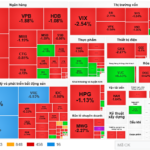

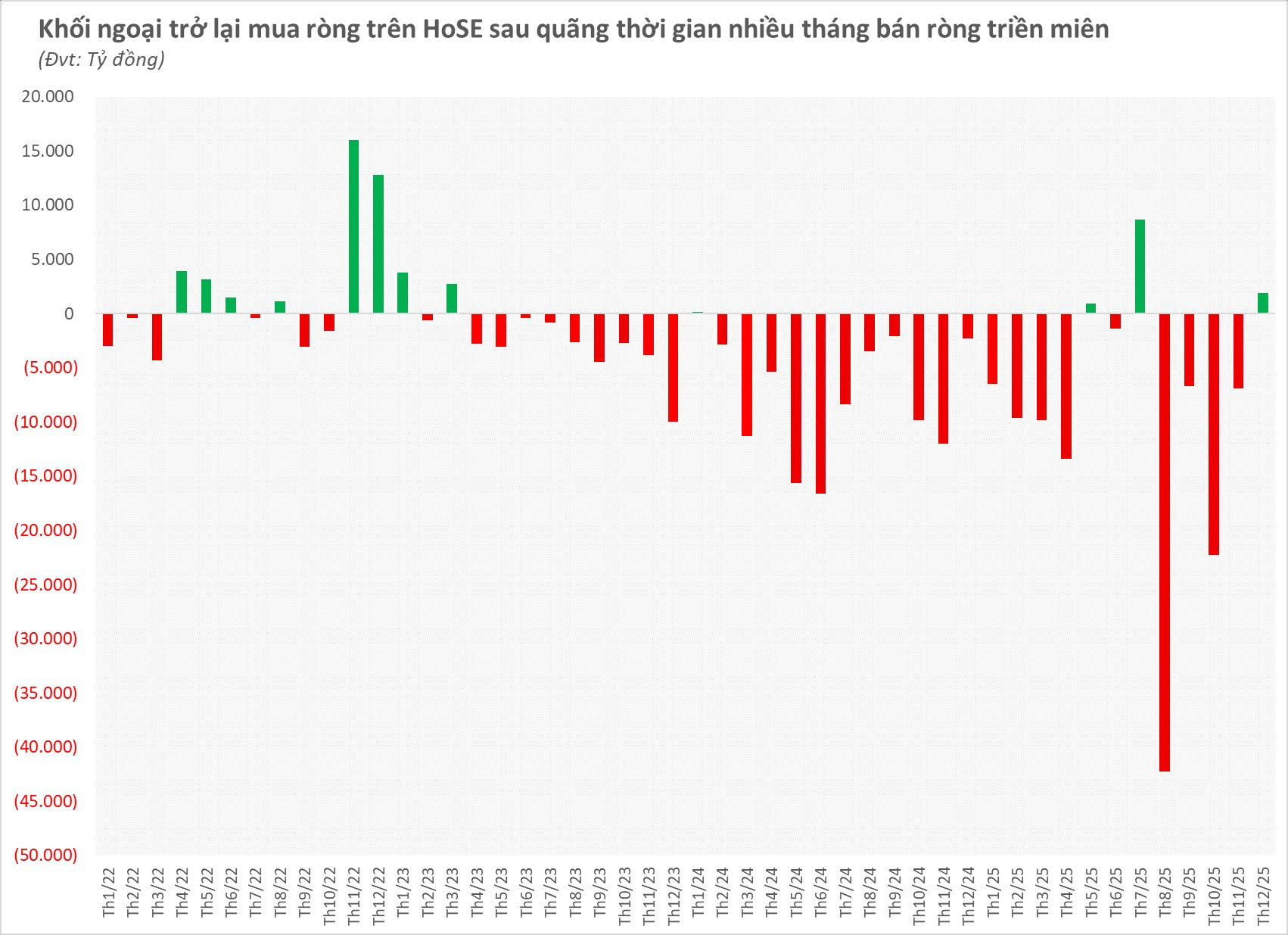

After months of consistent selling, foreign capital is signaling a shift in Vietnam’s stock market. While not flashy or explosive in a single session, the persistence is notable, compelling the market to take notice. Specifically, in the last five sessions, foreign investors have net bought consecutively on HOSE, totaling over VND 3.4 trillion.

