At the 2025 Tax and Customs Administrative Procedures Policy Dialogue Conference held on December 26th, Ms. Lê Thị Duyên Hải, Deputy Secretary-General of the Vietnam Tax Consultants Association, remarked: “The majority of citizens acknowledge the positive reforms made by the tax industry in digital transformation. The provision of electronic documents and AI-powered tools like chatbots has enabled taxpayers to access policies more quickly and accurately.”

However, Ms. Hải suggested that the tax industry must continue to address challenges faced by businesses and households. Specifically, regarding administrative penalty violations, she argued that unintentional procedural violations not affecting budget revenues should carry penalties that are deterrent but not burdensome for taxpayers.

From 2026, household businesses will transition to self-declared tax filing instead of the current lump-sum tax system. (Illustrative image)

“For instance, filing errors in tax declarations that do not impact tax obligations still incur penalties of 6–8 million VND for individuals—an excessively high amount.”

“Particularly, from 2026, households and individual businesses will be required to file taxes electronically, taking full responsibility for declaration, calculation, and payment. During the transition from lump-sum to self-declared taxes, data errors are inevitable.”

“Filing mistakes that do not result in underpayment of taxes may become common. Therefore, penalties should be based on the impact on tax amounts to ensure fairness and appropriateness,” Ms. Hải illustrated.

She also emphasized that for purely procedural errors, tax authorities should provide support mechanisms, reminders, and reasonable transition periods to help businesses adapt to new policies without fear of penalties.

Another issue raised by Ms. Hải was that e-commerce platforms handling payments declare and pay taxes on behalf of sellers (households and individuals) but do not issue invoices on their behalf, causing significant concern among sellers.

She proposed that platforms deducting and paying taxes should also issue invoices to buyers on behalf of household businesses.

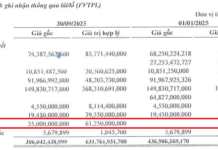

Speaking at the conference, Deputy Minister of Finance Cao Anh Tuấn stated that in 2025, support policies reduced and deferred approximately 241.74 trillion VND in taxes and land rents for businesses and citizens.

This included 116.1 trillion VND in deferred taxes (VAT, corporate income tax, personal income tax) and land rents, and 125.64 trillion VND in reduced taxes (environmental protection tax, import tax), fees, and land rents.

“These measures are being implemented to support businesses and citizens in overcoming challenges, stabilizing production, and contributing to socioeconomic development,” Deputy Minister Cao Anh Tuấn stressed.

In the tax sector, administrative procedures have been streamlined from 235 to 223. Notably, 100% of tax procedures are now available as full-service online public services, fully integrated into the National Public Service Portal.

Must-Know Benefits and Considerations for Household Businesses Earning Over 200 Million VND/Year When Switching from Lump-Sum Tax to Declaration Model

As of January 1, 2026, new tax regulations for businesses will be implemented in accordance with Resolution 198/2025/QH15 and Decision 3389/QD-BTC. Business owners with annual revenues ranging from 200 million to 3 billion VND should take note of the following key points.

POSCO Claims Unjust Tax Penalty, Customs Authority Responds

Posco VST Co., Ltd. firmly believes it has been unjustly penalized with a tax fine exceeding VND 304 billion, following the Customs Authority’s decision to impose tax reassessment and penalties.