The past few years have marked a pivotal transformation in the banking sector, characterized by record-high technology investments and aggressive, synchronized workforce restructuring. Concurrently, many banks have streamlined their branch operations, closing numerous physical locations while shifting focus toward data-driven capabilities.

Digging deeper, this evolution is primarily driven by shrinking lending profit margins, compelling banks to seek more sustainable growth strategies. Consequently, technology investments surged last year, enabling banks to streamline customer journeys, minimize errors, prevent fraud, and enhance product engagement throughout the customer lifecycle. In this context, artificial intelligence has emerged as a critical tool, enabling banks to swiftly translate transaction data into precise business decisions, replacing intuition-based or delayed reporting practices.

Banks Prioritize Front-End Technology Investments

Currently, the customer-facing segment of banks—encompassing the entire journey from identification and account opening to payments, lending, investments, and post-sales support across digital platforms—has taken center stage. With non-cash transactions soaring to nearly 18 billion in the first nine months of the year, totaling over 260 million billion VND, optimizing customer experience and ensuring digital channel security have become top priorities.

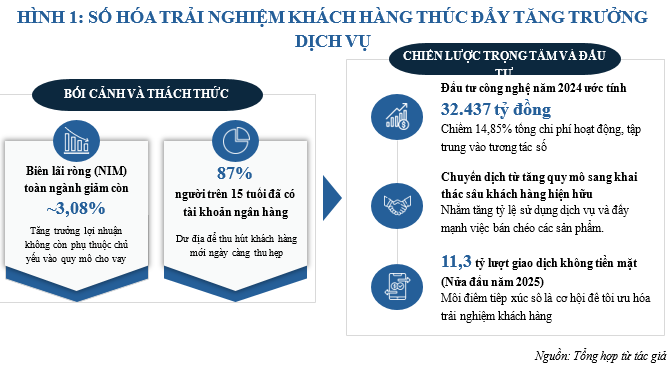

As the industry’s net interest margin dipped to 3.08% by the end of Q3 2025, banks can no longer rely solely on loan portfolio expansion for profit growth. This margin compression has shifted focus toward fee-based income, which is directly tied to customer usage patterns and can grow without necessarily increasing credit risk. The surge in cashless payments allows banks to design reasonable fee structures, cross-sell products, and generate revenue from utilities customers are willing to pay for. However, sustainable fee income stems not from arbitrary fee hikes but from delivering clear value—such as saving customers time, reducing transaction errors, ensuring security, and offering timely, relevant product recommendations.

With 2024 technology investments reaching an estimated 32,437 billion VND, or 14.85% of total operating expenses, banks have pivoted from physical expansion to optimizing digital interactions. By year-end 2024, nearly 87% of individuals aged 15 and above held bank accounts, narrowing the scope for natural growth through new account openings. Banks must now focus on deepening engagement with existing customers by enhancing experiences and efficiently cross-selling products. The goal is to create a more efficient system where customers receive tailored services, utilize more offerings, and are less likely to switch banks, thereby improving profit quality within the same customer base.

In contrast to earlier practices, where banks primarily focused on loan growth and customer acquisition, customer care was often reactive and operationally driven. This resulted in fragmented customer data, with each channel interpreting customer needs differently, hindering a unified customer view—especially for those using multiple products. Customer care must evolve from mass service to segmented, behavior-based approaches, leveraging technology for data integration while reserving human intervention for complex advisory needs.

