I. MARKET TRENDS IN WARRANTS

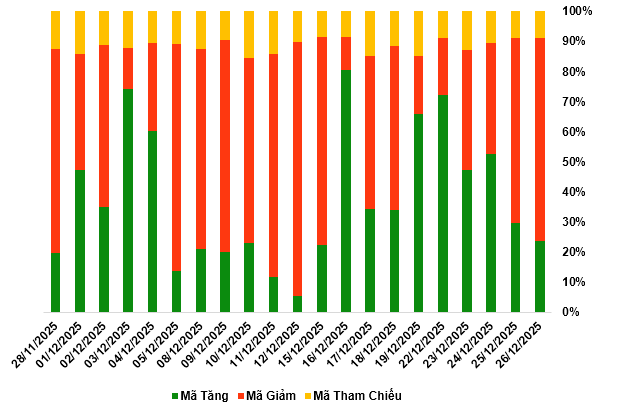

By the close of trading on December 26, 2025, the market recorded 61 gainers, 175 decliners, and 23 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

Source: VietstockFinance

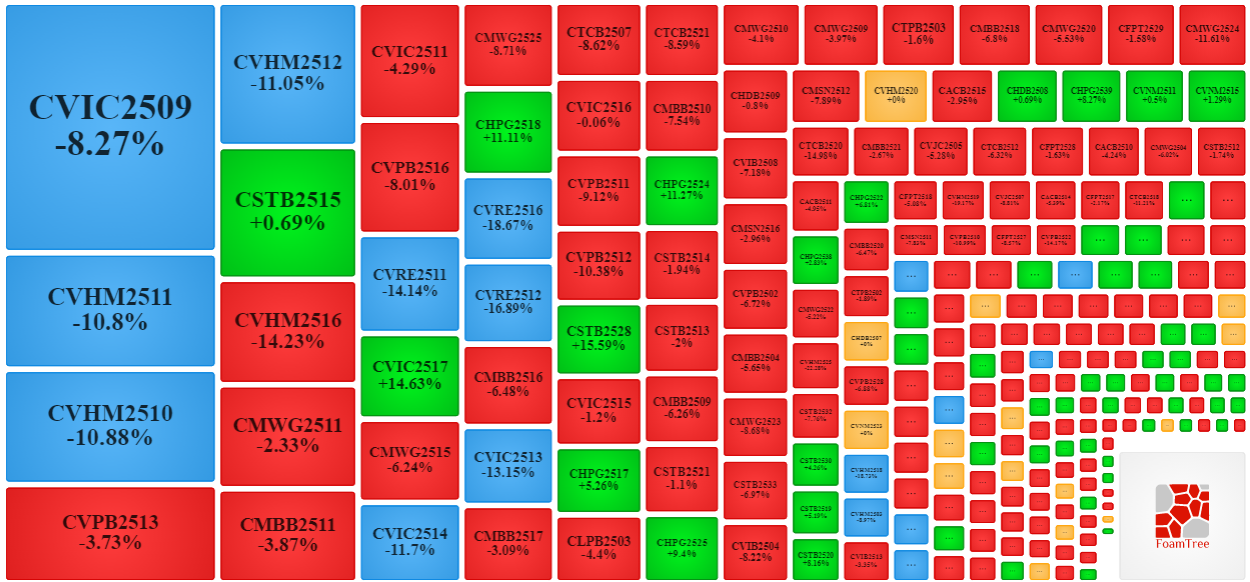

During the December 26, 2025 session, selling pressure dominated, leading to price declines in most warrant codes. Notably, the major warrant codes in the declining group were CVIC2509, CVHM2511, CVPB2513, and CMWG2511.

Source: VietstockFinance

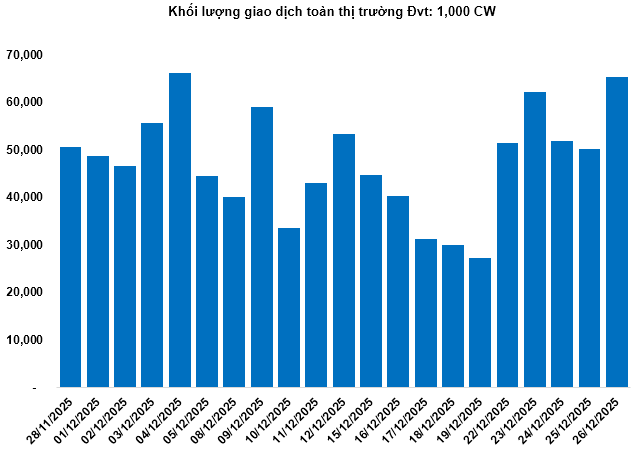

Total market volume on December 26 reached 65.24 million CW, up 30.26%; trading value hit 132.24 billion VND, a 11.03% increase from December 25. CMBB2518 led the market in both volume and value, with 3.05 million CW traded, equivalent to 7.02 billion VND.

