I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF DECEMBER 22-26, 2025

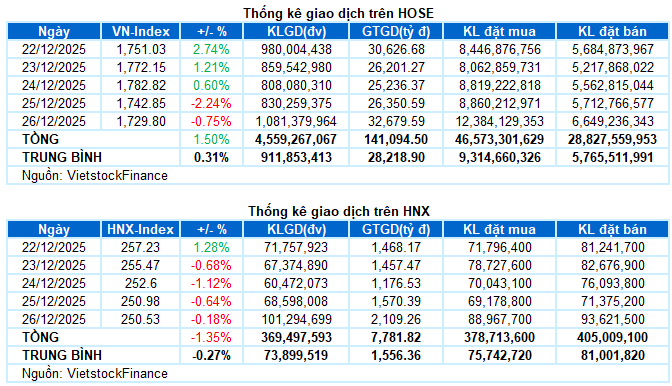

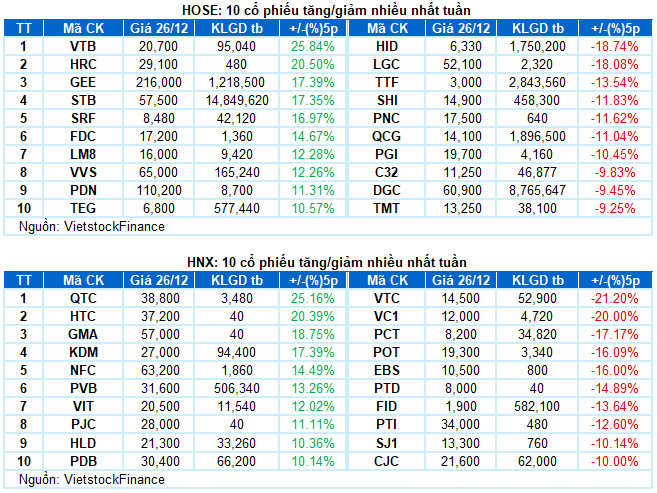

Trading Activity: Major indices continued their downward trend during the December 26th session. Specifically, the VN-Index declined by 0.75%, closing at 1,729.8 points, while the HNX-Index remained below the reference mark at 250.53 points. Over the week, the VN-Index still gained 25.49 points (+1.5%), whereas the HNX-Index lost 3.44 points (-1.35%).

The Vietnamese stock market concluded the week with significant volatility. The VN-Index maintained a positive uptrend in the early sessions, driven by large-cap stocks. However, efforts to establish a new historical peak around 1,800 points were thwarted as Vingroup’s leading stocks unexpectedly reversed, triggering widespread selling pressure across multiple sectors. Negative sentiment dominated, causing the index to gap down sharply and retreat to the 1,700-point level in the final session. Recovery attempts in the afternoon session significantly narrowed the decline but were insufficient to restore the index to positive territory. The VN-Index closed the week at 1,729.8 points.

In terms of impact, VIC remained the most negatively influential stock, subtracting 5 points from the VN-Index in the final session. This was followed by VHM, VPL, and VPB, which collectively dragged the index down by an additional 7.26 points. Conversely, support primarily came from HPG, GAS, and STB, though their contributions were modest, adding only about 2.5 points to the index.

By sector, non-essential consumer goods experienced the most significant decline, adjusting downward by 2.36%, negatively impacted by VPL hitting the floor, along with FRT (-1.23%), DGW (-1.39%), VGT (-1.61%), DRC (-1.36%), STK (-1.59%), TCM (-1.12%), and HTM (-10.48%). Nonetheless, a few bright spots within the sector attracted decent buying interest, including MWG (+1.16%), PET (+1.65%), PNJ (+0.52%), MSH (+1.07%), GIL (+1.46%), and TSJ (+14.52%).

The real estate and industrial sectors also exerted considerable pressure, with numerous stocks facing heavy selling, including VIC (-1.9%), VHM (-3.76%), BCM (-1.49%), VPI (-2.78%), IDC (-1.09%), NLG (-2.9%), DIG (-1.69%), ACV (-2.36%), VJC (-1.93%), GMD (-1.65%), VSC (-2.18%), VCG (-1.29%), HHV (-1.51%), CTD (-3.1%), and LGC hitting the floor.

On the positive side, the energy and utilities sectors were the standout performers, both gaining over 1%, primarily driven by leading stocks such as BSR (+2.2%), PLX (+1.43%), PVS (+4.01%), PVD (+3.21%), GAS (+1.88%), POW (+1.59%), GEG (+1.38%), DNP (+2.56%), TMP (+4.14%), and DNH reaching their upper limits.

