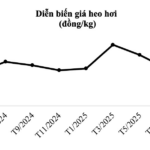

Much like the viral song, the most beautiful memory of this year’s live hog prices unfolded in the first two quarters. Continuing the strong upward trend from the previous year-end, the national average live hog price surged, even reaching 80,000 VND/kg in March. Throughout the first quarter, the price rarely dipped below 70,000 VND/kg.

Behind this surge was a decline in hog supply, largely due to diseases, particularly the complex outbreak of African Swine Fever (ASF) with thousands of new cases. Farmers and even large companies had to sell hogs to combat the disease, causing short-term price drops and pressuring the supply. Additionally, the impact of Typhoon Yagi in October 2024 damaged many farms, slowing the restocking pace of farmers. Notably, the Livestock Law effective from the beginning of 2025 triggered a “mass relocation” of non-compliant farming facilities, significantly affecting hog supply and, consequently, prices.

After peaking, hog prices began to decline but remained stable between 72,000 – 75,000 VND/kg, compared to 64,000 – 68,000 VND/kg in the same period last year. Furthermore, the price of feed ingredients continued to trend downward, with corn and soybean prices in the first six months of the year 20% lower than the same period last year (data from DDGS).

Source: VietstockFinance

|

The first half of the year thus became a driving force for major players in the livestock industry, such as Dabaco (HOSE: DBC), BAF, and Hoa Phat Agriculture (HPA), to achieve strong growth. DBC profited up to one trillion VND in the first six months, nearly five times more than the same period last year. BAF, known for “vegetarian pigs,” earned 327 billion VND, double the same period, benefiting from real estate sales. Meanwhile, HPA also profited 939 billion VND, 2.3 times more than the same period.

Plummeting with the “Terrible November”

After the second quarter, the next chapter in hog prices was not as beautiful as the beginning. Despite forecasts of maintaining high prices due to supply shortages caused by ASF and floods, the actual price movement was relatively negative. In the third quarter, hog prices entered a sharp decline nationwide. In September 2025 alone, prices fluctuated between 50,000 – 59,000 VND/kg, significantly lower than the 66,000 – 69,000 VND/kg of the same period.

The decline in hog prices was attributed to cyclical factors, as the third quarter is typically a low point for the pig farming industry when schools close, reducing demand. Additionally, the impact of diseases and floods increased the number of hogs sold to combat the disease, pushing prices to the bottom.

The impact of this situation on the business landscape of major players varied. In the third quarter, Dabaco and HPA maintained growth, with profits of 343 billion and 358 billion VND, respectively. However, Dabaco also operates in chicken breeding, eggs, vegetable oil, trade services, and even real estate. HPA has additional revenue from eggs and cattle farming. Notably, both companies revealed that the feed segment in the third quarter performed very positively due to favorable raw material prices and exchange rates.

BAF, with all revenue coming from pig farming after eliminating agricultural product trading, was more heavily impacted. In the third quarter, “vegetarian pigs” only netted 21 billion VND, a 66% decrease, partly due to additional barn costs from flood damage and the operation of two new barns.

Entering the early months of the fourth quarter, hog price movements became more negative. The complex outbreak of ASF, with 402 cases in 31 provinces in November alone (according to the Ministry of Agriculture and Environment), combined with floods causing heavy damage to many farmers, led to a massive sell-off of hogs. Prices plummeted to the bottom at 48,000 VND/kg, with some places dropping to 46,000 VND.

“This is the worst November for the pig farming industry,” said Dabaco Chairman Nguyễn Như So.

Scarce Supply, Rising Prices

The remaining memory brightens as the sell-off of hogs due to disease and flood impacts subsides. With scarce supply, hog prices rebound strongly. From the bottom of 48,000 VND/kg in mid-November, prices surged nearly 39% in just one month, reaching around 66,500 VND/kg as of December 25. In some northern provinces, prices hit 70,000 VND/kg.