Cumulatively since the start of December, foreign investors have net bought approximately VND 1.87 trillion on HOSE. While this figure isn’t substantial enough to reverse the year’s overall trend, it’s noteworthy when compared to the previous four months, during which foreign investors consistently net sold tens of trillions of dong.

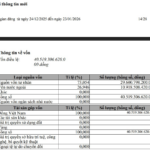

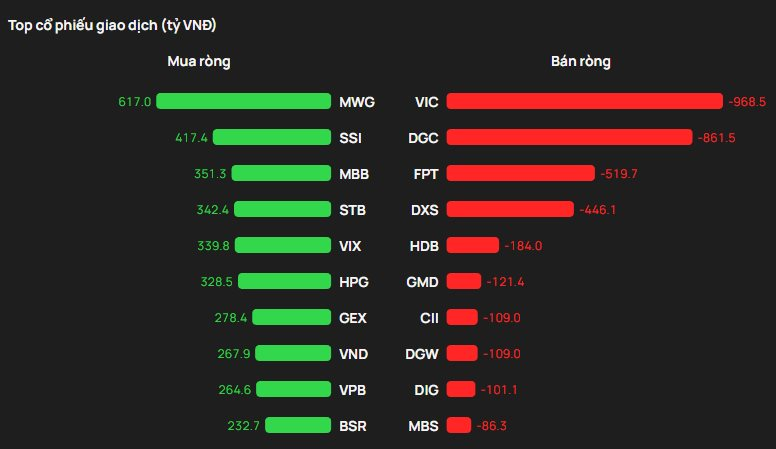

The recent foreign inflows haven’t been widespread but rather concentrated on large-cap stocks with high liquidity and strong growth prospects. Notably, MWG saw net purchases of over VND 600 billion, while SSI securities were net bought for more than VND 400 billion. Among banks, MBB and STB received net investments of VND 350 billion and VND 240 billion, respectively.

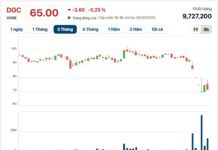

Conversely, VIC faced significant selling pressure, with nearly VND 970 billion sold, while DGC saw net selling of over VND 860 billion since the month began.

Top stocks net bought/sold by foreign investors in December 2025

The consecutive net buying sessions reflect foreign investors’ increased assertiveness compared to previous periods, shifting from mere observation or defensive positions. This net buying trend likely stems from a combination of factors rather than a single cause.

Amid global macroeconomic uncertainties, Vietnam stands out with its sustainable and impressive growth. Notably, in October, FTSE Russell upgraded Vietnam from a Frontier Market to a Secondary Emerging Market—a historic milestone for Vietnam’s financial market. This recognition by a leading global index provider opens opportunities to attract stronger foreign capital in the medium to long term.

The technical and policy advancements accompanying this upgrade have drawn attention from international institutional investors, who prioritize safety standards and market accessibility.

In practice, foreign capital often doesn’t wait for the full effect of an upgrade to act. Proactive funds tend to invest early, targeting stocks likely to be included in indices and meeting criteria for size, liquidity, and transparency. Recent net buying may also be exploratory, focusing on blue-chip stocks poised to benefit most if passive capital and ETFs deepen their involvement in subsequent phases.

However, it’s important to note that current net buying volumes remain modest compared to prior net selling. With over VND 3.4 trillion across five sessions, foreign investors are clearly not making a “big bet” but rather maintaining a flexible strategy, buying while monitoring market reactions.

Looking ahead, investors remain relatively optimistic about Vietnam’s stock market. According to Dragon Capital, Vietnam enjoys a favorable macroeconomic foundation, with high economic growth, controlled inflation, and an increasingly prominent private sector. These factors underpin the long-term earnings prospects of listed companies.

Additionally, the stock market is expected to improve in quality and efficiency, driven by internal economic forces such as increased infrastructure spending, robust FDI inflows, and a growing domestic investor base.

“We believe this is an opportune time for investors to remain steadfast, consolidate reasonable positions, and focus on long-term goals, setting the stage for a more positive 2026,” Dragon Capital commented.

From a more optimistic perspective, Petri Deryng, head of Pyn Elite Fund, believes a VN-Index target of 3,200 points is achievable within three years, based on an average annual corporate profit growth of 18–20%.

At this pace, the market’s P/E ratio by 2028 is projected at a reasonable 16 times, significantly lower than its long-term growth potential.