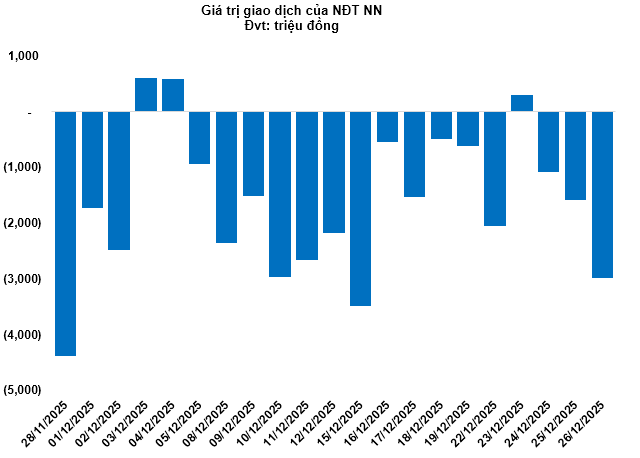

Foreign investors continued net selling on December 26, totaling 2.98 billion VND. CMWG2521 and CHPG2534 saw the highest net outflows. For the week, foreign net selling exceeded 7.39 billion VND.

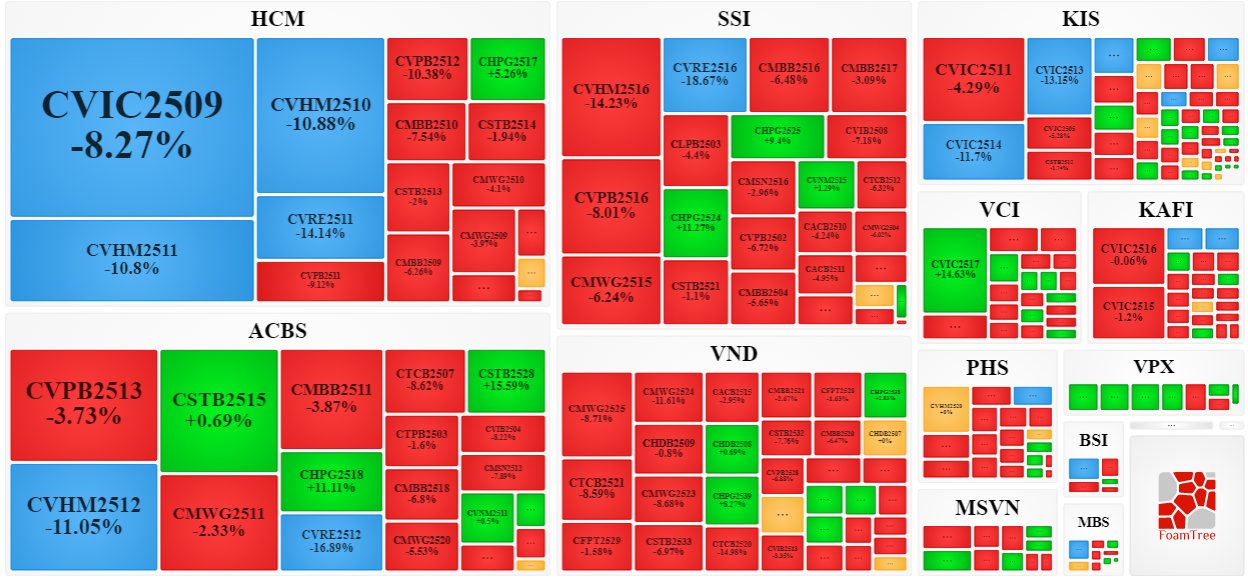

Securities firms HCM, SSI, KIS, and ACBS are the leading issuers with the most warrant codes in the market.

Source: VietstockFinance

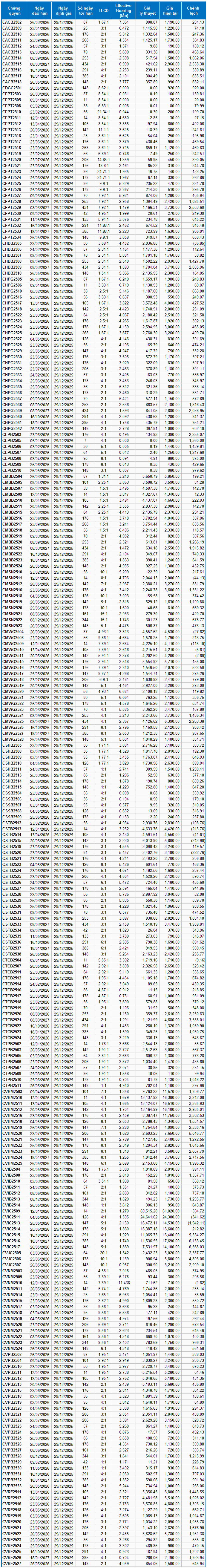

II. MARKET STATISTICS

Source: VietstockFinance

Source: VietstockFinance

III. WARRANT VALUATION

Using a valuation method effective from December 29, 2025, the fair prices of warrants currently trading are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, adjusted for the term of each warrant.

According to this valuation, CVIC2513 and CVIC2511 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2510 and CVNM2517 have the highest effective gearing in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:58 28/12/2025

Bank Stock Surges as Brokerage Firms Unexpectedly Net Buy VND 400 Billion Amid 40-Point Index Rally

Proprietary trading desks at securities firms continued their net buying streak on the Ho Chi Minh City Stock Exchange (HOSE), accumulating a total of VND 586 billion in the latest session.

Foreign Investors Pour 3.4 Trillion VND into Vietnamese Stocks in Just 5 Sessions, Signaling a Major Market Comeback

The consistent net buying across multiple sessions underscores a more assertive stance from foreign investors compared to previous periods, shifting from mere observation or defensive positions to proactive engagement.