The Nguyen Kim electronics chain once attracted a large number of visitors and shoppers. Photo: TL |

When Even Giants Retreat

Central Retail Group has announced the transfer of its entire stake in the company owning the Nguyen Kim electronics chain to Pico Holdings for approximately $36 million. Formally, this is a familiar merger and acquisition deal. However, in essence, it marks the end of a decade-long electronics retail strategy for a leading regional retail conglomerate.

Central Retail began investing in Nguyen Kim in 2015, when the chain still held the position of the “big brother” in Vietnam’s electronics industry, with revenue nearing VND 8.8 trillion and a brand deeply embedded in the minds of urban consumers. At that time, Dien May Xanh had significantly lower revenue.

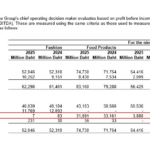

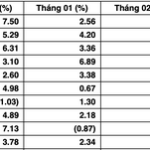

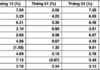

A decade later, the landscape has completely reversed. Central Retail’s electronics revenue in Vietnam has continuously declined. In the first nine months of 2025 alone, revenue reached only about 3.88 billion baht, a decrease of over 18% compared to the same period last year. By the end of 2024, the Nguyen Kim chain had shrunk to fewer than 50 stores, while its leading competitor had built a network of over 2,000 outlets.

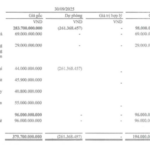

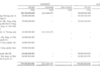

The decision to sell Nguyen Kim at a price equivalent to only a fraction of the initial investment, along with recognizing an asset impairment loss of nearly 5.9 billion baht ($186.7 million), indicates Central Retail’s resolute decision to exit a game no longer commensurate with its invested resources.

What captures observers’ attention is not Central Retail’s withdrawal but the fact that the conglomerate is not lacking in advantages. On the contrary, it possesses one of the strongest retail ecosystems in Vietnam: the GO! hypermarket chain, Big C, Tops Market, a network of shopping centers, and a substantial retail real estate portfolio.

In theory, electronics retailing is a highly synergistic component with food and consumer goods retailing. High customer traffic, cross-selling potential, optimized logistics, and consumer data are all “levers” that Central Retail holds.

However, reality differs. According to analysts, thin profit margins, high rental costs, short product lifecycles, and prolonged price wars have rendered the ecosystem advantages insufficient to offset operational pressures. The hypermarket model, which was the foundation of Nguyen Kim, has gradually become less flexible in the face of rising compact chains, dense outlet coverage, and the growth of e-commerce (EC).

The electronics market often witnesses shocking price reductions from retailers. |

In other words, electronics retailing is no longer a game where only scale and capital matter. Central Retail is not an isolated case. Speaking with KTSG Online, a manager from another major supermarket chain in Ho Chi Minh City mentioned halting their electronics segment due to weakened purchasing power, thin profit margins, fierce price competition, and increasing pressure from EC.

Previously, Vietnam’s electronics market had witnessed several quiet and high-profile exits. Notably, the Tran Anh electronics chain, once a symbol of the northern market, closed last year after more than a decade in operation.

Tran Anh once achieved revenue exceeding VND 4 trillion, operated nearly 40 hypermarkets, and was backed by a Japanese partner. However, after years of losses, even after being acquired by a major domestic retailer, the chain could not sustain itself.

Earlier, chains like Viet Long, Topcare, and further back, HomeOne, Wonderbuy, Best Carering, gradually disappeared. The common thread among these models was high operating costs, reliance on promotions, and inability to withstand prolonged consumption shocks.

What’s noteworthy is that this elimination cycle is not a temporary phenomenon but has repeated over the past 15 years, each time the market entered a more intense competitive phase.

Great Opportunities Come with Great Challenges

On the flip side, Pico Holdings, the buyer of Nguyen Kim, faces a rare opportunity for repositioning. Pico is a long-established domestic electronics brand, particularly strong in the northern market and once a direct competitor to Tran Anh during its heyday.

