The afternoon session began slowly, with the VN-Index gradually showing signs of upward momentum, even surpassing 1,790 at one point, raising hopes of a return to the 1,800 mark lost in the morning session. However, immense pressure emerged during the ATC session, erasing nearly 50 points.

Consequently, the VN-Index closed with a disappointing decline of nearly 40 points, settling at 1,742.85, a 2.24% drop compared to the previous session, despite spending most of the day in positive territory. Similarly, the HNX-Index ended in the red, shedding 1.62 points to close at 250.98. In contrast, the UPCoM-Index gained 0.25 points, reaching 120.15.

| Market plunges during ATC session |

|

Source: VietstockFinance

|

Liquidity also picked up significantly towards the end of the afternoon session. Today, nearly VND 26.4 trillion was traded on the HOSE, while the total market recorded VND 28.6 trillion.

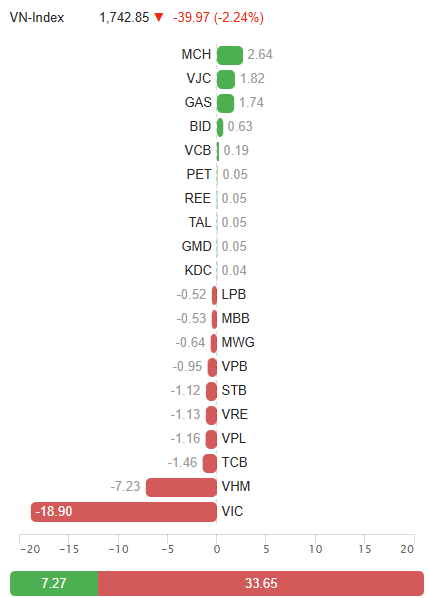

The primary driver of today’s decline was undoubtedly the Vingroup stocks, as the trio of VIC, VHM, and VRE all plummeted to their lower limits, with VPL also dropping nearly 3%, creating an unexpected scenario. Notably, VIC showed early signs of pressure, turning from green to red towards the end of the morning session.

|

Vingroup stocks plummet, exerting immense pressure on the market

Source: VietstockFinance

|

Among the top 5 stocks with the most negative impact on the index today, the aforementioned quartet occupied 4 positions, with VIC shedding 18.9 points, VHM 7.23 points, VPL 1.16 points, and VRE 1.13 points. The remaining stock in the top 5 was TCB, which lost 1.46 points after declining by 2.72% today.

On a positive note, on its first day of listing on the HOSE, MCH impressed with a 5.03% gain, reaching VND 223,500 per share, thereby becoming the stock contributing the most points to the VN-Index, adding 2.64 points.

|

VIC, VHM, VPL, and VRE cause significant point losses for the VN-Index

Source: VietstockFinance

|

While the Vingroup stocks undeniably exerted the most pressure, the majority of stocks on the market today also underperformed expectations.

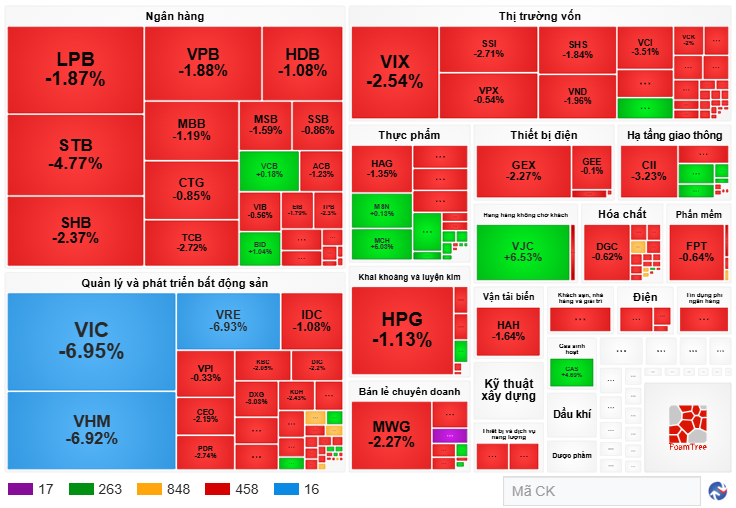

A glance at the market map reveals that red dominated, with 458 declining stocks, including 16 hitting their lower limits, compared to only 280 advancing stocks, and 848 remaining unchanged. Red prevailed in 17 out of 23 sectors according to VS-Sector.

Real estate led the decline with a 5.49% drop, followed by hardware and equipment (-3.84%), consumer services (-2.92%), and commercial and professional services (-2.06%). Six other sectors also declined by over 1%, including large-cap groups such as securities and banking, further amplifying the negative impact.

