On December 25th, Masan Consumer Corporation (Masan Consumer) officially listed nearly 1.07 billion MCH shares on the Ho Chi Minh City Stock Exchange (HoSE), with a reference price of VND 212,800 per share.

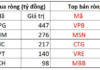

At this price, MCH’s market capitalization is estimated at over VND 227 trillion, equivalent to approximately USD 8.6 billion. This substantial market cap instantly positions MCH among the leading enterprises on HoSE, making it one of the largest consumer stocks in the market.

On its listing day, Masan Consumer also announced the final registration date for implementing a series of shareholder benefits, including issuing shares to increase capital from equity, distributing treasury shares to existing shareholders, and paying an interim cash dividend for the second tranche of 2025.

Specifically, Masan Consumer plans to issue an additional 226,874,640 shares to increase its charter capital from equity. The execution ratio is 10,000:2,147, meaning for every 10,000 rights, shareholders will receive 2,147 new shares.

Simultaneously, the company intends to distribute over 10.88 million treasury shares to existing shareholders, with an execution ratio of 10,000:103. This means shareholders holding 10,000 existing shares will receive an additional 103 treasury shares.

Masan Group Chairman Nguyen Dang Quang at the MCH listing ceremony

In addition to the share capital increase, Masan Consumer has approved an interim cash dividend for the second tranche of 2025, with a payout ratio of 25%, equivalent to VND 2,500 per share. The payment is scheduled for January 30, 2026.

In the current shareholder structure, Masan Consumer Holdings owns nearly 747 million MCH shares, equivalent to 70.4% of the charter capital. It is estimated that this entity will receive approximately VND 1,870 billion from the interim dividend.

Masan Consumer is currently the consumer goods company with the highest household penetration in Vietnam, owning a diverse range of brands such as CHIN-SU sauces, Nam Ngư, instant noodles (Omachi, Kokomi), beverages (Vinacafé, Wake-up, Vĩnh Hảo), and other products like Ponnie and Heo Cao Bồi.

In the first nine months of 2025, Masan Consumer recorded revenue of over VND 21,280 billion. After-tax profit reached VND 4,659 billion, a slight decrease compared to the same period last year.

Debuting on HOSE in the Green: Chairman Nguyen Dang Quang Expresses Unwavering Confidence in MCH Stock

On the morning of December 25, 2025, approximately 1.07 billion shares of MCH, belonging to Masan Consumer Corporation (Masan Consumer), were officially listed on the Ho Chi Minh City Stock Exchange (HOSE).

Where Does Masan Consumer Stand Among Asia’s Top FMCG Empires?

In every capital market, institutional investors consistently seek out a leading national enterprise—often referred to as a *National Champion*—whose product portfolio deeply integrates into the fabric of daily national life. These entities serve as cornerstone investments, anchoring portfolios with their strategic significance and market dominance.