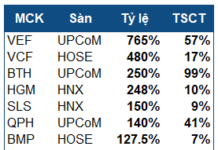

Nearly four years since March 2022, when Trinh Van Quyet, Chairman of FLC Group, was prosecuted and detained for alleged stock market manipulation, the FLC ecosystem has undergone significant turmoil, both in the capital market and business operations.

The latest development emerged in the stock market. On December 24, the Hanoi Stock Exchange (HNX) announced the delisting of shares from three companies: FLC Mining and Asset Management Investment JSC (GAB), H.A.I Agrochemical JSC (HAI), and CFS Import-Export and Trading Investment JSC (KLF).

According to HNX, the final trading day for these three stocks on UPCoM is December 30, 2025, before their official delisting on December 31, 2025. The reason cited is that these companies have lost their public company status under securities law regulations. This means that, starting in 2026, these companies will no longer be listed on the stock market.

Previously, the State Securities Commission (SSC) also revoked the public company status of FLC Group JSC as of December 18, 2025. Simultaneously, FLC Faros Construction JSC (ROS) was also stripped of its public status.

Several other companies within the FLC ecosystem had their public status revoked by the SSC, including FLCHomes Real Estate Development Investment and Business JSC (FHH) and FLC Stone Mining and Investment JSC (AMD). Many of these companies share the same registered address at FLC Landmark Tower, Le Duc Tho Street, Hanoi.

Notably, despite being listed on UPCoM, these stocks had been suspended or restricted from trading for extended periods, primarily due to violations of information disclosure obligations, delayed financial report submissions, and failure to hold shareholder meetings as required.

Thus, seven companies within the FLC ecosystem have now had their public status revoked and are gradually being delisted following the legal entanglements of the group’s founder, who faces charges related to stock manipulation and asset fraud.

What’s particularly regrettable for investors is that these stocks, once traded at several hundred thousand dong per unit, now hover around a few thousand dong when delisted, even lower than the price of a glass of iced tea.

Before Trinh Van Quyet’s legal troubles, FLC was one of the largest real estate conglomerates, with a portfolio of projects spanning from the North to the South. Prior to his arrest on March 29, 2022, the company continuously announced new investment plans and was researching and promoting legal procedures for nearly 300 projects.

However, after March 29, 2022, numerous FLC projects were halted, had their research approvals revoked, or ceased operations in various localities. Notable examples include the Hoang Long Industrial Zone (Thanh Hoa), Thai Binh International General Hospital, and the Yen Thuy tourism-resort-golf complex (formerly Hoa Binh).

Nevertheless, FLC has recently shown signs of recovery, with several key projects being unblocked and restarted.

Most recently, in mid-December, the Gia Lai Provincial People’s Committee approved adjustments to the investment policy and allowed FLC Group JSC to continue as the investor for the FLC Hilltop Gia Lai project, with a total capital of approximately 760 billion dong, located in the center of Pleiku City. The project, which began construction in 2019, had been stalled due to legal issues.

Also in Gia Lai, the Dak Doa Golf Course project, with a total investment of over 1.15 trillion dong, has been put back on track. Although approved by the Prime Minister and started in 2021, the project had been suspended for a long time before local authorities required FLC to enhance the protection of the existing pine forest and prepare a follow-up plan.

In the housing segment, the FLC Tropical City Ha Long (GreenLife Apartment) social housing project has completed its main structural components and is ready for roofing work. Prices are expected to range from 15 to 22 million dong per square meter, with applications accepted from December 2025 and handover scheduled for Q3/2026.

In Hanoi, Hausman Premium Residences within the FLC Premier Parc urban area (Dai Mo) has attracted attention by completing construction nearly a year ahead of schedule, with handover expected in June 2026.

Additionally, the FLC Quang Binh Hotel & Villas, with a capacity of 433 rooms, is being accelerated to open in 2026.

The Hausman Premium Residences project within FLC Premier Parc urban area is completing construction nearly a year ahead of schedule.

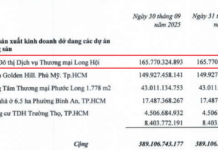

At the extraordinary shareholders’ meeting in mid-November, FLC’s leadership reaffirmed that real estate remains the core business, with over 50 projects under development and research across 11 provinces and cities. As of September 2025, the company has handed over 2,301 out of 3,173 units and completed red book issuance procedures for many customers.

After the deepest crisis in its history, FLC is gradually restructuring its operations, though the road ahead remains fraught with challenges.

Exclusive First Look: Bamboo Airways’ Inaugural Flight to Long Thanh Airport

On the morning of December 19, 2025, Bamboo Airways’ flight QH18, operated by an Airbus A321, touched down at Long Thanh Airport at 8:35 AM. This flight was one of three inaugural journeys marking the grand opening of Long Thanh – Vietnam’s largest and most advanced “super airport.”

Mass Exodus: Companies Linked to Trinh Van Quyet and FLC Delist from Stock Market

Companies affiliated with Trịnh Văn Quyết, former chairman of FLC Group, are successively losing their public company status and delisting from the stock exchange.