A notable highlight today was the continued net buying by foreign investors across the market, totaling over VND 566 billion. This marks the fifth consecutive session of net buying by foreign investors, an event as rare as “finding a needle in a haystack” over the past two years.

VHM, despite hitting its lower limit, saw foreign investors net buy nearly VND 119 billion, the highest in the market. This was followed by STB with over VND 117 billion, and MCH with nearly VND 100 billion.

| Foreign investors “snap up” VHM during its decline |

Morning Session: Sudden Pressure Emerges, VN-Index Retreats Below 1,800

After surpassing the 1,800-point milestone and even advancing further to exceed 1,805 points, pressures emerged, causing the market to gradually retreat below this critical threshold.

At the close of the morning session, the VN-Index still gained 9.37 points but had retreated below 1,800, settling at 1,792.19. The UPCoM-Index rose slightly by 0.61 points to 120.51. Meanwhile, the HNX-Index dipped by 0.04 points to 252.56.

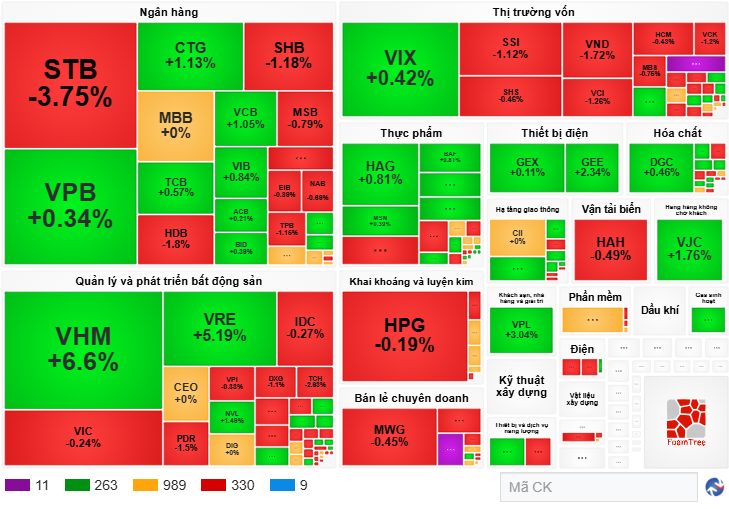

By the end of the morning session, the market map tilted towards red, with 330 declining stocks, including 9 hitting their lower limits, compared to only 274 advancing stocks. The prevalence of red among large-cap groups such as banking, real estate, and securities exacerbated the actual pressure.

In the banking sector, several stocks retreated, including STB (-3.75%), SHB (-1.18%), HDB (-1.8%), MSB (-0.79%), and TPB (-1.16%). Conversely, some stocks also gained, maintaining a tug-of-war, such as VPB (+0.34%), CTG (+1.13%), TCB (+0.57%), and notably VCB (+1.05%).

In the securities sector, red dominated, with many major names weakening, including SSI (-1.12%), VND (-1.72%), HCM (-0.43%), and TCX (-1.39%). Meanwhile, advancing stocks were scarce, with VIX (+0.42%) and AAS (+15% for the second consecutive session) standing out.

A similar pattern emerged in the real estate sector, where the duo of VHM (+6.6%) and VRE (+5.19%) bolstered the entire sector’s performance. Notably, VHM contributed 7.91 points to the VN-Index, nearly matching the index’s overall gain. The remainder of the sector saw widespread red, with the “point reservoir” VIC retreating, exerting significant pressure.

Pressure was also evident in other sectors such as steel, retail, and maritime transport. Conversely, food, electrical equipment, chemicals, and aviation stocks provided support.

|

Red spreads towards the end of the morning session

Source: VietstockFinance

|

Despite notable point fluctuations in the morning session, liquidity remained modest at VND 12 trillion, with the VN-Index recording just over VND 11 trillion. Foreign investors also significantly reduced their trading volume, with only VND 816 billion in purchases and over VND 868 billion in sales, resulting in a net sell of nearly VND 53 billion.

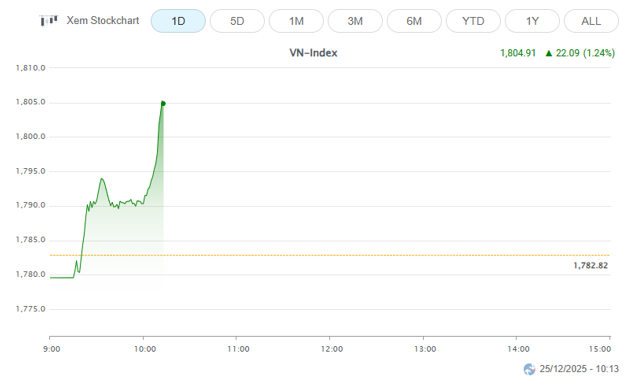

10:10 AM: VN-Index Surpasses 1,800 Points, Setting a New Record

As of 10:10 AM, the VN-Index officially surpassed the 1,800-point milestone, marking a new record high for the Vietnamese stock market.