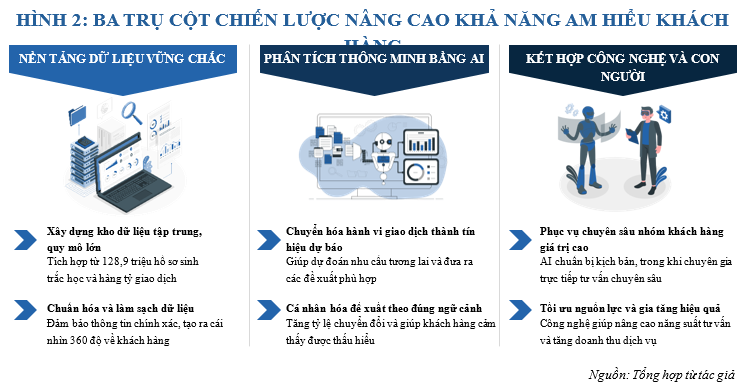

AI Enhances Customer Understanding

Understanding customers goes beyond knowing their identities; it involves grasping their financial life stages, needs, risks, and likely responses to bank offerings. Biometric authentication has strengthened customer identification, enabling secure data integration and account protection, which are essential for accurate behavior analysis. The vast volume of real-time non-cash transactions necessitates robust data processing and analytics capabilities to maintain competitiveness in customer experience. However, advanced analytics must be balanced with stringent security and risk mitigation. Any breach or analytical error could swiftly erode customer trust, damaging the bank’s reputation. Thus, customer insights should be developed through three concurrent layers: data governance, AI-driven behavior analytics, and human oversight, ensuring both speed and accuracy in decision-making.

Over recent years, banks have transitioned from siloed operations to systematic approaches, with centralized, standardized data repositories becoming essential for holistic customer insights. As non-cash transactions grow in value, continuous data updates and real-time analytics are imperative. Post-biometric verification, data cleansing and dormant account removal have reduced noise, enhancing behavior and segmentation model accuracy.

Artificial intelligence unlocks significant potential by converting transaction behaviors into signals and actionable decisions. AI not only records past actions but also predicts future needs. Crucially, product recommendations must align with customer contexts. For instance, suggesting travel insurance and credit limit adjustments after a flight booking is more effective than offering consumer loans, reducing mismatches, increasing conversion rates, and fostering a sense of understanding that manual models struggle to achieve, especially at scale.

While digital channels excel in mass service, high-value customers demand greater personalization, blending technology with human expertise in premium banking services. Automated systems identify data signals and prepare advisory scenarios, while experienced staff handle critical tasks like risk assessment and tailored financial recommendations. This hybrid model boosts advisory productivity, allowing staff to manage larger portfolios without compromising quality, while ensuring consistent experiences across online and offline channels.

After a prolonged focus on scale, 2025 marks a critical shift for banks, transitioning from customer acquisition to value maximization within existing portfolios. If executed effectively, this transformation will propel banks into a new era where AI drives growth through timely, precise customer understanding and service, transcending cost-cutting measures.

– 12:00 25/12/2025

VPBank Solidifies Leadership with Cutting-Edge, Convenient, and Sustainable Services

VPBank solidifies its pioneering position by consistently enhancing service quality and integrating cutting-edge technology. Through a comprehensive digital transformation strategy, the bank not only streamlines operational processes but also delivers an exceptional customer experience, meeting demands with speed, convenience, and security.

NCB Visa “Pride” Secures Spot Among Top 10 Pioneering Products & Services of 2025

National Citizen Commercial Joint Stock Bank (NCB) is honored to receive the “Top 10 Pioneering Products – Services” award for its Pride Visa Card at the Vietnam Trusted Products 2025 program.

SHB Bags Double Honors from Mastercard for Personal and Business Credit Cards 2025

At the recent Mastercard Customer Forum 2025, Saigon-Hanoi Commercial Joint Stock Bank (SHB) was honored with dual accolades for its strategic excellence in both individual credit card products and corporate credit card solutions. This achievement underscores SHB’s commitment to fostering a balanced card ecosystem that seamlessly integrates sustainable credit growth with cutting-edge digital financial solutions tailored for the next generation of businesses.

Positive Signals from Credit Institutions in the Final Months of the Year

The final months of the year have witnessed significant positive shifts in the profit landscape of Vietnam’s financial and banking sector. Updated data from September and October reveals a notable recovery, particularly among commercial banks and select financial companies with robust, sustainable growth strategies.