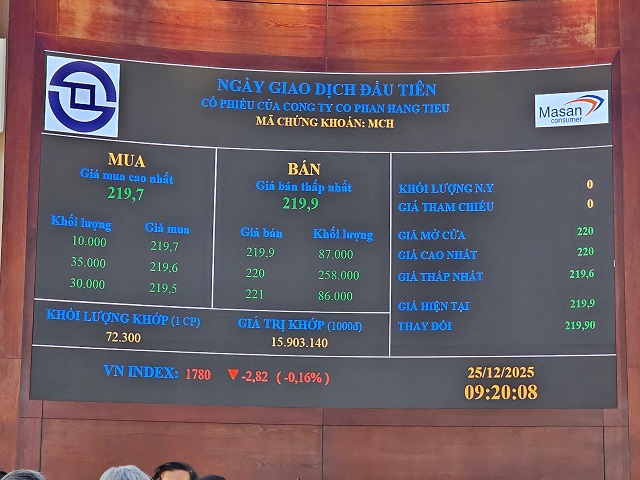

With a reference price of VND 212,800 per share on its first trading day and a trading band of +/- 20%, the market capitalization of nearly 1.07 billion MCH shares upon listing exceeded VND 227,000 billion.

MCH shares turned green just minutes after listing on HOSE.

|

For Masan, MCH is a “crown jewel”

Masan Group Chairman Nguyễn Đăng Quang speaks at the MCH listing ceremony.

|

Speaking at the ceremony, Mr. Nguyễn Đăng Quang, Chairman of Masan Group, stated that today marks the official trading of MCH shares on HOSE. For Masan, MCH is not just a “crown jewel” in terms of value but also a symbol of pride and trust.

At Masan, serving consumers is an endless business opportunity, full of creative inspiration, and a source of limitless value creation, delivering high growth, sustainable profits, and exceptional shareholder value—this is the potential story of MCH.

Building strong brands through innovation and an extensive distribution network is the path to success in the consumer goods industry. This is what MCH has achieved over nearly 25 years.

At Masan, technology will reshape humanity and redefine how we create the highest consumer value with the lowest resource consumption—this is what MCH will creatively realize. Furthermore, the “Go Global” strategy, armed with Vietnamese pride and values, is at the core of MCH’s identity.

“Therefore, I am absolutely confident that MCH will become a deeply ingrained brand in the minds of Vietnamese consumers—a brand for savings, investment, growth, and value, present in every household alongside other Masan products and brands,” Chairman Nguyễn Đăng Quang affirmed.

HOSE representatives announce and present the listing approval decision to Masan Consumer Corporation.

|

Masan Consumer Corporation (Masan Consumer, HOSE: MCH) is a subsidiary of Masan Group (HOSE: MSN). In 2003, Masan merged two companies: CTCP Công nghiệp – Kỹ nghệ – Thương mại Việt Tiến (1996), specializing in processed food and seasoning production, and CTCP Công nghiệp và Xuất nhập khẩu Minh Việt (2000), focused on trade and import-export.

After acquiring additional shares, expanding product lines, and relocating its headquarters, the company was renamed Masan Consumer Corporation in 2011. On January 5, 2017, MCH shares began trading on UPCoM with a reference price of VND 90,000 per share.

At its inception, the company had a charter capital of VND 15 billion. After 31 capital increases to expand operations, MCH’s charter capital as of September 30, 2025, stands at VND 10,676 billion. As of this date, Masan Group holds 69.37% of MCH’s shares, equivalent to 70.09% of voting rights.

Currently, MCH operates in the fast-moving consumer goods sector, directly distributing products across categories such as seasonings, convenience foods, beverages, coffee, and personal and household care products. With a penetration rate of 98% of Vietnamese households, MCH owns brands like CHIN-SU, Nam Ngư, Omachi, Kokomi, and Wake-Up 247. This gives Masan Consumer a highly stable business model and predictable cash flow, key factors for long-term investors.

This stability is evident in its financial performance over the years. From 2017 to 2024, MCH maintained an operating margin above 23%, while net profit from 2022 to 2024 grew at a compound annual rate of approximately 20%.

In the first nine months of 2025, revenue reached VND 21,281 billion, a slight 3% decrease year-on-year. Net profit was VND 4,660 billion, down 16%, impacted by the nationwide rollout of the “Retail Supreme” model. However, results improved month-over-month and quarter-over-quarter, setting the stage for future growth.

Total assets as of Q3 2025 were VND 31,885 billion, up 14% from the beginning of the year. By November 2025, Retail Supreme had identified approximately 440,000 retail points across 36 provinces and cities, with direct distribution to 354,000 outlets. Of these, 254,000 outlets became Retail Supreme members, enabling direct interaction and ordering with Masan Consumer. MCH also reorganized its sales representatives and methods to align with the new model.

Operational metrics highlight Retail Supreme’s early success. New product sales at outlets increased by about 5% in November 2025 and 11% by mid-December 2025 compared to the previous month. The number of items per successful order rose 180% from the start of 2025, while average sales representative store visits increased by approximately 20%.

With these achievements, Masan Consumer has essentially completed Phase 1 of Retail Supreme—”direct outlet coverage”—in 2025. This lays a critical foundation for Phase 2—”outlet modernization,” slated for full implementation in 2026.

From 2027 to 2030, Masan Consumer aims to complete its Consumer-Tech roadmap, expanding direct consumer connections and building a unified ecosystem from production to distribution. As hundreds of thousands of traditional retail stores are connected and upgraded, the value created extends beyond the company’s growth.

25% interim dividend for 2/2025

On December 11, 2025, MCH’s board approved a plan to simultaneously distribute treasury shares to shareholders and issue new shares to increase equity from retained earnings.

Specifically, MCH will issue 10.88 million treasury shares to existing shareholders via rights execution. With a 1.03% ratio, shareholders holding 1 share will receive 1 right, and 10,000 rights will yield 103 shares. These shares, distributed from treasury stock, are unrestricted. The source is surplus equity based on the latest audited financial statements.

Additionally, MCH plans to issue 226.87 million bonus shares to existing shareholders. With a 21.47% ratio, shareholders holding 1 share will receive 1 right, and 10,000 rights will yield 2,147 new shares. These shares are also unrestricted. The source is surplus equity based on the latest audited financial statements. Both issuances are expected in 2026.

The final registration date for exercising rights to receive treasury shares and rights allocation is January 12, 2026.

On December 25, the board also approved a 25% interim dividend for 2/2025 (VND 2,500 per share). With nearly 1.07 billion shares outstanding, MCH is expected to pay approximately VND 2,670 billion for this dividend.

Previously, in July, MCH paid over VND 2,600 billion for the first 2025 interim dividend, also at a 25% rate (VND 2,500 per share).

– 11:45 25/12/2025

Masan Consumer Sets HoSE Listing Price at VND 212,800 per Share, Valuing Company at Over $8.6 Billion

MCH shares are set to debut on the Ho Chi Minh City Stock Exchange (HoSE) on December 25th, with a reference price of VND 212,800 per share. This event marks a significant milestone, capping off a dynamic year for the market, characterized by numerous high-profile IPOs, listings, and large-scale floor transfers.

KLB Stock Approved for Listing on HOSE

KienlongBank (Kien Long Commercial Joint Stock Bank; UPCoM: KLB) has officially received approval to list its shares on the Ho Chi Minh City Stock Exchange (HOSE), as per the decision dated December 18. This milestone marks a significant turning point in the bank’s development and integration into the capital market.