week and one-month rates decreased by 116 and 4 basis points, respectively, hovering around 7.1-7.4% per annum. The six-month rate remained nearly unchanged, ending the week at 6.7% per annum.

|

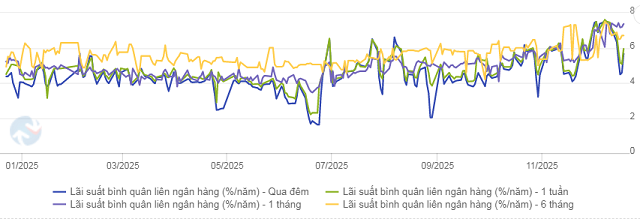

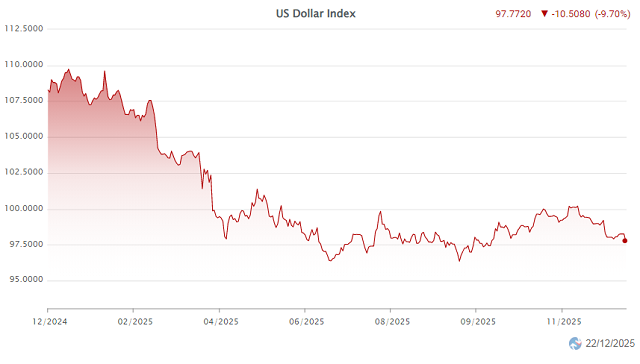

DXY Trends from the Beginning of 2025 to December 22

Source: VietstockFinance

|

In the international market, the USD Index (DXY) closed at 98.25 points on December 19, down 0.17 points from the previous week, marking its fourth consecutive week of decline.

The USD faced pressure as expectations grew for further monetary policy easing by the U.S. Federal Reserve (Fed) in 2026. U.S. CPI for November fell to 2.7%, the lowest since July and significantly below the 3.1% forecast, while the unemployment rate rose to 4.6%, the highest since 2021.

Additionally, news that U.S. President Donald Trump is set to announce a new Fed Chair—expected to pursue aggressive rate cuts—continued to weigh on the greenback. Meanwhile, the Bank of Japan (BoJ) raised its policy rate by 25 basis points to 0.75%, the highest in 30 years.

Domestically, Vietcombank listed the USD/VND exchange rate at the end of the week at 26,095 – 26,405 VND/USD (buy – sell), unchanged from the previous week.

– 11:32 December 23, 2025

Shinhan Bank: Despite Pressure, VND Poised for Recovery Through Prudent Management

Shinhan Bank Vietnam’s latest report suggests that while the Vietnamese Dong (VND) faces inevitable depreciation pressures amid heightened global uncertainty, Vietnam retains room to maneuver and stabilize its exchange rate. Favorable external factors expected later in the year could pave the way for VND adjustments and recovery.

Central Bank Mandates Enhanced Inspection and Oversight of Payment Acceptance Entities

The State Bank of Vietnam (SBV) has issued Official Dispatch No. 11241/NHNN-TT dated December 19, 2025, urging all banks, foreign bank branches, payment intermediary service providers, and SBV-affiliated units to implement synchronized measures. These measures aim to ensure secure, seamless, and compliant payment operations, effectively meeting the heightened payment demands during the 2025 year-end settlement period and the 2026 Lunar New Year celebrations.

Gold Market and USD Exchange Rate Forecast for 2026

UOB Bank forecasts the USD/VND exchange rate at 26,300 in Q1/2026, 26,100 in Q2/2026, 26,000 in Q3/2026, and 25,900 in Q4/2026. For gold, UOB has revised its price predictions to $4,300/oz in Q1/2026, $4,400/oz in Q2/2026, $4,500/oz in Q3/2026, and $4,600/oz in Q4/2026.

SHB Honored by State Bank of Vietnam and ADB for Outstanding Support to Women-Led Businesses

The State Bank of Vietnam (SBV) and the Asian Development Bank (ADB) jointly hosted an event to honor leading banks, including SHB, for their exceptional contributions to supporting women-led businesses. This initiative plays a pivotal role in fostering sustainable economic growth and empowering women in Vietnam’s business landscape.