On its first trading day on the HoSE, Masan Consumer’s stock (MCH) surged 5% above the reference price to 223,500 VND, marking an all-time high. This corresponds to a market capitalization of over 236 trillion VND (8.7 billion USD), a nearly 80% increase since early October. For many investors, this raises questions about whether pre-listing expectations have already been fully priced in.

What Opportunities Lie Ahead After the Pre-Listing Rally?

Despite MCH’s significant price increase and its current position at a historical peak, Vietcap Securities believes there’s still attractive upside potential. They argue that the stock’s long-term value will reflect the company’s profit growth.

Vietcap highlights MCH’s clear growth drivers: product innovation, distribution network expansion, technological advancements, and international market penetration. They project 15% revenue growth and 20% profit growth for 2026, with a compound profit growth rate of 16% from 2026 to 2028. This is impressive for a company already leading in many FMCG segments.

Addressing concerns about “arriving late,” Vietcap analysts point to three key catalysts post-listing:

– Unlocking Capital and Liquidity: Historically, large-cap stocks migrating to HoSE see average daily trading volumes increase by 200% within six months.

– Inclusion in Major Indices: With a market cap nearing 9 billion USD, MCH instantly becomes HoSE’s largest consumer company, positioning it for potential inclusion in the VN30 index after six months, as well as foreign ETFs like VanEck and Xtrackers, and the FTSE EM index by September 2026.

– Margin Trading: Eligibility for margin trading after six months will attract a surge of capital from retail investors, who currently account for 85% of market liquidity.

Vision 2030: Expanding Market Reach to 23.4 Billion USD

At the listing ceremony, Chairman Nguyen Dang Quang passionately referred to MCH as Masan’s “crown jewel,” embodying the company’s values and trust. He emphasized that MCH is more than a business; it’s a platform to fulfill its mission of “Serving Consumers” – a boundless opportunity to create limitless value.

The “Go Global” strategy, as highlighted by Mr. Quang, aims to bring Vietnamese pride and values to the world, fueled by the same ambition seen in Vietnam’s young athletic talents. This foundation has enabled MCH to maintain leadership in 80% of its product categories and reach 98% of Vietnamese households.

MCH is not resting on its laurels. It’s strategically expanding its consumer wallet share by venturing into high-growth segments like personal care and meal solutions. This is projected to increase its target market size from 15.7 billion USD to 23.4 billion USD by 2030.

With a projected compound profit growth rate of 16% from 2026 to 2028, MCH offers both defensive stability and growth potential. As Chairman Quang stated, MCH is a brand synonymous with “Savings, Investment, Growth, and Value,” destined to be present in every Vietnamese household.

Valuation Paradox: When a Subsidiary Outshines its Parent

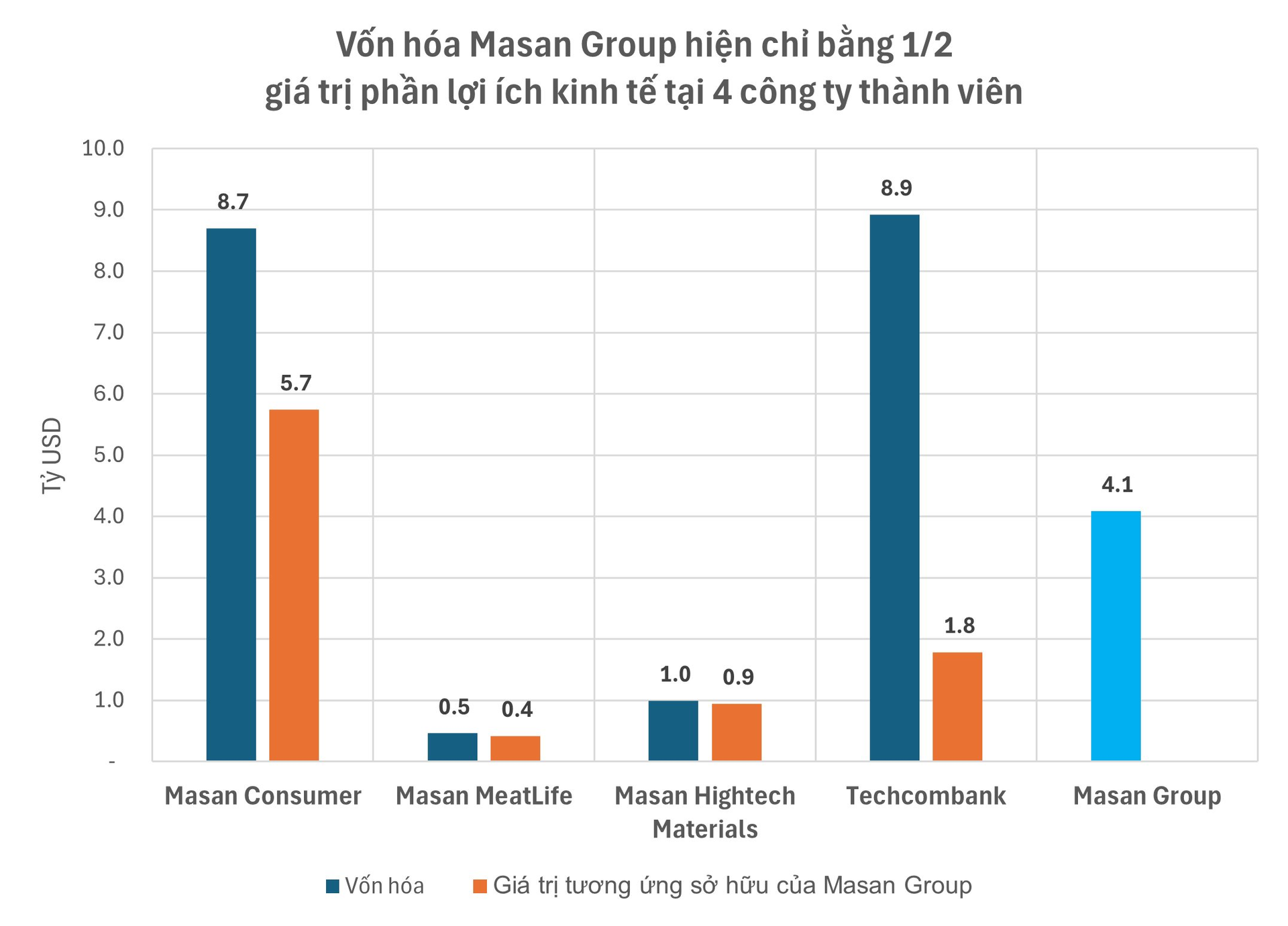

MCH’s HoSE listing isn’t just about a single stock; it’s about addressing a valuation paradox within Masan Group (MSN). Masan Group owns 66% of MCH, currently valued at 5.7 billion USD. Paradoxically, Masan Group’s total market cap is only 4.2 billion USD.

This means buying MSN offers investors MCH at a deep discount, plus valuable assets like a 20% stake in Techcombank, 85% in WinCommerce, and holdings in Masan MeatLife and Masan High-Tech Materials. MCH’s listing will likely lead to a fairer valuation of MSN through the Sum-of-the-Parts (SOTP) method.

Unlocking Long-Term Capital: MCH’s Strategic Shift to HOSE Marks a Transformative Milestone

On December 25th, Masan Consumer’s MCH shares will officially list on the Ho Chi Minh City Stock Exchange (HOSE). Vietcap Securities has released updated assessments regarding MCH’s prospects following the exchange transition.