On December 26, the Ministry of Finance, in collaboration with the Vietnam Chamber of Commerce and Industry (VCCI), hosted a policy dialogue conference on tax and customs administrative procedures for the year 2025.

Deputy Minister of Finance Cao Anh Tuan delivering a speech at the dialogue conference

Unlike previous years, where the conference followed a direct Q&A format, this year’s organizers embraced digital transformation. Questions, feedback, and suggestions from businesses and taxpayers were collected through various technology platforms, the Ministry of Finance’s e-portal, and the Tax and Customs Departments’ websites. Tax and customs authorities then addressed these inquiries sequentially on the e-portal.

According to the organizers, over 12,000 taxpayers participated online, and more than 600 questions were submitted.

Mr. Nguyen Huu Tuan from Hanoi inquired about leasing his unused property as a warehouse. “Since I’m not engaged in real estate trading or subleasing, do I only need to register a tax code for property leasing, or must I also register a business household?” he asked.

The Tax Department responded that determining whether to register as a business household depends on the provisions of Article 82 of Decree No. 168/2025/NĐ-CP.

Article 82 outlines the establishment of business households: “A business household is established by an individual or family members, who are liable for their business activities with their entire assets…”

Households engaged in agriculture, forestry, fisheries, salt production, and individuals selling street food, vending, or providing low-income services are exempt from business household registration, except for conditional business sectors. Provincial People’s Committees define the low-income threshold for their localities.

If Mr. Tuan registers as a business household, he must complete tax registration through the one-stop mechanism with the business registration authority, as per Decree No. 168/2025/NĐ-CP and Circular No. 68/2025/TT-BTC. If he does not register as a business household, he should register for tax with the tax authority under Circular No. 86/2024/TT-BTC.

Hai Huy Tourism LLC in Da Nang operates in the hospitality sector. Current regulations mandate invoicing at the time of revenue generation. However, the company noted that additional services like minibar, laundry, transportation, and dining are recorded daily during a guest’s stay and invoiced only upon checkout.

“Does this constitute incorrect invoicing timing, as many guests prefer a single invoice for their entire stay rather than multiple individual ones?” the company asked.

The Tax Department clarified that Decree No. 70/2025/NĐ-CP stipulates invoicing for service provision upon completion, regardless of payment status. If payment is made in advance or during service delivery, invoicing occurs at the time of payment.

For hotels, accommodation services, and ancillary services provided during a guest’s stay are invoiced upon checkout, reflecting the total services rendered throughout the stay.

Deputy Minister Cao Anh Tuan emphasized that the dialogue aimed to address challenges faced by businesses, ensuring their rights and fostering a favorable, equitable investment environment. This aligns with Vietnam’s integration and sustainable economic development goals.

He added that the Ministry of Finance will closely monitor developments to propose appropriate solutions, prioritizing the implementation of tax, fee, and land rent policies in the near future.

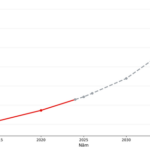

Vietnam Poised to Join World’s Top 32 Economies by 2025 as Experts Predict GDP Surpassing $1 Trillion Soon

Here is the latest forecast from the UK’s independent Centre for Economics and Business Research (CEBR) in the World Economic League Table (WELT).

Resilient Tactics Propel Vietnam’s Economy to Unexpected Success in 2025, Reports Russian Media

Russia’s Sputnik News recently published an article titled “Vietnam’s Resilient Strategy for Economic Success in 2025,” highlighting that despite significant external shocks, particularly tariff risks and global financial volatility, Vietnam’s economy in 2025 is poised to achieve most of its critical macroeconomic goals.

Sacombank Rebrands for a New Era

In the journey of a bank’s evolution, there are pivotal moments that call for a symbol—one that is steadfast enough to inspire trust, yet powerful enough to guide the future. Sacombank’s new logo emerges precisely at such a juncture, not as a mere aesthetic distinction, but as a bold affirmation of a new era marked by depth, excellence, and sustainability.