The Board of Directors and the Supervisory Board of BVBank have successfully fulfilled their duties for the 2020-2025 term. Despite the economic challenges over the past five years, which significantly impacted overall business operations, BVBank demonstrated resilience through flexible and market-aligned management. This approach ensured systemic safety and consistent annual growth, aligning closely with the goals set by the General Assembly. BVBank’s total assets, profits, and network expanded steadily from 2020 to 2025, adhering to strategic objectives.

For the 2025–2030 period, BVBank’s five-year strategy remains focused on its vision: “To become a versatile, modern retail bank, prioritizing individual and small-to-medium enterprise customers.” The General Assembly has approved changes to the Board of Directors and Supervisory Board, introducing experienced professionals from major financial institutions. These additions aim to enhance operational efficiency, financial strength, and market competitiveness, solidifying BVBank’s position in the industry.

In compliance with the 2024 Law on Credit Institutions, which prohibits concurrent leadership roles in two organizations, Mr. Ngô Quang Trung, Ms. Nguyễn Thanh Phượng, and Ms. Phan Thị Hồng Lan will not continue in their previous board roles. Ms. Phượng will remain as Chair of the Strategy and Innovation Committee, overseeing strategic planning, modernization, and personnel management to ensure BVBank’s sustainable growth during 2025–2030.