“Due to flood disasters, farmers sold hogs to escape floods, causing a sudden surge in supply to the market at the same time. Additionally, negative information about food safety affected consumer psychology, driving hog prices down. But since early December, prices are recovering due to scarce supply,” said Bùi Hương Giang, CEO of BAF.

According to Ms. Giang, restocking typically takes 4-6 months for hog supply to stabilize. Meanwhile, increased meat consumption demand near Tet will help hog prices maintain a good level. “I believe hog prices will remain at 70,000 VND/kg, at least in the first half of next year,” Ms. Giang added.

The recovery in hog prices also pleased Mr. Nguyễn Như So. The Dabaco Chairman stated that the fourth quarter would be heavily impacted by the “terrible November,” but the price recovery would help the company achieve 90-95% of its annual profit plan. Additionally, he predicted that in the first quarter of 2026, hog prices would remain at a “very good” level.

Opportunities to Increase Market Share as Smallholders Shrink

The mass relocation of smallholders after the Livestock Law 2019 took effect from the beginning of 2025 significantly changed the industry’s market share landscape. Compared to pre-2019, when smallholders accounted for 70-75% of Vietnam’s total hog population, it is now 50-50 with industrial hogs. This trend, according to Ms. Hương Giang, is inevitable and accelerated by diseases and natural disasters.

“The balance of farming ratios has clearly shifted, now equal between smallholders and industrial pig farming. This trend will continue until 2030, with the ratio forecast to be around 30%. From a policy perspective, the government’s direction is to move towards industrialized and modernized farming. Secondly, to achieve industrialization, financial capacity and a sustainable farming mindset are needed to invest in proper barn infrastructure and meet environmental standards. Smallholders will be limited in both aspects, so the shift in ratios is an inevitable trend,” quoted the CEO of BAF.

This trend presents a significant opportunity for modern pig farming companies to seize. BAF has closed the 3F chain (Feed-Farm-Food), currently with a total herd of about 800,000 pigs, including 85,000 sows, ranking third in the market after FDI companies C.P and C.J. The collaboration with Muyuan, a top global pig farming conglomerate, allows BAF to tighten biosecurity processes, reducing disease risks. The company continuously expands its scale, evidenced by eight new farms put into operation in 2025, as well as Vietnam’s first “pig condominium” project.

“As Vietnam’s total hog population grows (about 3%/year) and the population urbanizes, while smallholders decrease, the market share left by smallholders will be filled by industrial farming units,” Ms. Giang affirmed.

Similarly, Dabaco is implementing the 3F model. The company also has the advantage of owning ASF vaccines, which, according to Chairman Nguyễn Như So, have been administered to the entire hog population. Dabaco also announced plans to expand feed mills and high-tech farms, aiming for about 80,000 sows and over 2 million pigs per year by 2028.

HPA has only closed the 2F chain (Feed-Farm). According to Chairman Nguyễn Việt Thắng, the final F has not been implemented due to limitations in distribution to consumers. However, the company currently operates seven pig farms with a capacity of 750,000 pigs/year, targeting 900,000 pigs/year by 2030. The company also emphasizes its advantage in breeding, using Danbred pigs with top global reproductive performance, along with modern barn systems.

The three major players in the pig farming industry each have their own advantages. The competition among these giants has just begun, but it’s not just about selling prices. It’s also a race for market share in a new, more modern, fierce, but sustainable farming order.

– 09:00 27/12/2025

Revolutionary 12 Trillion VND Pig Farming Project Unveiled: AI-Powered Cough Detection and 24/7 Robot Patrols in 5-Story Residential Complex

On September 28, 2025, BAF Vietnam Agriculture JSC (HoSE: BAF) and Muyuan Food Group (China) formalized a joint venture partnership, launching Vietnam’s first high-tech, multi-story pig farming project. Located in Tay Ninh Province, the initiative boasts a total investment of VND 12,000 billion and leverages cutting-edge automation and AI technologies unprecedented in the country’s livestock sector.