Acquiring Nguyen Kim allows Pico to rapidly expand its coverage, penetrate the southern market, and own a brand with significant recognition. However, this is only a necessary condition.

The Nguyen Kim chain that Pico takes over operates in an increasingly fierce electronics market, facing pressure from operational costs, a strong shift to EC channels, and the scale advantages of competitors with extensive networks. Under these conditions, the deal will only truly realize its value if accompanied by strategic adjustments and restructuring suitable for the new competitive landscape.

Pico’s challenge is not merely expansion but selective downsizing, system streamlining, catalog optimization, multi-channel enhancement, and leveraging local market insights for quicker responses.

In reality, Vietnam’s electronics market is currently experiencing the most intense price war in its history. Large promotions, year-round clearance sales, and long-term installment plans have become the norm, no longer effective demand stimulants.

The electronics market is fiercely competitive. Photo: P.U |

Meanwhile, purchasing power remains weak. Many surveys indicate consumers are postponing upgrades of major electronics, prioritizing essential spending. The lack of significant technological breakthroughs to stimulate upgrades has lengthened replacement cycles.

For instance, Tet, traditionally a time for retailers to clear inventory before new product seasons, saw major electronics chains in Ho Chi Minh City offering 30-60% discounts from early November 2025, along with various incentives and 0% installment plans, yet purchasing power remained unchanged.

Already thin profit margins continue to erode. Companies without sufficient purchasing scale, optimized logistics costs, and effective inventory management are easily caught in a loss spiral.

Another reality is the shift of electronics industry growth to EC channels. Revenue from electronics and appliances on online platforms increased by over 40% last year and continues to grow at double-digit rates this year.

This places traditional chains under dual pressure: maintaining physical store networks while increasing investment in online channels to avoid falling behind. Not all businesses have the resources to pursue both fronts simultaneously.

Even leading chains are continuously reducing outlets, restructuring personnel, and adjusting business models, indicating the game has shifted from scale expansion to survival.

The Central Retail – Pico deal extends the harsh filtering process of the electronics market, where more and more enterprises and brands are exiting. The industry is returning to its essence with thin margins, high risks, and increasingly stringent operational requirements.

Even Central Retail, a conglomerate with a leading retail and commercial real estate ecosystem, having to withdraw shows that electronics retailing is no longer easy terrain. For Pico and remaining businesses, the challenge is not expansion at all costs but adaptability, agility, and aligning with consumer changes.

When even leading chains are reducing outlets, restructuring, and changing models, the market signals a shift from a scale race to a grueling test of endurance and long-term survival.

Lê Hoàng

– 19:00 24/12/2025

Nguyễn Kim After 10 Years Under Thai Ownership: From Market Leader to Lagging Behind Domestic Competitors

The $36 million sale of Nguyen Kim to Pico Holdings marks the end of Central Retail’s decade-long foray into Vietnam’s electronics retail market. By offloading this underperforming business segment at a significant loss, the Thai conglomerate is strategically refocusing its efforts on its core strengths: food and real estate.

How Has Nguyen Kim Fared Under Thai Ownership After a Decade?

After a decade-long investment of over $200 million to acquire Nguyen Kim, Central Retail has now fully divested its stake, incurring a staggering $190 million loss in the process.

Vietnamese Entrepreneurs Reacquire Nguyễn Kim from Thai Owners

On December 23rd, Thai retail giant Central Retail announced the signing of a share sale agreement with PICO Holdings Corporation, a leading Vietnamese electronics retailer. This agreement marks the complete divestment of Central Retail’s direct and indirect investments in NKT New Technology and Solution Development Investment Corporation (NKT).

MWG Finalizes Plan for Điện Máy Xanh’s IPO in 2026

World Mobile Group Joint Stock Company (HOSE: MWG) has confirmed its strategy to take Dien May Xanh public with an initial public offering (IPO) and listing planned for 2026. This move is expected to drive double-digit profit growth and expand the retail ecosystem.