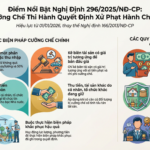

According to Decree 296/2025, effective from January 1, 2026, household businesses are subject to coercive measures for the enforcement of administrative penalty decisions in case of violations.

Specifically, Decree 296 stipulates that if shared assets are insufficient to execute the decision (pay fines, remedy consequences, etc.), authorities are entitled to deduct funds or seize the personal assets of household business members (the head of the household and registered participants).

Seizing personal assets is not straightforward, as individual members’ assets may be intertwined with marital shared property (illustrative image) |

Commenting on this regulation, Mr. Nguyễn Ngọc Tịnh, Vice Chairman of the Ho Chi Minh City Tax Consultancy and Agency Association, stated that when starting operations, household businesses may register only 1 or 2-3 members.

For instance, if a household business with 2 members (siblings) is subject to an administrative penalty but lacks sufficient funds to pay, authorities will freeze the business’s bank account (shared assets) to deduct the fine. If this account is insufficient, they will proceed to freeze the bank accounts of the 2 members to collect the penalty.

In cases where these members’ accounts are also insufficient, authorities will seize the personal assets of each household business member.

However, according to Mr. Tịnh, seizing personal assets is not straightforward, as individual members’ assets may be intertwined with marital shared property (as per the Civil Code and Marriage and Family Law).

If a spouse disagrees with disposing of (auctioning) the shared property to pay the fine, state management agencies cannot proceed.

Mr. Tịnh believes the new regulation on coercive measures for administrative penalty violations by household businesses may serve as a deterrent, preventing the dissipation of shared assets to evade penalties. However, enforcing this against personal assets (especially those involving spouses) is not simple and may lead to prolonged disputes. Household businesses should comply with legal regulations to avoid such situations.

Thy Thơ

– 12:29 27/12/2025

Over 18,300 Household Businesses Transition from Fixed Tax to Declaration-Based Taxation

Over 18,300 businesses have proactively transitioned from fixed tax rates to self-declared tax filings ahead of schedule, significantly boosting budget revenues and streamlining tax administration as of 2026.

Navigating VAT Calculations for Sole Proprietors

For businesses with annual revenue below 500 million VND, VAT exemption applies. However, exceeding this threshold by even a marginal amount, such as 501 million VND, triggers VAT liability. The discrepancy in calculation compared to personal income tax raises concerns about fairness, reasonableness, and the potential for revenue manipulation in practice.

Tax Experts Highlight Hoàng Hường, Hằng Du Mục, Ngân 98, and Mailisa

Mrs. Nguyen Thi Cuc, Chairwoman of the Vietnam Tax Consultants Association, recently highlighted a surge in online cases involving counterfeit goods, substandard products, and large-scale tax evasion. She warns that individuals and households employing tactics like using multiple bank accounts, fragmenting transactions, and concealing revenue often face consequences far exceeding the amounts they attempt to evade.