I. MARKET DYNAMICS OF WARRANTS

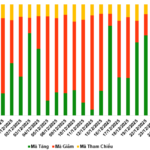

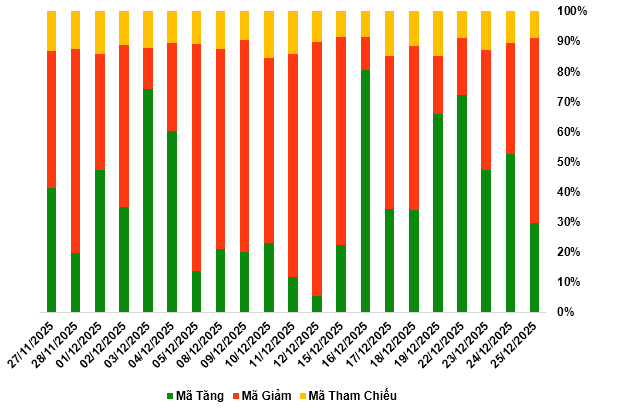

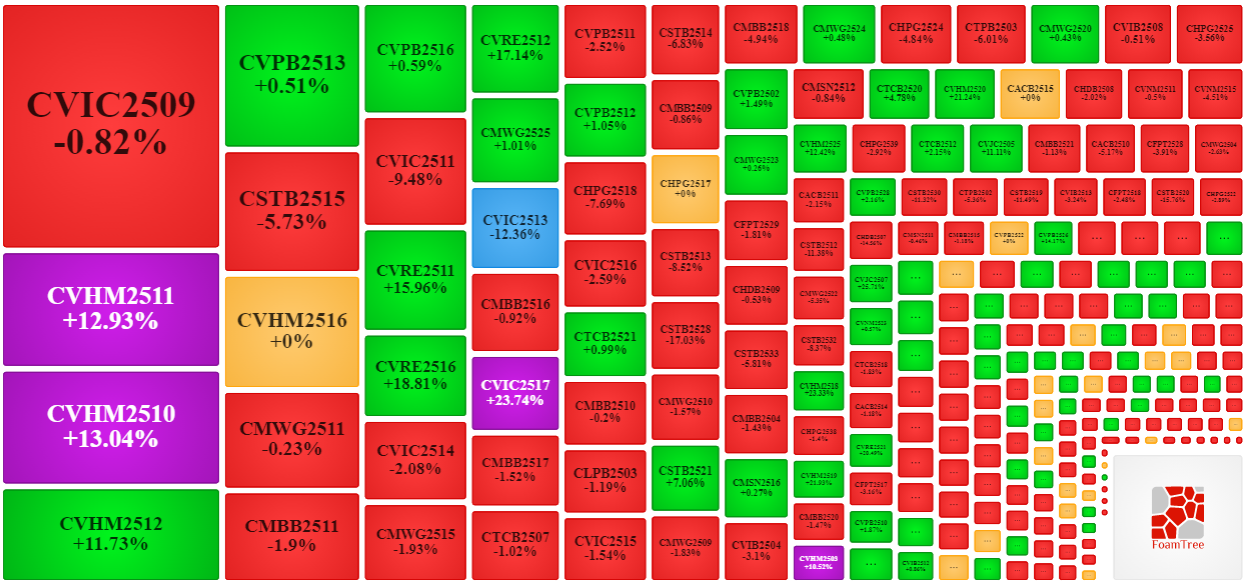

By the close of the trading session on December 25, 2025, the market recorded 77 gainers, 159 decliners, and 23 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

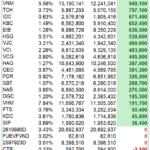

During the December 25, 2025 session, sellers regained control, driving most warrant prices downward. Notably, the top decliners included CVIC2509, CSTB2515, CMWG2511, and CMBB2511.

Source: VietstockFinance

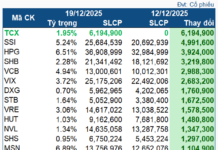

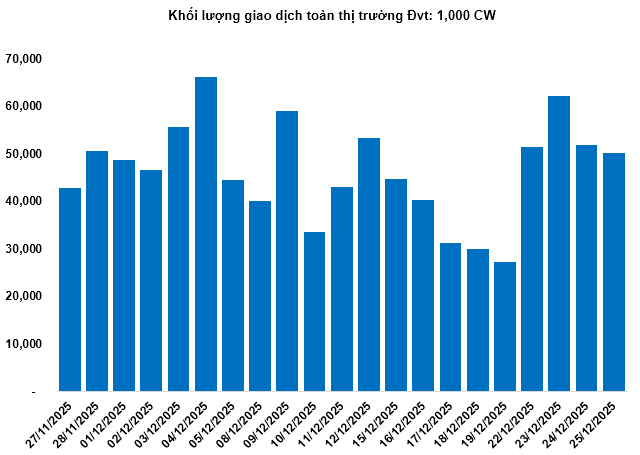

Total market volume on December 25 reached 50.08 million warrants, down 3.5%; trading value hit 119.09 billion VND, up 16.75% from December 24. CSTB2528 led in volume with 1.93 million warrants, while CVRE2516 topped trading value at 5.79 billion VND.

