Vietnam’s Macroeconomic Outlook for 2026 Looks Promising

According to a report by ABS Research, global economic growth in 2026 is projected to slow to around 2.8-2.9%, supported by stable consumption and spending. Escalating trade tensions and non-tariff barriers could disrupt supply chains, while immigration restrictions may negatively impact growth, particularly in aging populations. However, progress in tariff negotiations with the U.S. has reduced uncertainty. While faster productivity growth driven by AI could benefit economies, it also raises the risk of asset bubbles.

Central banks have limited room to cut interest rates amid sluggish economic conditions. The Fed is expected to cut rates only once in 2026, maintaining rates at 3.25-3.5% through 2027. The ECB is unlikely to cut rates further, while Japan may continue tightening monetary policy. Global inflation is expected to ease but remain above 2% in the U.S. and near targets in the Eurozone.

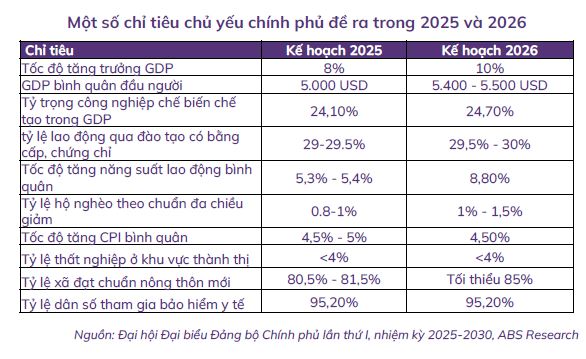

Vietnam has set an ambitious 10% GDP growth target for 2026, exceeding the 7.5-8.5% range planned for 2026-2030. ABS Research forecasts a positive macroeconomic outlook, with GDP growth around 9.5% in the baseline scenario, driven by:

Public investment, with over 95% of the plan expected to be completed, will remain a key growth driver.

FDI inflows are projected to hit record highs in 2026, as Vietnam’s participation in multiple FTAs, abundant labor, competitive wages, and favorable tax rates continue to attract foreign investors.

Domestic consumption is expected to recover strongly in 2026, supported by rising per capita income, personal income tax reforms, and a low-interest-rate environment.

Export prospects are positive as the U.S., EU, Japan, and China enter a more stable recovery phase. New trade agreements will further enhance competitiveness.

Government reforms in land, investment, construction, energy, and capital market regulations are creating a more favorable business environment and promoting healthy growth.

However, Vietnam faces challenges from both domestic and international factors, including: increasing natural disasters, pressure on the VND/USD exchange rate due to low foreign reserves and rising trade deficits, risks of tariff evasion, and potential inflationary pressures from rising global energy and food prices amid geopolitical tensions.

Equity Markets Remain Attractive for Investment

ABS Research forecasts 2025 listed companies’ net profits to grow 26.2% year-on-year, driven by strong growth in non-financial sectors. In 2026, net profits are expected to rebound 21.6%, supported by revenue growth and margin improvement.

The VN-Index recovered from April to October 2025 before entering a consolidation phase. By late November 2025, it traded at a 2025 TTM P/E of 14.75x, up from 13.42x in 2024, following a 424-point (33.5%) rally year-to-date. This valuation is above the +1 standard deviation of the 3-year P/E average (14.52x), making it less attractive but still offering opportunities if companies maintain growth.

Mid- and small-cap stocks are most attractively valued at a P/E of 11.0x, 26.8% below the 3-year average and 25.4% below the market average.

Mid-cap stocks are the most expensive, trading above the market average but below their 3-year average.

Large-cap stocks rose 17.8% in 2025, outpacing the market’s 16.3% gain.

With low interest rates and limited alternative investments, domestic capital is expected to remain active in the equity market in 2026.