VN-Index surpasses the 1,800-point milestone

|

Thus, after much effort, the VN-Index achieved the new milestone of 1,800 points, even advancing further to reach 1,804.91 by 10:13 AM.

The market’s momentum was driven by contributions from major players such as VHM (7.98 points), VIC (1.91 points), VCB (1.12 points), and VRE (1.07 points). Additionally, green spread to nearly 300 stocks, with dozens of others also hitting their upper limits.

However, market liquidity remained unimpressive, reaching only VND 6.9 trillion, while foreign investors net bought a modest VND 80 billion.

|

VN-Index surpasses the 1,800-point milestone

Source: VietstockFinance

|

Market Opening: VN-Index “Delivers Early Gifts”

The market opened with enthusiasm, as green dominated across the VN-Index (+7.75 points), HNX-Index (+1.78 points), and UPCoM-Index (+0.57 points). Notably, the VN-Index advanced to 1,790.57 points, poised to conquer the 1,800-point threshold.

Green quickly spread to 255 stocks, with 8 hitting their upper limits, notably AAS of SmartInvest Securities, surging by 15%.

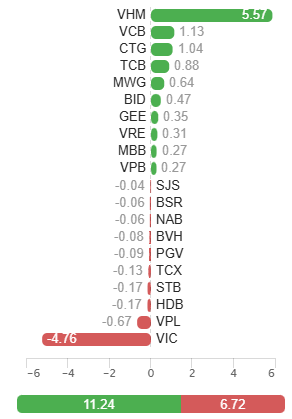

Right at the opening, VHM led the market with a 5.57-point contribution, after the stock gained 4.97%. Following were three banking stocks: VCB (1.13 points), CTG (1.04 points), and TCB (0.88 points). Collectively, the top 10 contributing stocks added 11.24 points, significantly outpacing the top 10 decliners, which shed 6.72 points.

|

VHM quickly contributes points

Source: VietstockFinance

|

Overnight, Wall Street also “delivered gifts” as indices rallied enthusiastically. At the close, the S&P 500 gained 0.32%, ending at 6,932.05, an all-time high. The Dow Jones Industrial Average rose 288.75 points, or 0.60%, also closing at a record high of 48,731.16.

This surge followed the U.S. Commerce Department’s release of Q3 GDP data, showing a 4.3% growth rate, surpassing the 3.2% forecast by Dow Jones. Additionally, investors continued to anticipate the “Santa Claus Rally” effect, a period when markets typically rise towards year-end. This year, the rally extends from December 24th’s opening session to January 5th.

– 15:55 25/12/2025

Market Pulse 26/12/2025: Foreign Investors Resume Net Selling, VN-Index Narrows Decline

At the close of trading, the VN-Index fell by 13.05 points (-0.75%), settling at 1,729.8 points, while the HNX-Index dropped 0.45 points (-0.18%), closing at 250.53 points. Market breadth was overwhelmingly negative, with 479 decliners outpacing 245 advancers. Similarly, the VN30 basket saw red dominate, as 18 stocks declined, 10 advanced, and 2 remained unchanged.

Stock Market Week 22-26/12/2025: Unpredictable Volatility Ahead

The VN-Index experienced highly unpredictable fluctuations with significant volatility during the final two sessions of the week. The index’s reversal after approaching its previous peak highlights the market’s ongoing challenges, particularly as liquidity remains inconsistent and the upward momentum heavily relies on the leadership of blue-chip stocks.

Unlocking Long-Term Capital: MCH’s Strategic Shift to HOSE Marks a Transformative Milestone

On December 25th, Masan Consumer’s MCH shares will officially list on the Ho Chi Minh City Stock Exchange (HOSE). Vietcap Securities has released updated assessments regarding MCH’s prospects following the exchange transition.

Market Pulse 12/26: Downward Trend Persists as Foreign Investors Resume Net Selling

Selling pressure intensified, pushing major indices further into the red by the end of the morning session. At the midday break, the VN-Index dropped over 52 points (-3.01%), retreating to 1,690.47 points. Similarly, the HNX-Index fell by 2.7 points, settling at 248.28 points. Market breadth was overwhelmingly negative, with 575 decliners and only 149 advancers.