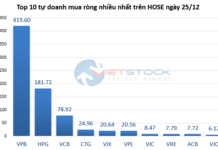

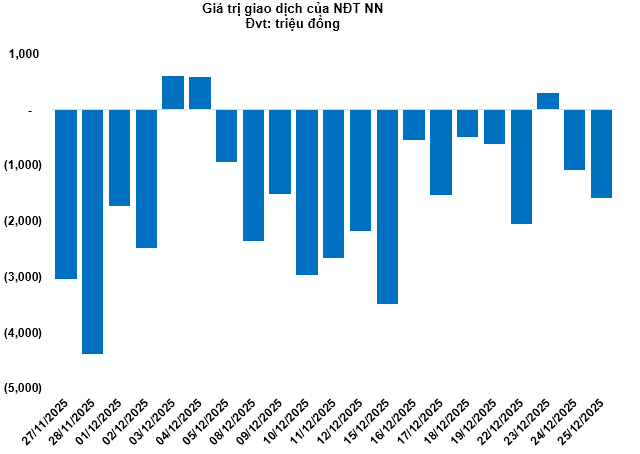

Foreign investors continued net selling on December 25, totaling 1.58 billion VND. CSTB2529 and CVHM2522 saw the highest net outflows.

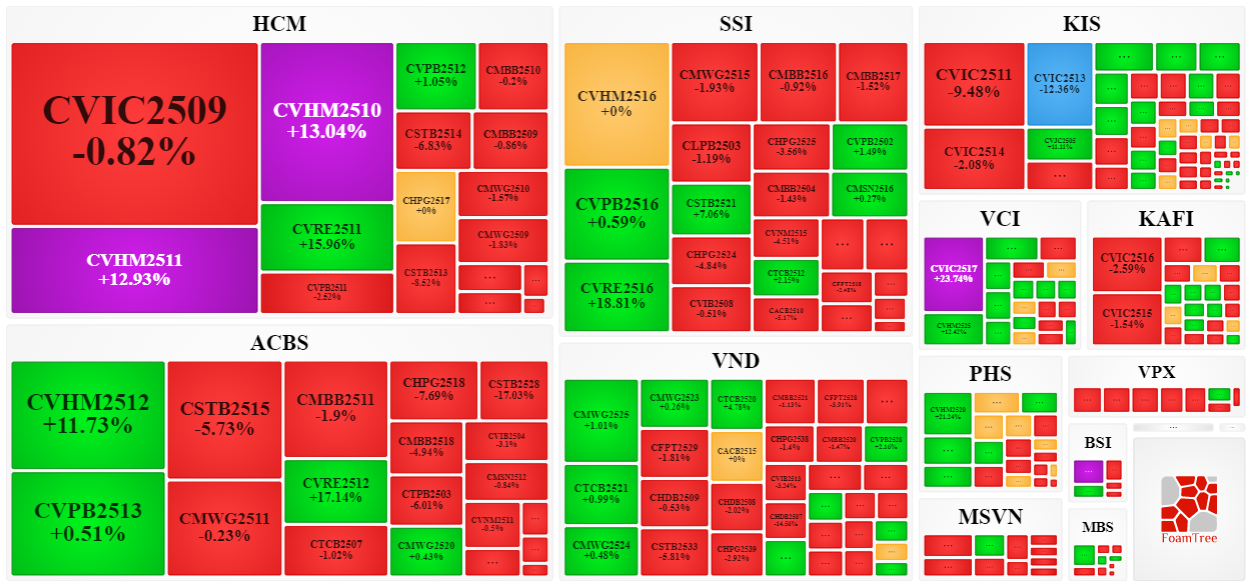

Securities firms HCM, SSI, KIS, and ACBS currently issue the most warrants in the market.

Source: VietstockFinance

Source: VietstockFinance

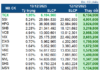

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from December 26, 2025, the fair prices of traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for warrant maturities.

According to this valuation, CVIC2513 and CACB2509 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2510 and CVNM2517 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 25/12/2025

PHS Falls Short of 2025 Plan, Projects 57% Profit Growth in 2026

Phu Hung Securities Corporation (UPCoM: PHS) is poised to conclude 2025 with a post-tax profit of nearly VND 90 billion, achieving 86% of its annual target. Riding on optimistic market forecasts for 2026, PHS anticipates a profit surge to over VND 140 billion, marking a 57% increase compared to the projected 2025 results.