After an initial surge, the VN-Index experienced a sharp decline towards the end of the session, influenced by fluctuations in Vingroup shares. Closing on December 25th, the VN-Index dropped nearly 40 points to 1,742. Trading volume remained robust, with transaction values on HOSE exceeding 25 trillion VND.

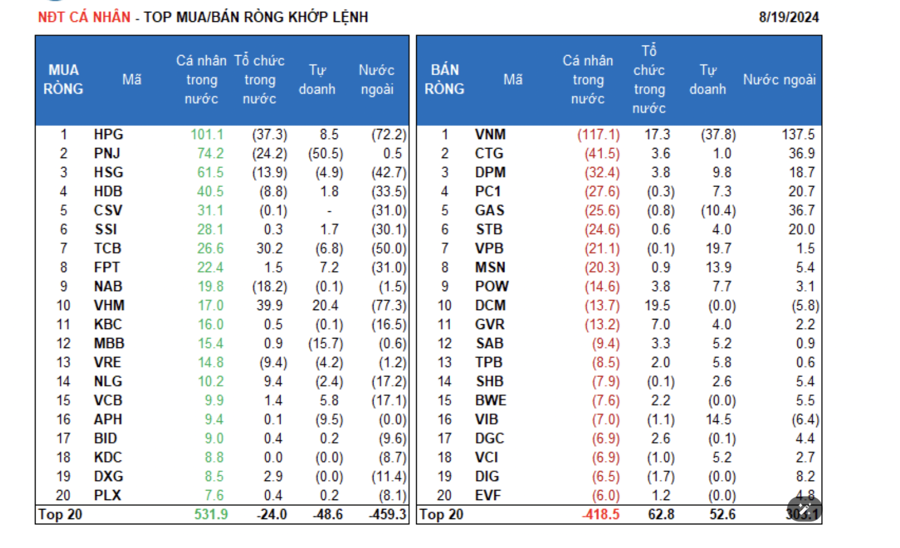

Foreign investors demonstrated active trading, achieving a net purchase of 573 billion VND across the market.

On HOSE, foreign investors net bought 613 billion VND

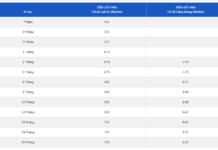

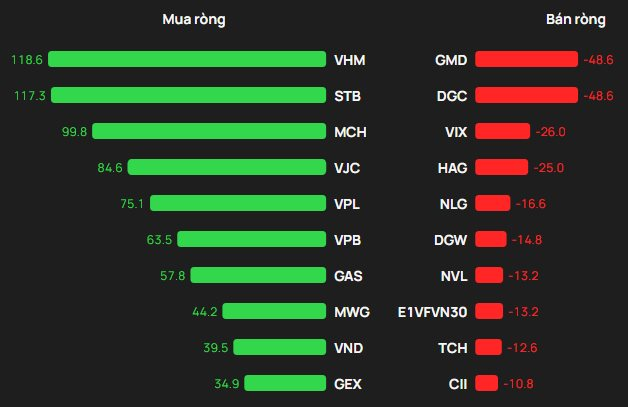

In terms of purchases, VHM was the most heavily bought stock by foreign investors on HOSE, with a value of over 119 billion VND. STB followed closely, with 118 billion VND in purchases. Additionally, MCH and VJC were bought for 100 billion VND and 85 billion VND, respectively.

Conversely, GMD was the most heavily sold stock by foreign investors, with 49 billion VND. DGC and VIX followed, with sales of 49 billion VND and 26 billion VND, respectively.

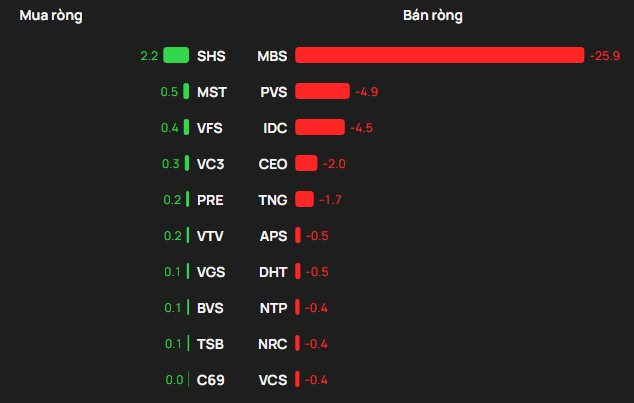

On HNX, foreign investors net sold 37 billion VND

On the buying side, SHS led with a net purchase of 2 billion VND. MST was next, with 1 billion VND in net purchases. Foreign investors also allocated a few billion VND to net buy VFS, VC3, and PRE.

On the selling side, MBS faced the most significant selling pressure from foreign investors, with nearly 26 billion VND. PVS followed with 5 billion VND, and IDC, CEO, and TNG were sold for a few billion VND each.

On UPCOM, foreign investors net sold 3 billion VND

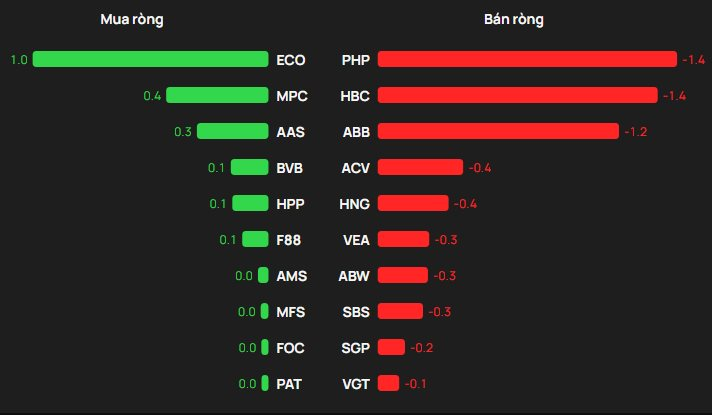

On the buying side, ECO was purchased by foreign investors for 1 billion VND. MPC and AAS followed with a few billion VND in net purchases each.

Conversely, PHP was net sold by foreign investors for 1.4 billion VND. Foreign investors also net sold HBC, ABB, and others.

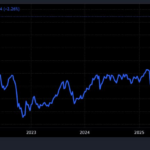

Technical Analysis for the Afternoon Session of December 25: Sustaining the Uptrend

The VN-Index is demonstrating robust growth, significantly increasing the likelihood of surpassing its October 2025 peak (equivalent to the 1,740-1,795 point range). Conversely, the HNX-Index remains below the Middle line of the Bollinger Bands, while the Stochastic Oscillator is signaling a sell indication.

Technical Analysis for the Afternoon Session of December 24: Shaking at the October 2025 Peak

The VN-Index is currently experiencing a tug-of-war, testing the previous October 2025 peak (equivalent to the 1,740-1,795 point range). Meanwhile, the HNX-Index remains below the Middle line.

Vietstock Daily 25/12/2025: Scaling New Heights?

The VN-Index climbed higher after a volatile session, extending its winning streak to a fifth consecutive day. The index remains closely aligned with the upper Bollinger Band, supported by trading volumes consistently above the 20-day average. Recent net buying activity from foreign investors further bolsters the positive short-term outlook.