Vietnam’s stock market continued its sharp decline, primarily driven by the downward pressure from Vingroup-related stocks. Amid the overall market gloom, Pomina (ticker: POM) shares defied the trend, surging to their upper limit and even reaching a “zero sell” status with over 4 million buy orders at the ceiling price.

POM’s price climbed to VND 5,500 per share, marking its 8th consecutive ceiling session and nearing a two-year high. Notably, this rally occurred while the stock was under trading restrictions, only tradable on Fridays.

In just two months, POM’s value soared by 175%, nearly tripling its late October price. This surge boosted its market capitalization by over VND 1.5 trillion.

POM stock hits ceiling on December 26 morning session

This remarkable rally came as Pomina received unexpected support from VinMetal, a Vingroup subsidiary. Established in early October, VinMetal recently increased its charter capital to VND 15 trillion. The company operates in the steel production sector under billionaire Pham Nhat Vuong’s conglomerate.

Vingroup announced a zero-interest working capital loan for Pomina, valid for up to two years. This preferential funding will help Pomina improve cash flow, restore its supply chain, stabilize production, and gradually recover its financial health.

Additionally, Vingroup will prioritize Pomina as a steel supplier for its ecosystem companies like VinFast, Vinhomes, and VinSpeed. This move ensures a sustainable market for Pomina and aligns with Vingroup’s strategy to increase local material sourcing for its major projects in Vietnam.

The relationship between VinMetal and Pomina was further solidified with the appointment of Mr. Do Tien Si as VinMetal’s CEO and legal representative. Mr. Si (born 1967), currently Pomina’s CEO and Vice Chairman, is a seasoned steel industry veteran with over 30 years of experience in production, management, and investment.

A mutually beneficial partnership for Vingroup and Pomina

According to a recent KBSV analysis, the collaboration benefits both Vingroup and Pomina, potentially posing market share risks for other steel producers if successful.

For Pomina, Vingroup’s financial support and operational expertise will optimize its construction steel production and sales, especially if Vingroup fully absorbs its output. This could improve EBITDA and reduce debt pressure in the medium term. Vingroup, particularly Vinhomes and Vincons, will gain access to competitively priced steel from Pomina. With an annual capacity of 1.5 million tons, Pomina is expected to account for 15% of the industry’s total consumption in 2024.

KBSV estimates Pomina’s current market share at around 1%, with prices 2% higher than competitors. The brokerage believes Vingroup will need time to invest in and upgrade Pomina’s production lines to enhance competitiveness and reduce costs, maximizing the partnership’s benefits.

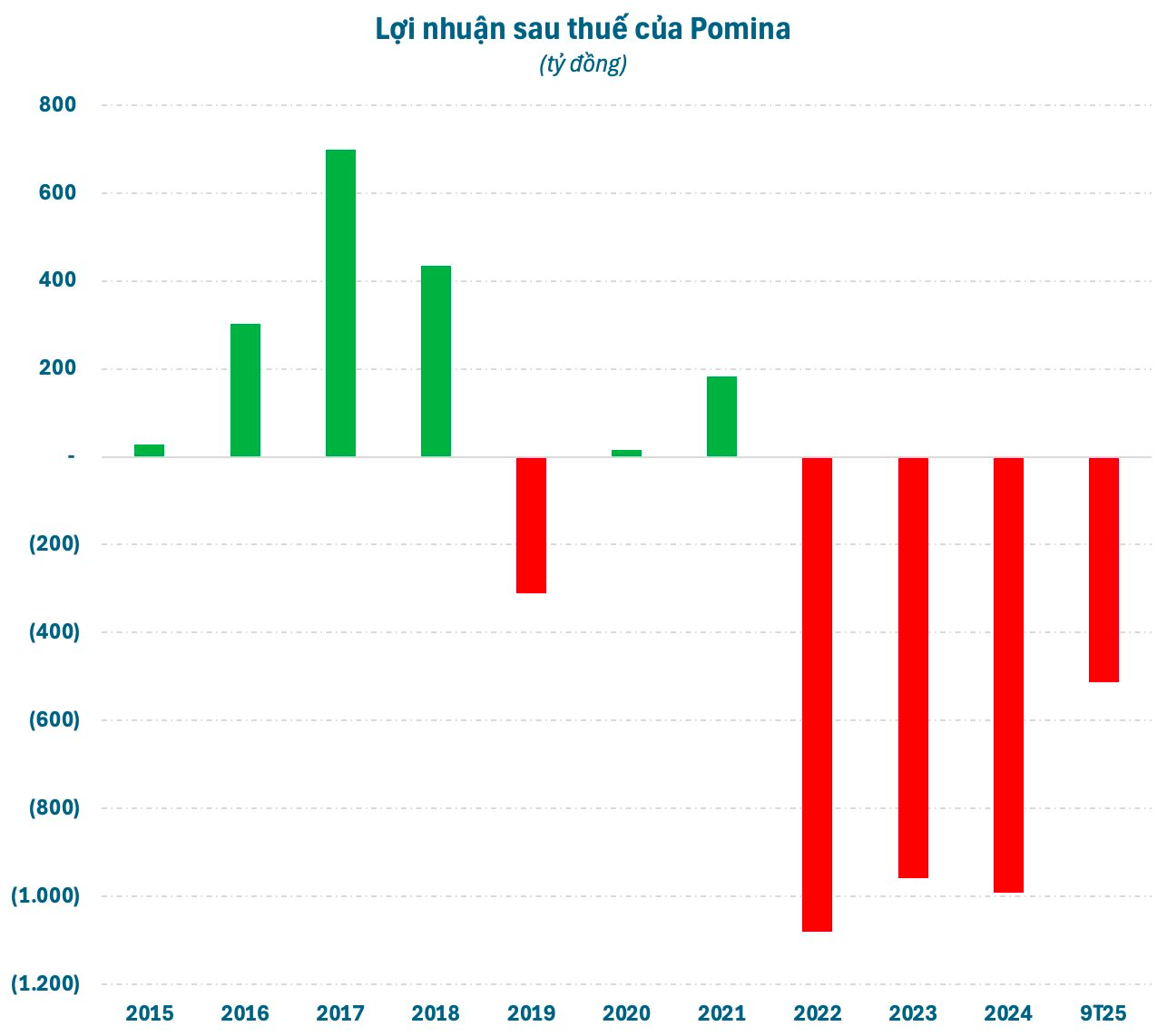

Financially, Pomina has struggled, reporting losses exceeding VND 1 trillion annually from 2022 to 2024. In the first nine months of 2025, it lost over VND 500 billion, pushing accumulated losses past VND 3 trillion and resulting in negative equity.

Historically, Pomina enjoyed profitable periods with earnings ranging from VND 400 to 700 billion. However, post-boom, profits declined sharply, leading to significant losses.

Due to its financial troubles, Pomina was delisted from HoSE in May 2024 for severe disclosure violations. Now trading on UPCoM, this marks a significant setback for the former steel giant, highlighting its ongoing challenges.

What Are Vingroup’s Plans as Phạm Nhật Vượng Unexpectedly Withdraws from the North-South High-Speed Railway Megaproject?

Stepping away from the North-South axis, Vingroup is strategically reallocating resources to a diversified investment portfolio, simultaneously launching a series of mega-projects. Highlights include the Olympic Sports City, high-speed rail networks, the VinMetal steel complex, and the groundbreaking Can Gio coastal metropolis.