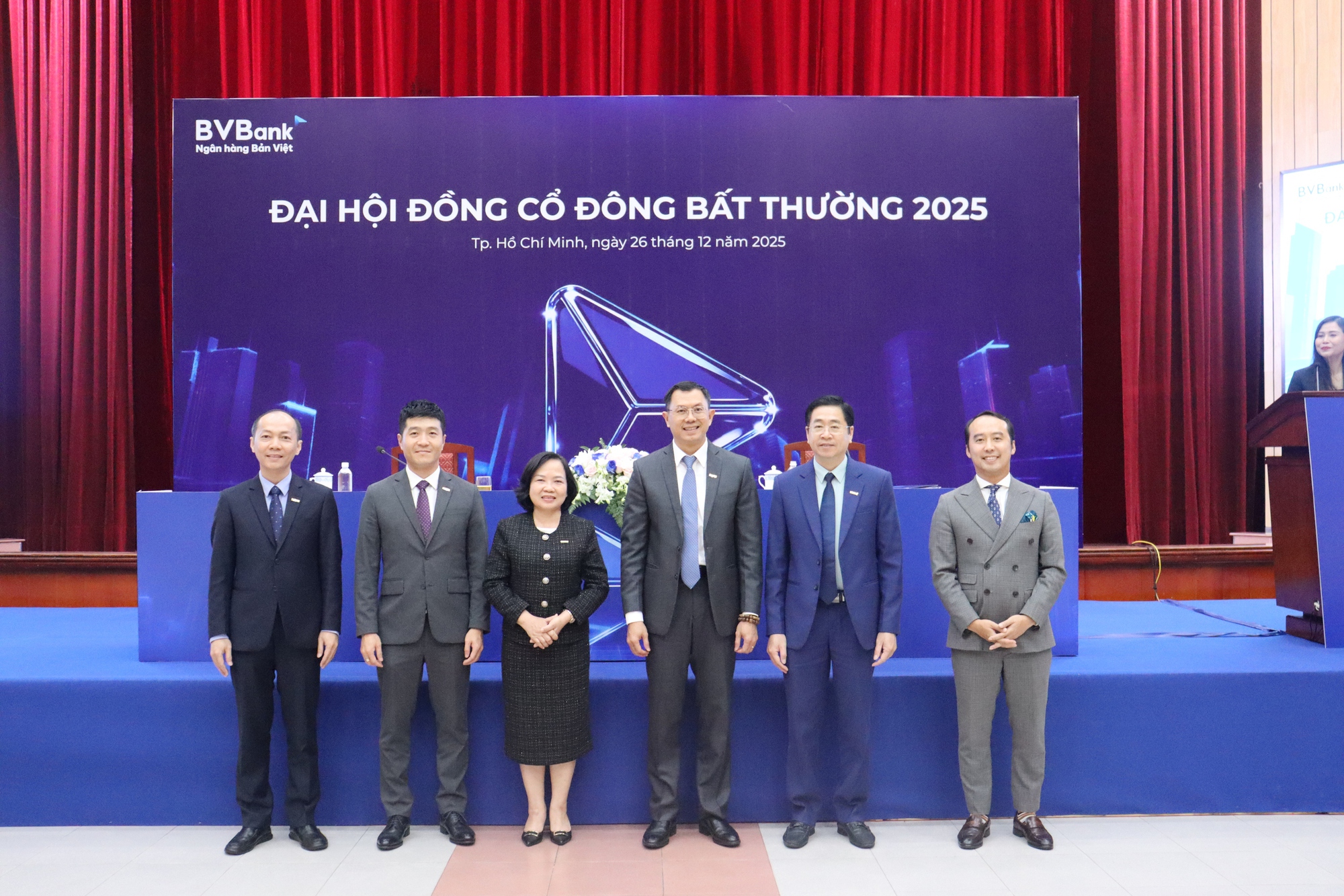

The 2025–2030 Board of Directors comprises six members: Mr. Lê Anh Tài, Mr. Nguyễn Nhất Nam, Mr. Lý Hoài Văn, Ms. Nguyễn Thị Thu Hà, Mr. Phạm Quang Khánh, and independent member Mr. Phạm Thanh Sơn. Plans include adding a second independent member within 90 days.

New Board of Directors for BVBank’s 2025–2030 term

The 2025–2030 Supervisory Board includes five members: Mr. Lý Công Nha, Ms. Nguyễn Thị Thanh Thuý, Mr. Lê Hoàng Nam, Ms. Nguyễn Thị Thanh Tâm, and Ms. Bùi Thị Quanh.

Both boards consist of long-standing BVBank leaders and new experts from leading financial institutions. Together, they aim to drive comprehensive growth, leveraging opportunities to contribute to Vietnam’s rapid national development, in alignment with the Strategy and Innovation Committee’s vision.

A key proposal approved at the General Assembly is the 2026 capital increase plan: Current charter capital is VND 6,408 billion, with a planned increase of VND 3,504 billion. This includes VND 3,204 billion from a 2:1 public offering to existing shareholders and VND 300 billion from an Employee Stock Ownership Plan (ESOP). Total capital will reach VND 9,912 billion, significantly boosting financial capacity and market competitiveness.

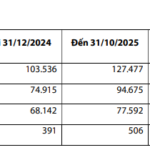

In December 2025, BVBank celebrated 33 years of operation, including 13 years of innovation. Customer numbers have surged to 2.9 million, a sixfold increase since 2020. As of November 2025, total assets reached VND 127,281 billion (doubling since 2020), with 126 branches (1.4 times more than 2020). Pre-tax profits hit VND 515 billion, achieving 94% of the annual target.

BVBank: 11-Month Profit Hits VND 515 Billion, Board of Directors and Supervisory Board Elected for 2025-2030 Term

On the afternoon of December 26th, Ban Viet Commercial Joint Stock Bank (BVBank, UPCoM: BVB) held an extraordinary shareholders’ meeting. The agenda included proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members to the Board of Directors and the Board of Supervisors for the 2025-2030 term.

Revitalizing NCB’s Leadership: Appointing New Board Members and Auditors for the Upcoming Term, Aiming for Early PACCL Completion

On December 24, 2025, National Commercial Bank (NCB, HNX: NVB) successfully held an extraordinary shareholders’ meeting, approving the election of a new Board of Directors and Board of Supervisors, finalizing the 2026 capital increase plan, and addressing other key matters.

BVBank Seeks to Boost Capital by 9.912 Trillion VND

Ban Viet Joint Stock Commercial Bank (BVBank, UPCoM: BVB) has announced the materials for its 2025 Extraordinary Shareholders’ Meeting, scheduled for December 26. The agenda includes proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members of the Board of Directors and Supervisory Board for the 2025-2030 term.