Joint Stock Commercial Bank for Industry and Trade of Vietnam (Vietinbank, Stock Code: CTG) has recently submitted a report to the State Securities Commission, Vietnam Stock Exchange, HSX, and HNX regarding the results of its dividend payment through share issuance.

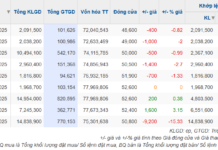

As of the end of the issuance period on December 18, 2025, Vietinbank successfully distributed nearly 2.4 billion dividend shares to 55,846 shareholders, with a rights execution ratio of 100:44.63658403 (shareholders owning 10,000,000,000 shares received 4,463,658,403 new shares).

The capital for this issuance was sourced from the remaining profits of 2021, 2022, and the period from 2009 to 2016. The expected share transfer date is within January 2026.

Following the December 18, 2025 issuance, the total number of CTG shares increased from approximately 5.4 billion to nearly 7.77 billion, corresponding to an increase in VietinBank’s charter capital from approximately 53.7 trillion VND to nearly 77.67 trillion VND.

Illustrative image

In addition to the stock dividend, on November 17, 2025, VietinBank disbursed over 2.4 trillion VND to pay cash dividends at a rate of 4.5%, equivalent to 450 VND per share.

In other developments, VietinBank announced the public offering of Saigon Port Corporation (SGP) shares it owns through a standard public auction on HNX.

According to the initial plan, on December 22, 2025, HNX was scheduled to hold an auction for over 19.6 million SGP shares, equivalent to a 9.07% stake in Saigon Port’s charter capital, with a starting price of 29,208 VND per share.

However, by the registration and deposit deadline (15:30 on December 15, 2025), no investors registered to purchase Saigon Port shares. Consequently, HNX canceled the auction due to insufficient conditions for its organization.

Regarding business operations, according to the Consolidated Financial Report for Q3/2025, total operating income for the first nine months of 2025 reached 63.9 trillion VND, a 5.4% increase compared to the same period last year. Net interest income was 47.1 trillion VND, up 5.2% due to strong debt growth; however, net service income decreased by 10.9% year-on-year to over 6 trillion VND.

For the first nine months, VietinBank’s pre-tax profit stood at 29.5 trillion VND, a 51.4% increase compared to the same period last year.

As of September 30, 2025, VietinBank’s total assets reached 2,762 trillion VND, a 15.8% increase since the beginning of the year. Deposits and loans to other credit institutions rose by 28.8%; customer loans increased by 15.6%, while deposits at the State Bank decreased by 23.4%.

At the end of Q3/2025, total liabilities were 2,592 trillion VND, up 15.9% since the beginning of the year. Deposits and borrowings from other credit institutions surged by 49.2%; issuance of securities also increased by 20.1% compared to the beginning of the year.

PVI Infrastructure Investment Fund Exits Major Shareholder Role in Saigontel

PVI Infrastructure Investment Fund divested 6.2 million shares of SGT on December 18, 2025, reducing its ownership stake to 2.57% and relinquishing its position as a major shareholder in Saigontel.

F88 Stock Price Poised to Drop Below $1 Million Mark

Based on current market prices, the stock split will adjust F88’s share price to approximately 90,000 VND per share.