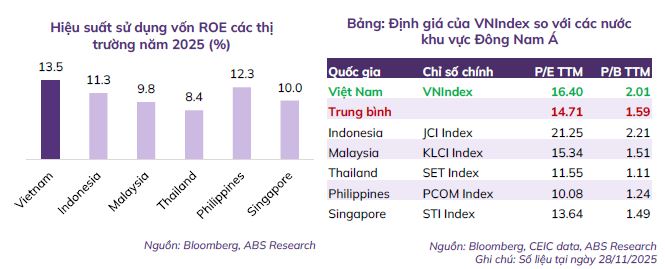

Compared to Southeast Asia, the VN-Index trades at a higher P/E of 16.4x. However, with strong profit growth and the highest projected GDP growth in the region, its 2026 P/E is expected to drop to 12.1x, making it attractive.

FTSE’s upgrade of Vietnam from “Frontier” to “Secondary Emerging” will attract significant capital from emerging market funds.

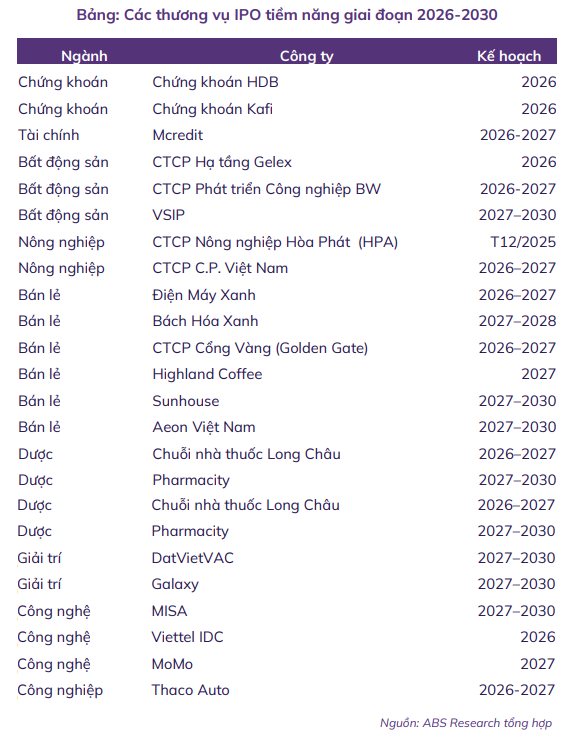

Vietnam’s ongoing reforms, including improved market access for foreign investors, sector diversification, and high-quality IPOs, are expected to drive growth. Estimated IPOs from 2025-2027 could reach $47 billion, adding quality stocks and attracting foreign capital.

Long-Term Uptrend Continues

The market remains in a long-term uptrend, with periodic corrections. These adjustments offer opportunities to identify suitable stocks for 2026.

ABS forecasts the VN-Index to surpass 2025 highs, targeting 1,940 points in the base case, with optimistic scenarios reaching 2,040-2,084-2,188 points. Valuations are supported by improving corporate earnings, low interest rates, and returning foreign capital following the FTSE upgrade.

|

In the first scenario, the market consolidates between 1,600-1,800 points, completing a mid-term correction within the secondary uptrend. The VN-Index then resumes its primary uptrend, targeting 1,875-1,940 points. Support is at 1,600 points.

In the second scenario, further corrections may create attractive entry points at 1,500-1,430 points, or deeper at 1,350 points. With the primary uptrend intact and strong economic growth, deeper corrections offer attractive investment opportunities with reduced risk.

Post-correction, the market is expected to rally to 2,040-2,084-2,188 points. Support for this scenario is at 1,300 points.

– 11:18 26/12/2025

VCBF Expert: VN-Index Valuation Remains Attractive Despite Significant Surge

Vietnam’s economy in 2026 is poised for robust growth, fueled by public investment, surging foreign direct investment (FDI), a thriving tourism sector, and buoyant domestic consumption, according to VCBF experts. Despite the VN-Index’s significant rise, its valuation remains attractive, presenting compelling long-term investment opportunities.