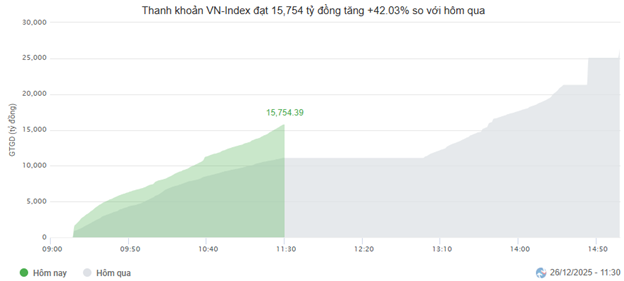

Market liquidity surged this morning, with trading volume on the HOSE reaching over 532 million units, equivalent to a value of more than 15 trillion VND, a robust 42.03% increase compared to the previous session. Similarly, the HNX recorded a value of 970 billion VND, up 28.53% from the previous session.

Source: VietstockFinance

|

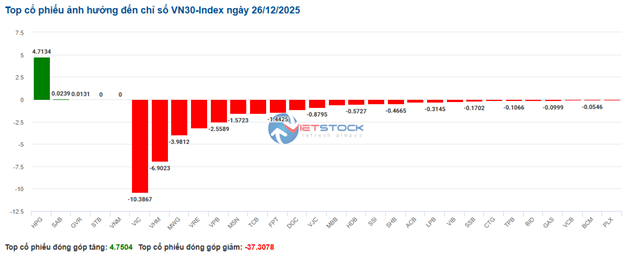

Among the top 10 stocks influencing the VN-Index, VIC had the most negative impact, deducting 17.75 points from the index. Following closely were VHM, VPL, and VPB, which collectively dragged the index down by nearly 12 points. Conversely, the top 10 positive contributors managed to add a modest 1.8 points, highlighting the sellers’ dominance.

| Top 10 Stocks Impacting VN-Index – Morning Session, December 26, 2025 |

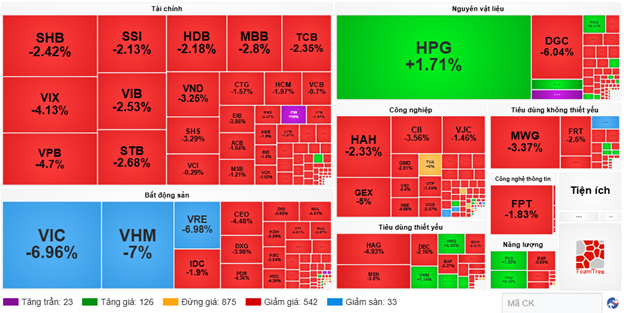

Red dominated most sectors, with real estate experiencing the sharpest decline of 5.81% this morning. Alongside the Vingroup trio hitting the floor, other stocks like KDH (-3.89%), KBC (-2.84%), NVL (-4.51%), BCM (-2.98%), PDR (-4.36%), TAL (-2.68%), SJS (-2.07%), and TCH (-4.24%) also plunged.

Additionally, the financial and industrial sectors, both large-cap groups, exerted significant pressure on the market. Numerous stocks fell over 2%, including TCB, VPB, MBB, TCX, HDB, STB, SHB, SSI, VIB, VPX, BVH, VIX; GEE, GEX, GMD, VEF, VCG, HAH, CTD, VSC, PC1, and VGR, all hitting the floor.

On the brighter side, utilities were the only sector holding onto a faint green, primarily due to positive contributions from stocks like GAS (+1.16%), POW (+0.79%), TDM (+0.87%), AVC (+1.8%), SHP (+1.47%), and PGD (+1.74%). The rest of the sector either remained at the reference level or faced selling pressure, such as HDG (-3.57%), NT2 (-1.04%), GEG (-2.07%), BWE (-1.03%), and TMP (-1.72%).

Source: VietstockFinance

|

Foreign investors added to the pressure, net-selling over 1.2 trillion VND across all three exchanges. Selling pressure was concentrated on VHM and VIC, with values of 275.36 billion VND and 154.1 billion VND, respectively. Meanwhile, VJC led the net-buying list with a modest 33.39 billion VND.

| Top 10 Stocks Net Bought/Sold by Foreign Investors – Morning Session, December 26, 2025 |

10:40 AM: Selling Pressure Pervades

Pessimism gripped the market, driving key indices further into negative territory. As of 10:30 AM, the VN-Index dropped over 40 points, trading around 1,702 points. The HNX-Index fell by 0.68 points, trading around 250 points.

Red dominated the VN30 basket, with most stocks declining. Notably, VIC, VHM, MWG, and VRE negatively impacted the VN30-Index, deducting 10.38 points, 6.9 points, 3.98 points, and 3.18 points, respectively. In contrast, only HPG, SAB, and GVR supported the VN30, adding over 4.7 points collectively.

Source: VietstockFinance

|

Red dominated nearly all sectors. The real estate sector faced continued challenges, with Vingroup stocks like VHM, VIC, and VRE seeing floor-level sell orders in the millions, and most other stocks also in the red. Specifically, IDC fell 1.63%, CEO dropped 1.79%, PDR declined 2.56%, and DXG decreased 1.99%. Conversely, a few stocks showed recovery, such as VC3 (+0.37%), SGR (+6.71%), and PVL (+12.12%), though their impact was minimal.

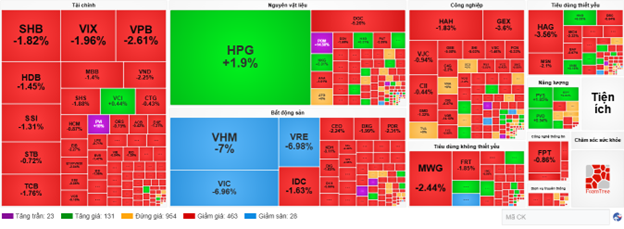

The financial sector also saw widespread declines, with stocks like SHB (-1.82%), VIX (-2.17%), HDB (-1.63%), and VPB (-2.78%) under significant selling pressure.

The energy sector, however, showed optimism, with oil and gas stocks performing well: BSR (+0.31%), PVS (+1.23%), and PVD (+0.94%).

Compared to the opening, sellers maintained a strong advantage, with 463 declining stocks versus 131 advancing stocks.

Source: VietstockFinance

|

Opening: Vingroup Stocks Pressure VN-Index

The market opened with red dominating. The VN-Index faced negative pressure as Vingroup stocks (VHM, VIC, VPL, and VRE) collectively hit the floor following the group’s unexpected withdrawal from the North-South high-speed rail project.

The real estate sector also performed poorly, with stocks like TCH, IDC, KHG, PDR, and DXG all in the red.

The financial sector was equally pessimistic, with SHB (-0.61%), MBB (-0.4%), HDB (-2.18%), SSI (-0.66%), TCB (-0.15%), and VND (-1%) all declining.

Conversely, the materials sector started positively, particularly steel stocks like HPG (+3.24%), HSG (+1.56%), NKG (+3.01%), and POM (+14.58%).

– 13:00, December 26, 2025

Proprietary Trading Firms Surge with Nearly $17 Million in Blue-Chip Stock Purchases on December 24th

Proprietary trading desks at Vietnamese securities companies collectively executed a net buy of VND 979 billion on the Ho Chi Minh City Stock Exchange (HOSE) during the referenced period.

Foreign Block Net Buys Amid VN-Index’s 40-Point Drop, Aggressively Accumulating Vingroup Stock

Foreign investors demonstrated robust trading activity, with a net buying value of VND 573 billion across the entire market.