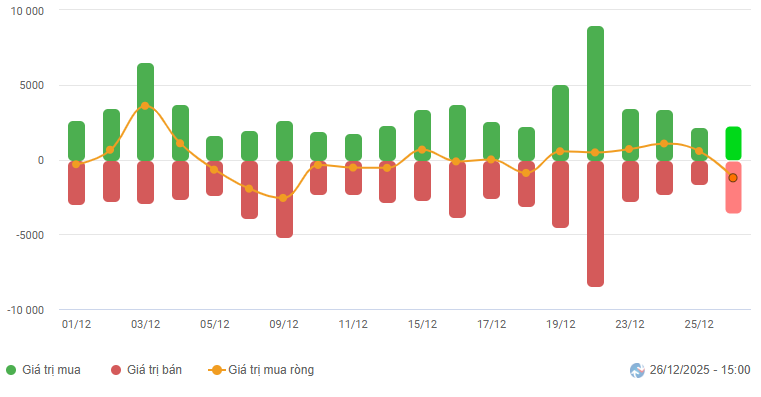

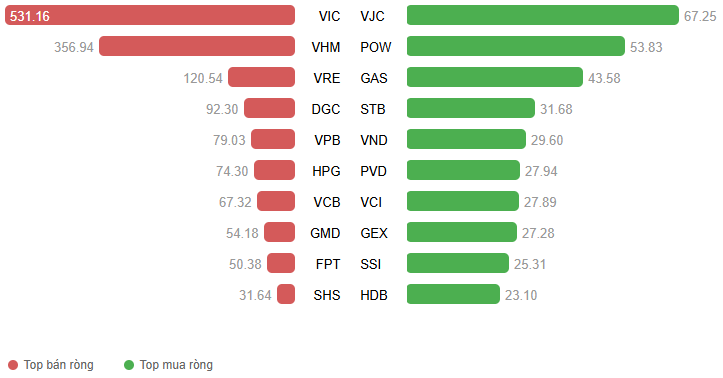

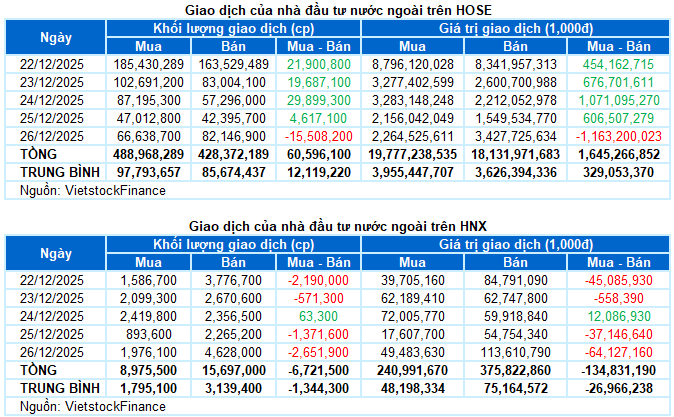

Foreign investors were net buyers with a value of 1.5 trillion VND across both exchanges during the week. Specifically, foreign investors net bought over 1.6 trillion VND on the HOSE, while net selling nearly 135 billion VND on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

Top Performing Stock of the Week: GEE

GEE +17.39%: GEE recorded a positive week, surpassing the Middle line of the Bollinger Bands with trading volume consistently above the 20-day average.

The MACD indicator has signaled a buy as it crossed above the Signal line, while the Stochastic Oscillator continues its upward trajectory following a previous buy signal. If this trend persists, the short-term positive outlook will be further reinforced.

Worst Performing Stock of the Week: HID

HID -18.74%: HID continued its downward adjustment, extending its losing streak to the fourth consecutive session and retreating to test the 50-day SMA.

Currently, the MACD indicator is widening its gap with the Signal line after issuing a sell signal and is approaching the 0 threshold. If the indicator falls below this level in upcoming sessions, pessimism will intensify.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:05 26/12/2025

Unlocking Long-Term Capital: MCH’s Strategic Shift to HOSE Marks a Transformative Milestone

On December 25th, Masan Consumer’s MCH shares will officially list on the Ho Chi Minh City Stock Exchange (HOSE). Vietcap Securities has released updated assessments regarding MCH’s prospects following the exchange transition.

Market Pulse 12/26: Downward Trend Persists as Foreign Investors Resume Net Selling

Selling pressure intensified, pushing major indices further into the red by the end of the morning session. At the midday break, the VN-Index dropped over 52 points (-3.01%), retreating to 1,690.47 points. Similarly, the HNX-Index fell by 2.7 points, settling at 248.28 points. Market breadth was overwhelmingly negative, with 575 decliners and only 149 advancers.

Vietnamese Stock Market Surpasses 1,800 Points for the First Time in History

Amidst the remarkable surge of the Vingroup conglomerate, the resurgence of foreign investment has emerged as a pivotal catalyst for Vietnam’s stock market.