Illustrative Image

According to preliminary statistics from the General Department of Customs, Vietnam’s cassava and cassava product exports in November reached over 267 thousand tons, valued at more than $94 million, marking a 2.8% increase in volume and a 7% rise in value compared to the same period last year.

Cumulatively, in the first 11 months of 2025, the country earned over $1.1 billion from exporting more than 3.6 million tons of cassava, reflecting a 10.9% decrease in volume and a 27.4% drop in value compared to the same period in 2024.

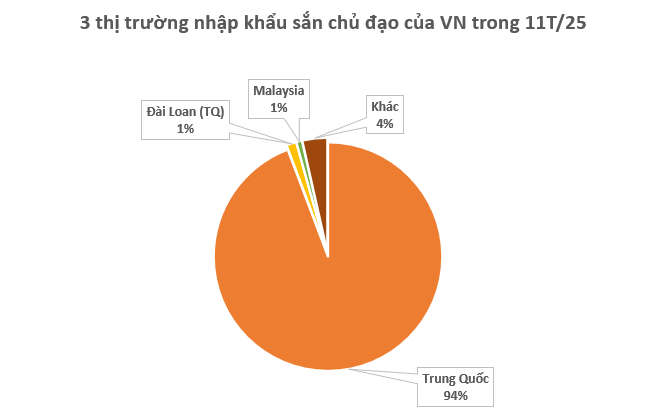

In terms of market distribution, China remains the largest importer of Vietnamese cassava. Specifically, Vietnam exported over 3.4 million tons of various cassava products to China, generating a revenue of more than $1.04 billion, a significant 58% increase in volume and a 9% rise in value compared to 2024.

However, export prices plummeted by 31%, averaging $307 per ton.

Taiwan (China) ranked second with over 50 thousand tons, valued at more than $18 million, a 15% increase in volume but a 20% decrease in value. Similarly, prices dropped by 30%, averaging $373 per ton.

Malaysia secured the third position with over 29 thousand tons, valued at more than $11 million, showing a 98% increase in volume and a 45% rise in value. Export prices decreased by 26%, averaging $380 per ton.

Cassava and its derivatives are not only among Vietnam’s 13 key agricultural products but have also propelled the country to the second position globally in cassava exports. Since the beginning of the year, export prices have declined primarily due to reduced imports from China, abundant domestic supply (both from spontaneous production and large inventories), and competition from Thai products. Despite increased export volumes, the decline in value has posed challenges and sustainability concerns for Vietnam’s cassava industry.

The Import-Export Department forecasts that Vietnam’s cassava exports will continue to face favorable conditions. Demand from China is expected to remain high due to domestic supply shortages and the need for raw materials in ethanol and animal feed production. However, exporters also face several challenges, including intensified competition from Thailand as it recovers its supply; fluctuations in international prices of substitute raw materials like corn and wheat; adjustments in China’s import and quarantine policies; rising production costs; and weather-related risks affecting domestic raw material supply.

Notably, according to China’s customs data for the first nine months of 2025, Vietnam surpassed Thailand to become the largest supplier of cassava starch to China, capturing 48.77% of the market share. Vietnam exported over 1.86 million tons of cassava starch to China, a 72.1% increase, while Thailand’s exports grew by only 0.9%, dropping to second place with a 34.78% market share in China.