Technical Signals of VN-Index

During the morning trading session on December 26, 2025, the VN-Index continued its sharp decline, forming an Inverted Hammer candlestick pattern.

The previous peak in October 2025 (equivalent to the 1,740-1,795 point range) demonstrated its strength as the index tested this level twice in December 2025 but reversed with deep declines both times.

The index has fallen below the Middle line of the Bollinger Bands, indicating a rather pessimistic short-term outlook.

Technical Signals of HNX-Index

During the morning trading session on December 26, 2025, the HNX-Index entered its fourth consecutive declining session.

Both the MACD and Stochastic Oscillator indicators signaled selling, indicating that short-term risks remain high.

GAS – Vietnam Gas Corporation – JSC

During the morning trading session on December 26, 2025, GAS shares rose for the third consecutive session, forming a Three White Soldiers candlestick pattern. Trading volume remained above the 20-session average, reflecting investor optimism.

Currently, GAS has successfully broken through the previous peak in June 2025 (equivalent to the 67,300-69,300 range) and is approaching the August 2024 peak (equivalent to the 72,300-73,800 range).

Additionally, the stock price remains close to the Upper Band of the Bollinger Bands, consistently forming higher highs and higher lows (Higher High, Higher Low). The MACD indicator continues to rise after giving a buy signal, further supporting the upward trend.

PET – PetroVietnam Technical Services Corporation

PET shares reversed with a slight decline during the morning trading session on December 26, 2025, reflecting less optimistic investor sentiment.

Currently, PET is retesting the short-term downward trendline while the MACD indicator has given a buy signal and is approaching the zero line. If this signal is maintained, the short-term upward momentum will be more sustainable.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:02 December 26, 2025

Market Pulse 12/26: Downward Trend Persists as Foreign Investors Resume Net Selling

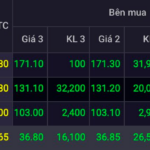

Selling pressure intensified, pushing major indices further into the red by the end of the morning session. At the midday break, the VN-Index dropped over 52 points (-3.01%), retreating to 1,690.47 points. Similarly, the HNX-Index fell by 2.7 points, settling at 248.28 points. Market breadth was overwhelmingly negative, with 575 decliners and only 149 advancers.

Vietnamese Stock Market Surpasses 1,800 Points for the First Time in History

Amidst the remarkable surge of the Vingroup conglomerate, the resurgence of foreign investment has emerged as a pivotal catalyst for Vietnam’s stock market.

Vietstock Daily 26/12/2025: The Unexpected Market Reversal

The VN-Index experienced a sharp decline as it retested its October 2025 peak (equivalent to the 1,740-1,795 point range). In the near term, the index is expected to find crucial support from the Middle line of the Bollinger Bands.