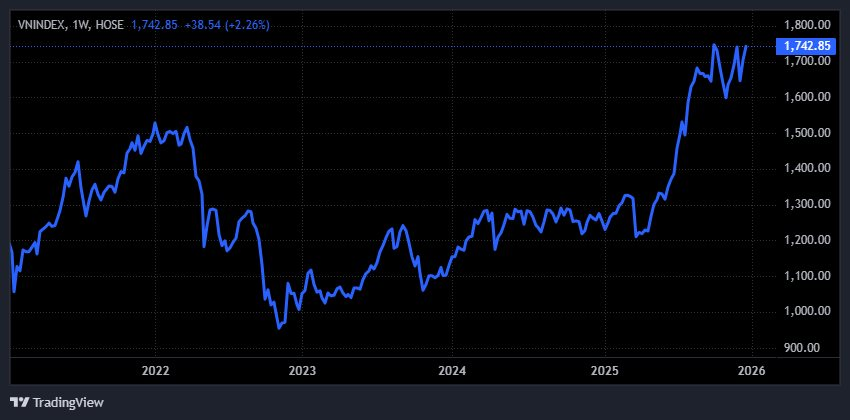

The Vietnamese stock market experienced a dramatic U-turn in the final minutes of trading on December 25th. For most of the session, the VN-Index hovered above its reference point, with cautious yet steady investor sentiment supporting a 5-10 point gain. It even briefly touched the historic 1,800-point mark for the first time.

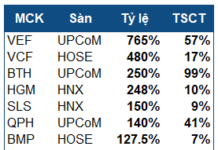

However, a sudden downturn in the performance of Vingroup-affiliated stocks (“Vin” stocks) ignited a late-session sell-off. Intense selling pressure, particularly during the ATC order matching phase, overwhelmed buyers, leaving the market vulnerable.

Consequently, the VN-Index plummeted nearly 40 points (2.2%) to close at 1,742.85, leaving investors reeling from a session that began with optimism but ended in shock.

This reversal followed Vingroup’s announcement to withdraw its investment registration for the North-South High-Speed Railway project. The company cited a strategic shift to focus on key infrastructure and energy projects, including the Olympic Sports City and Trống Đồng National Stadium, as well as high-speed rail lines connecting Bến Thành – Cần Giờ and Hà Nội – Quảng Ninh.

Mr. Nguyễn Thế Minh, Director of Securities Analysis at Yuanta Vietnam, attributed the market’s sharp decline to the underperformance of Vingroup-related stocks. These three stocks alone accounted for approximately 90% of the index’s drop.

According to Minh, the rapid downturn caught investors off guard. The news of Vingroup’s withdrawal emerged late in the session, during a sensitive market period, triggering instinctive reactions.

“When stock prices plummet rapidly, panic spreads, especially among individual investors, leading to impulsive sell-offs without considering that such psychologically driven shocks are often short-lived,” Mr. Minh explained.

He suggested that if the news had surfaced earlier in the day, investors might have had more time to assess it, potentially preventing such an extreme market reaction. The sudden announcement, coupled with some securities firms previously reducing margin lending ratios for Vingroup stocks, exacerbated the selling pressure.

Beyond the Vin group’s impact, experts noted no significant negative macroeconomic news that could have substantially influenced the session. While interbank interest rate information emerged in the afternoon, the banking system remained stable. Year-end liquidity tightened seasonally but posed no major concerns. Credit activity slowed as the fiscal year neared its end, with systemic liquidity expected to improve from January.

Regarding Vingroup’s withdrawal from the high-speed rail project, analysts argued that this alone wasn’t substantial enough to trigger such a sharp decline. Vingroup’s involvement was limited to a registration, with no actual implementation. Meanwhile, on December 19th, several major infrastructure projects commenced, indicating Vingroup’s strategic reallocation of investment priorities.

Experts attributed the market’s reaction more to psychological factors than shifts in profit expectations. Infrastructure investments typically yield lower margins compared to real estate, Vingroup’s traditional strength. Thus, exiting the rail project doesn’t signify deteriorating prospects but rather a focus on higher-yielding sectors.

Looking ahead, analysts believe such psychological shocks are transient. The market may stabilize within a few sessions, possibly rebounding in the next session. The VN-Index’s short-term uptrend remains intact, and the recent drop isn’t enough to reverse it. The short-term outlook remains positive.

Vingroup Withdraws Investment Registration for North-South High-Speed Railway Project

Vingroup (HOSE: VIC) has officially submitted a request to the Government to withdraw its investment registration for the North-South High-Speed Railway project. This strategic move allows the conglomerate to refocus its resources on critical infrastructure and energy initiatives, including the Olympic Sports City and the Trống Đồng National Stadium, as well as high-speed rail projects such as Bến Thành – Cần Giờ and Hà Nội – Quảng Ninh.

Technical Analysis for the Afternoon Session of December 25: Sustaining the Uptrend

The VN-Index is demonstrating robust growth, significantly increasing the likelihood of surpassing its October 2025 peak (equivalent to the 1,740-1,795 point range). Conversely, the HNX-Index remains below the Middle line of the Bollinger Bands, while the Stochastic Oscillator is signaling a sell indication.

Technical Analysis for the Afternoon Session of December 24: Shaking at the October 2025 Peak

The VN-Index is currently experiencing a tug-of-war, testing the previous October 2025 peak (equivalent to the 1,740-1,795 point range). Meanwhile, the HNX-Index remains below the Middle line.

Vietstock Daily 25/12/2025: Scaling New Heights?

The VN-Index climbed higher after a volatile session, extending its winning streak to a fifth consecutive day. The index remains closely aligned with the upper Bollinger Band, supported by trading volumes consistently above the 20-day average. Recent net buying activity from foreign investors further bolsters the positive short-term outlook.