As of this afternoon’s survey, the price of SJC gold bars at SJC, DOJI, PNJ, and Bao Tin Minh Chau has adjusted to 157.2 – 159.2 million VND per tael, a decrease of 600,000 VND per tael compared to this morning’s opening session.

The price of gold rings at these companies remains unchanged.

—

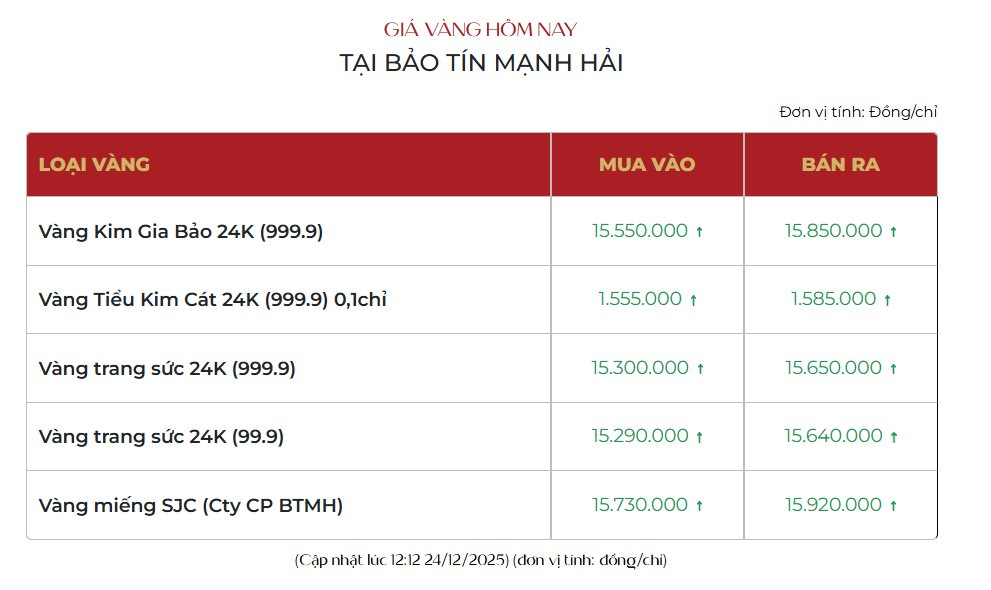

This afternoon, the price of gold rings at Bao Tin Minh Chau and Bao Tin Manh Hai is uniformly listed at 155.5 – 158.5 million VND per tael, an average increase of about 1 million VND per tael compared to yesterday’s closing session.

Gold price listing at Bao Tin Manh Hai.

Meanwhile, PNJ and DOJI both list the price of gold rings at 154 – 157 million VND per tael, an increase of 500,000 VND per tael.

For gold bars, prices at these companies are generally around 157.8 – 159.8 million VND per tael, continuing the upward trend in line with market movements.

—

This morning, the global spot gold price was recorded at $4,512 per ounce, an increase of about $25 compared to the previous session. This precious metal continues to maintain its position around the highest level in history, indicating that the flow of money into defensive assets still dominates the international market.

As of the night of December 23rd, the global gold price was about 71% higher than at the end of 2024, equivalent to an increase of nearly $1,865 per ounce.

Domestically, at the opening of this morning’s session, Mi Hong gold shop listed the price of gold rings and gold bars at 157.7 – 159 million VND per tael, an increase of 200,000 VND per tael on the buying side, while the selling price remained the same as yesterday.

Other gold shops have not adjusted their gold prices. At Bao Tin Minh Chau, the price of gold rings is listed at 154.5 – 157.5 million VND per tael. PNJ and DOJI are maintaining the price of gold rings at 153.5 – 156.5 million VND per tael. Meanwhile, SJC lists gold rings at 152.6 – 155.6 million VND per tael.

For gold bars, prices at major companies fluctuate around 157 – 159 million VND per tael. In yesterday’s session, the price of gold rings and gold bars increased by an average of 1.5-1.8 million VND per tael.

Why is the price of gold rising continuously?

According to economic experts, the main driving force behind the strong increase in gold prices comes from a combination of economic and policy factors. Firstly, the unstable international context is increasing the demand for holding safe-haven assets. New developments related to the relationship between the US and Venezuela have made the energy and financial markets more cautious, thereby supporting gold prices.

Additionally, US economic data is sending mixed signals. While Q3 GDP growth was stronger than expected, manufacturing activity shows signs of slowing as durable goods orders declined sharply. This makes the outlook for monetary policy more uncertain, reinforcing gold’s role in long-term investment portfolios.

Furthermore, pressure from budget deficits and medium-term inflation expectations continue to be fundamental factors supporting precious metal prices. Analysts believe that the large amount of money pumped into the economy in recent years has not yet fully reflected in consumer prices, but the potential for spread in the future remains.

At the same time, a weakening US dollar and US Treasury yields maintaining around 4.1% also create favorable conditions for gold as the cost of holding this non-interest-bearing asset decreases.

According to assessments by many international organizations, the upward trend in gold prices shows no signs of reversing. Technical analysis indicates that this precious metal remains in an uptrend, with the next target level mentioned around $4,600 per ounce.

Domestically, gold prices are expected to continue fluctuating according to international developments and market sentiment. However, experts advise investors to consider carefully, avoid the psychology of buying at high prices, and closely monitor macroeconomic factors that may impact trends in the future.

In a global economic context full of uncertainties, gold continues to assert its role as a value-holding channel chosen by many investors.

Gold Price Last Week: Surged Then Reversed, Closing Above 156 Million VND per Tael

Over the past week, gold prices experienced significant volatility during the early trading sessions, surging dramatically on Monday (15/12/2025) before reversing course and consolidating through the remainder of the week.