Yeah 1’s Y-CONCERT

On December 23, 2025, the Board of Directors of Yeah1 Group Joint Stock Company approved a resolution to inject additional capital into Mango+ Entertainment and Media LLC. Specifically, the additional capital contribution amounts to over 43.2 billion VND, increasing the company’s charter capital from 500 million VND to over 43.7 billion VND, a staggering 87-fold increase. Following this capital injection, Yeah1 retains 100% ownership of MangoPlus.

Currently, MangoPlus acquires content and production technology from MangoTV, holding exclusive distribution rights in Vietnam for popular programs such as Brother’s Journey Through Trials, Sister’s Wind-Defying Ride, Haha Family, All-Rounded Rookie, and more.

Additionally, MangoPlus is expanding its investment in content from Japan, South Korea, Thailand, and other regions, while also releasing exclusive content produced by Yeah1 to cater to the increasingly diverse preferences of its audience.

Yeah1 and MangoTV entered a comprehensive strategic partnership in content production and distribution in 2024.

As part of its strategic vision, the additional 43 billion VND in capital is earmarked for the completion of the U-Shape Production model. At the input stage (IP), MangoPlus focuses on leveraging reality TV formats, films, and interactive content from Mango TV (China).

For the commercialization output (Monetization), this funding will support the operation of the MangoPlus app, optimizing user experience and growing the viewer community to diversify revenue streams.

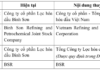

Alongside the investment in MangoPlus, in December 2025, Yeah1 announced a resolution to transfer 49% of its stake in 1Label Joint Stock Company to Sony Music Entertainment Hong Kong. This transaction transforms 1Label from a subsidiary into an associate company. This restructuring reflects Yeah1’s shift in operational strategy: partnering with Sony Music to leverage its global distribution network and achieve the goal of releasing music products internationally.

In terms of financial performance, Yeah1’s consolidated Q3 2025 financial report recorded net revenue of 390.9 billion VND, a 13.3% increase year-over-year. However, rising costs of goods sold reduced the gross profit margin from 22.9% to 11.6%.

Net profit for the quarter reached 7.3 billion VND, a 78.6% decline compared to the same period last year. For the first nine months of 2025, cumulative net revenue totaled 1,067.7 billion VND, up 69.8%. Notably, inventory value as of September 30, 2025, stood at 178.7 billion VND, a 4.4-fold increase from the beginning of the year, primarily reflecting ongoing production costs for programs in progress.

REE Injects Billions into Energy Sector Expansion

REE Corporation (HOSE: REE) has announced a strategic capital increase for its energy division, paving the way for significant investments in wind power projects.

“Ticket Frenzy for ‘Brother Beyond the Thorny Path’ Concert: Producer’s Stock Soars to New Highs, Smashing Liquidity Records”

The YEG (Yeah1 Group Joint Stock Company) stock has been consistently “on fire”, mirroring the scorching popularity of the show.