After two strong sessions, the stock market experienced fluctuations at high price levels. Amid this, AAS – SmartInvest Securities Corporation unexpectedly drew attention with a sharp surge to its ceiling price. Trading on UPCOM, AAS rose by 14.4% to reach 10,300 VND per share.

Alongside the price increase, trading volume for this stock surged significantly, with nearly 7 million units changing hands, equivalent to a transaction value of nearly 70 billion VND. Despite the steep rise, over 2.1 million units were still queued for purchase at the ceiling price.

Historically, AAS has previously surged dramatically before quickly cooling off. Notably, the stock experienced a significant rally in mid-2025, with its price climbing from 7,000 VND per share in April 2025 to a historic peak of 23,000 VND per share by August 28, marking a nearly 230% increase over four months. However, within just one month afterward, the stock plummeted by over 50%, forming a sharp decline on the price chart.

SmartInvest Securities, formerly known as Gia Anh Securities Corporation, was established on December 26, 2006, with a charter capital of 22 billion VND, operating in securities brokerage, investment advisory, and investment services. In 2020, AAS stock was approved for trading on the UPCoM market by HNX. Currently, the company’s charter capital stands at 2,300 billion VND.

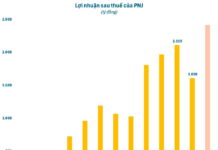

In terms of business performance, in the first nine months of 2025, AAS recorded 468 billion VND in operating revenue, a 36% increase year-on-year. After-tax profit reached 160 billion VND, up 122% compared to the same period in 2024.

For 2025, the company set a target of 520 billion VND in operating revenue and 82 billion VND in after-tax profit, representing increases of 27% and 11%, respectively. Thus, after nine months, AAS has achieved 90% of its revenue target and nearly 200% of its profit target for the year.

As of the end of Q3 2025, SmartInvest Securities allocated 991 billion VND to FVTPL, down 38% from the beginning of the year but up 30% from the end of Q2 2025. The company primarily invested in bonds (493 billion VND), though this investment decreased by over 1,000 billion VND compared to the start of the year.

Miza Files for HOSE Listing, Joins Wave of Stock Exchange Transfers

Miza Corporation (UPCoM: MZG) has officially submitted its stock listing application to the Ho Chi Minh City Stock Exchange (HOSE), marking a significant milestone for this leading paper manufacturer. This move propels Miza towards the next phase of its growth and joins the growing list of UPCoM companies eagerly awaiting their main board debut.