“Restless” Due to Interest Rates

At a bank branch on Ham Nghi Street (Sai Gon Ward, Ho Chi Minh City), Mrs. Mai Hoa (62 years old, a retired officer) is processing the settlement of her old savings account to switch to another bank that has just announced new interest rates.

“I deposited 500 million VND for a 12-month term at a state-owned bank earlier this year, when the interest rate was meager. Now, seeing the neighboring bank offering nearly 7%/year, I stand to gain an additional ten million VND annually. At my age, that’s a significant amount for medical expenses and holiday celebrations,” Mrs. Hoa shared.

Not only traditional savers but also office workers are buzzing with digital banking apps.

Ms. Phuong Vy (from An Lac Ward) mentioned that she took advantage of her lunch break to transfer her 200 million VND savings to Vikki Bank after noticing a 6.5% interest rate for just a 6-month term.

Banks enter the year-end deposit interest rate race.

“Previously, I kept my money in major banks for peace of mind, but with the current difference of nearly 2%, I opted for a private joint-stock bank with advanced technology to maximize profits,” Ms. Vy said.

Observations across various banking systems reveal that one bank has implemented a policy adding 1.5%/year for individual customers opening online accounts every Friday. For deposits of 100 million VND or more with terms over 12 months, the actual interest rates range from 7.6% to 8.3%/year, depending on the branch and deposit size.

Another joint-stock commercial bank offers a promotional policy, adding up to 0.6%/year for first-time depositors, pushing the highest interest rate to 7.5%/year for terms from 6 to 36 months. Techcombank adds 1%/year to savings interest for all deposits in December 2025 with terms of 3, 6, or 12 months. Thus, customers can receive up to 7.1%/year.

The “special interest rate” segment is attracting customers with substantial financial capabilities. One bank offers a record interest rate of 9%/year (for 12-13 month terms) on deposits from 2,000 billion VND. Two other banks closely follow with rates of 8.1-8.4%/year for amounts from 500 billion to nearly 1,000 billion VND.

Even the “Big 4” (Agribank, Vietcombank, VietinBank, BIDV) cannot remain outside this spiral, unanimously raising interest rates by 0.3 to 0.6 percentage points after over two years of maintaining low rates.

Capital Mobilization Pressure

According to economist Nguyen Tri Hieu, the widespread increase in interest rates by banks is not only to meet year-end payment demands but also to prepare for 2026. With a targeted economic growth of over 10%, credit demand is expected to surge to 24%.

Total capital mobilization in Ho Chi Minh City by the end of 2025 is estimated to exceed 5.1 million billion VND.

“The pressure to mobilize capital is immense. Banks are forced to raise interest rates to retain customers amid competition from corporate bonds and rival banks,” Mr. Hieu analyzed.

Ms. Tran Thi Ngoc Lien, Deputy Director of the State Bank of Vietnam (SBV) Branch in Zone 2, affirmed that the banking sector in Ho Chi Minh City ensures sufficient credit supply for production, business, and inventory needs during the peak period, meeting year-end and Tet 2026 demands.

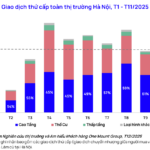

Regarding interest rates, the SBV Branch in Zone 2 reported that by the end of November, deposit interest rates in VND at commercial banks generally increased compared to the previous month.

Joint-stock commercial banks adjusted rates up by 0.1-0.3%/year for various terms. State-owned commercial banks reduced rates by about 0.5%/year for 6-month terms but increased them by 0.1-0.8%/year for other terms. For joint-venture and foreign banks, deposit rates decreased by about 0.1%/year for 12-month terms and increased by 0.5-0.7%/year for other terms.

The SBV Branch in Zone 2 noted that the total capital mobilization by credit institutions in Ho Chi Minh City this year is estimated to exceed 5.1 million billion VND. By year-end, capital mobilization in the city is projected to increase by 11.94% compared to the end of 2024.

Your Anchor for 2026

Over the past period, Vietnam has intensified its focus on public investment, particularly in critical infrastructure. Public spending on infrastructure accounts for approximately 6-7% of GDP, significantly higher than other countries in the region. This has been and continues to be a vital driver supporting economic growth momentum.

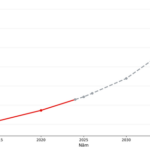

Vietnam Poised to Join World’s Top 32 Economies by 2025 as Experts Predict GDP Surpassing $1 Trillion Soon

Here is the latest forecast from the UK’s independent Centre for Economics and Business Research (CEBR) in the World Economic League Table (WELT).

Resilient Tactics Propel Vietnam’s Economy to Unexpected Success in 2025, Reports Russian Media

Russia’s Sputnik News recently published an article titled “Vietnam’s Resilient Strategy for Economic Success in 2025,” highlighting that despite significant external shocks, particularly tariff risks and global financial volatility, Vietnam’s economy in 2025 is poised to achieve most of its critical macroeconomic goals.