PetroVietnam Technical Services Corporation (PTSC, stock code: PVS) recently held a conference to review its 2025 performance and outline plans for 2026.

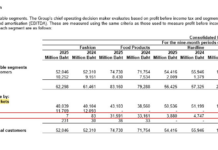

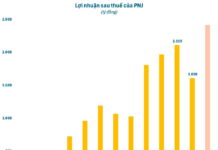

In 2025, PTSC’s consolidated revenue is estimated at VND 32,000 billion, a 35% increase year-on-year and surpassing the annual target by 107%. This marks the highest revenue in the company’s history.

However, pre-tax profit is projected at VND 1,480 billion, a nearly 5% decline compared to 2024. Despite this, PTSC concluded 2025 by exceeding its revenue target by 42% and its profit goal by 90%.

In Q4 2025 alone, revenue reached nearly VND 9,000 billion, an 8% decrease from the same period in 2024. Pre-tax profit for Q4 is estimated at VND 263 billion, a significant 69% drop compared to Q4 2024.

In a recent update, Vietcap Securities attributed PTSC’s robust 2025 revenue growth primarily to the outstanding performance of its M&C segment, driven by progress in the Lot B, Lac Da Vang, and key offshore wind EPCI projects. Vietcap noted that the profit decline stems from PTSC’s conservative cost estimation approach.

For 2026, PTSC has set a revenue target of VND 33,000 billion (+3% from preliminary 2025 results) and pre-tax profit of VND 1,300 billion (-14% from preliminary 2025 results). Notably, the 2026 revenue goal is 36% higher than the previously announced target of VND 24,300 billion in October 2025, underscoring the company’s confidence in securing ample workload for the year.

From 2022 to 2025, PTSC consistently exceeded its targets, with actual revenue and profit surpassing plans by an average of 52% and 70%, respectively.

In related news, PTSC recently held a ceremony to launch the PTSC TITAN vessel, enhancing its fleet of oil and gas service vessels. The addition of the PTSC TITAN is expected to strengthen the capacity and synergy of PTSC’s specialized fleet.

The PTSC TITAN is a multi-purpose oil and gas service vessel (AHTS) equipped with a DP2 dynamic positioning system and a pulling force of over 50 tons, ranking among the largest vessels in PTSC’s fleet.

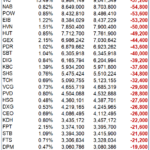

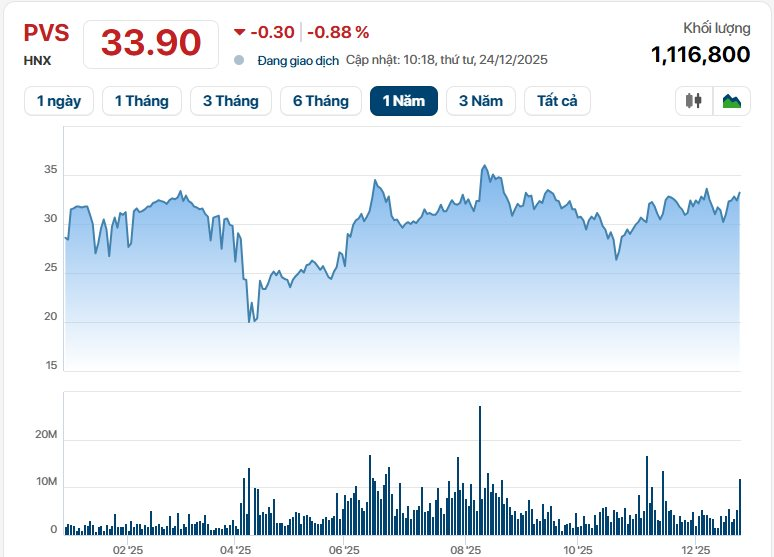

On the stock market, PVS shares are trading at approximately VND 33,900 per share, near a four-month high. The company’s market capitalization stands at nearly VND 17,300 billion.

Who’s Behind Vietnam’s $1.3 Billion Offshore Project Requiring 13,000 Tons of Steel and a 1,000-Strong Workforce?

With a total investment of approximately VND 3,300 billion, this project mobilized nearly 1,000 engineers and workers directly involved in the construction and manufacturing process.