In the booming era of cashless payments, frequent bank account transactions often raise concerns about tax scrutiny. However, financial experts and current laws clarify that tax obligations are determined by the nature of the funds—their origin—rather than account balances or transaction frequency.

To ensure legal compliance and protect your rights, it’s crucial to distinguish between taxable and tax-exempt income. Below is a detailed breakdown:

5 Taxable Income Types in Your Bank Account

Not all incoming funds are taxable, but if transactions fall into the following categories, individuals must declare and pay Personal Income Tax (PIT):

Salaries and Wages: Includes regular pay, bonuses, and allowances from employers. Individuals with income from multiple sources must file annual tax returns.

Online Business and Freelance Earnings: Income from e-commerce, freelance work (design, writing, consulting, etc.) exceeding 100 million VND annually is taxable.

Service Fees and Commissions: Earnings from brokerage fees, commissions, or service charges in money transfer/withdrawal transactions.

Interest on Loans (to Organizations): Interest earned from lending to businesses or organizations (taxed at 5%). Note: Peer-to-peer loans remain tax-free.

Real Estate Profits: If tax authorities detect a higher transfer value than declared in notarized contracts, the difference is subject to tax and penalties.

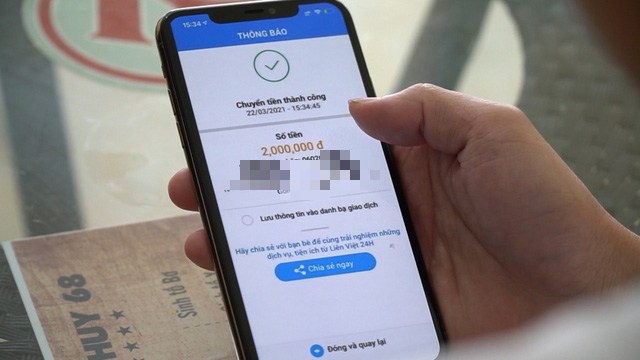

Five taxable income types in personal bank accounts.

Major Tax Reforms Starting 2026

The new Personal Income Tax Law (effective 2026) introduces significant changes to thresholds and taxable entities:

Increased Threshold for Rental Income: Taxable rental income from properties (e.g., rooms, warehouses) rises from 100 million VND to below 500 million VND annually. Periodic declarations (twice/year) remain mandatory.

Taxation on Digital Assets: From July 1, 2026, digital asset transfers will incur a 0.1% tax on transaction value.

Fully Tax-Exempt Income Sources

The following income types are entirely tax-free, ensuring peace of mind for recipients:

Savings Interest: Bank interest is classified as capital income and exempt from PIT.

Remittances: Funds sent by overseas relatives are tax-free to encourage capital inflows.

Family and Personal Transfers: Spousal allowances, loans/repayments among relatives, and reimbursement transactions.

Raw Agricultural Sales: Income from unprocessed farm produce (rice, livestock, fruits) sold by landowners residing in the cultivation area.

Understanding tax-exempt income ensures compliance and avoids unexpected liabilities.

Expert Tips to Avoid Tax Complications

The highest legal risk lies in real estate transactions. Discrepancies between actual transfer values and notarized contracts trigger tax penalties and fines for evasion.

To prevent issues, experts recommend separating personal and business accounts. For family businesses, using the registered owner’s account for transactions is essential. Avoid mixing accounts (e.g., “husband’s license, wife’s account”) to ensure clear fund traceability. Most importantly, maintain complete records and honest declarations—your strongest legal defense during tax audits.

Can Cash Payments of VND 5 Million Be Deducted for Corporate Income Tax? Tax Authorities Clarify

The tax authority has recently provided specific guidance regarding businesses paying employee salaries in cash or in-kind, valued at 5 million VND or more per transaction. This clarification comes in the context of Decree No. 320/2025/NĐ-CP, which implements the Corporate Income Tax Law and officially takes effect from the 2025 tax year.

Tax Experts Highlight Hoàng Hường, Hằng Du Mục, Ngân 98, and Mailisa

Mrs. Nguyen Thi Cuc, Chairwoman of the Vietnam Tax Consultants Association, recently highlighted a surge in online cases involving counterfeit goods, substandard products, and large-scale tax evasion. She warns that individuals and households employing tactics like using multiple bank accounts, fragmenting transactions, and concealing revenue often face consequences far exceeding the amounts they attempt to evade.

Finalizing the 2% Property Transfer Tax: Key Issues and Implications

Under the newly amended Personal Income Tax Law, passed by the National Assembly on December 10th, the tax on real estate transfers remains in effect. It is calculated based on the sale price (x) at a rate of 2%, consistent with current regulations.